- Feb 12, 2007

- 59,384

- 24,018

- 2,290

What else raised the deficit besides two wars?

Granting a $1.8 trillion tax cut to the wealthiest Americans and borrowing money to pay for it.

Borrowing money to give every American $600

Passing a Medicare prescription Drug plan and borrowing money to pay for it

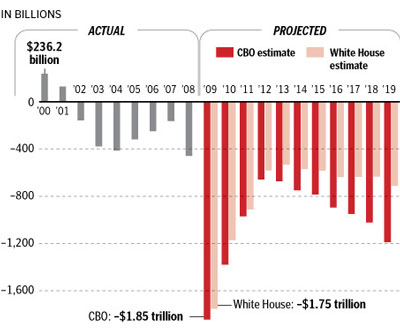

And how does all of that compare to the Obama Deficits?

If you're outraged over the Bush Era spending - where is your outrage over the current regime's?