- Thread starter

- #21

According to the IRS - In 2007 the average Adjusted Gross Income over $10 million only paid 19% income tax while the average middle class AGI paid 24% income tax.

The rich don't pay federal Social Security tax, Unemployment Tax, Medicare Tax, Medicaid Tax, FICA tax, etc on amounts over $120k. That pushes the middle class tax rate even higher & the Rich's tax rates even lower. Then add in Federal use taxes, fuel taxes, State, County & City taxes that all smack the middle class even harder percentage wise.

Your chart is pure fiction & it also does not even add up to 100%.

Mitt Romney only paid 13% while the middle class paid 28%. How the hell can someone paying 28% compete with someone paying only 13%????? It is called subsidizing the rich!

Here is the real chart that squares with reality.

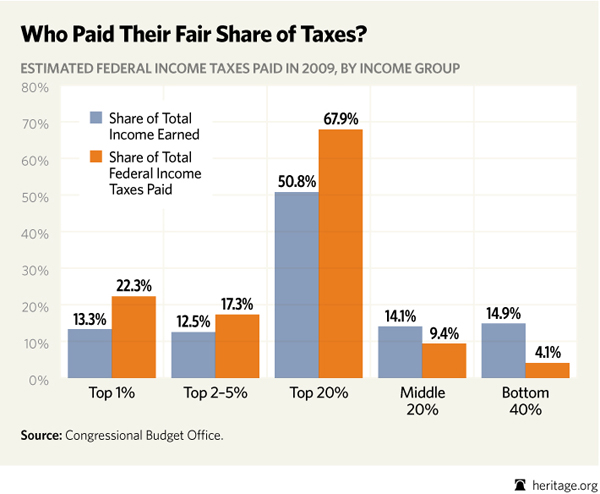

As I tried to explain to your ignorant ass once already, tax RATES mean NOTHING. The federal government does NOT pay debts with "rates" - they pay with money. And the wealthy are paying a fuck load of actual money.

You spin in not only typical of the dumbocrats, it's also weak and sad (also typiclal when it comes to their spin).

The CBO is widely regarded - by both sides - as the most reliable source for all things financial. So you can take your faulty IRS numbers and stick them up your dumbocrat ass.

If only dumbocrats could do basic math, they would understand the following:

13% of $10 million is $1.3 million

28% of $100,000 is $28,000

$1.3 million is a FUCK LOAD more of real actual money than $28,000 (again, since you dumbocrats are mathmatically challenged, it's more than 46x's the amount).

Guess your tax rate doesn't mean shit now when we talk real, actual money, uh?

and

and

You have been exposed as an idiot who fails to understand, basic math, economics, taxes, information sources or the difference between facts & fiction. Take your dumb ass back to the 3rd grade & stay awake this time if you can manage to progress from there.

You have been exposed as an idiot who fails to understand, basic math, economics, taxes, information sources or the difference between facts & fiction. Take your dumb ass back to the 3rd grade & stay awake this time if you can manage to progress from there.