asterism

Congress != Progress

Aren't you confusing business/corporate tax rates with personal tax rates?It certainly didn't from the 1920s to the 1980s.

Plenty of constructs known to some as "tax loopholes" have been closed. The mid 1980s saw one big one close, the ability for losses in one business to be used to offset gains in another business.

We're not just dealing with the idea of a top marginal rate of 39.6% in a vacuum compared to previous years, it's the total picture and a dynamic situation with importance on a 13% tax hike.

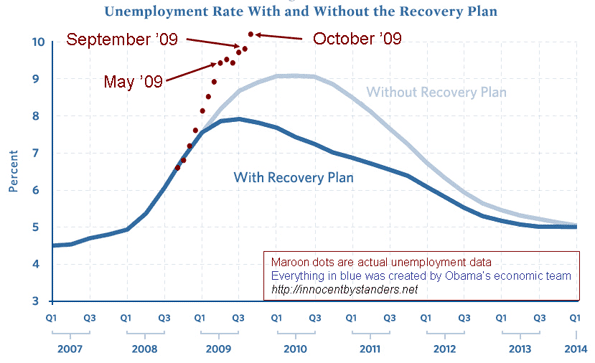

This is all academic at this point though, your side won and none of the worst case scenarios predicted by them if the government didn't step in came true. The government did step in and things are actually worse. You'll get to see firsthand how this tax increase is going to work out.

No.

In the end, all after tax profits end up as personal income for shareholders. With regards to innovation, most new ventures are started by businesses that operate without a taxable corporate entity.