Granny says, "Tax `em - an' den tax `em some more...

Tax the rich! OK, but then what, Mr. President?

April 12, 2011 -- For years, President Obama has been clear about his preferred tax policy: Tax the rich more and protect households that make less than $250,000 from higher taxes.

See also:

Obama urged to protect Social Security

April 12, 2011 -- The battle lines over Social Security are being drawn a day before President Obama delivers a major speech on the nation's long-term fiscal dilemma.

... an' use dem richfolks taxes to pay for Social Security."

Tax the rich! OK, but then what, Mr. President?

April 12, 2011 -- For years, President Obama has been clear about his preferred tax policy: Tax the rich more and protect households that make less than $250,000 from higher taxes.

It's not clear what he'll say about taxes on Wednesday when he lays out his ideas for how to tackle the country's long-term debt. If history holds, he'll stick to his guns. Certainly, continuing to promise low taxes for 98% of the country will help his newly launched 2012 re-election campaign. But it wouldn't be a great path to reining in debt. (Sorry GOP: Tax revenue has to go up) Relying solely on tax increases for the rich to aid in deficit reduction -- even when paired with significant spending cuts -- doesn't cut it for two reasons, said Tax Policy Center senior fellow Roberton Williams.

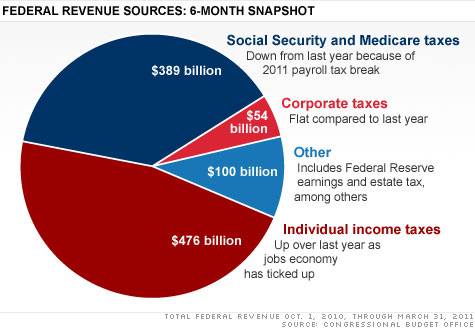

First, the income of the top 2% of taxpayers is typically more volatile than that of taxpayers lower down the income scale, so when the economy sours, so often do those high-end income streams. That means less revenue than expected will flow into federal coffers. Second, even if that weren't true, there just aren't enough rich people to generate the kind of revenue needed to substantially reduce deficits. To show the disparity, consider some recent calculations by the Congressional Budget Office. Raising all six income tax rates by 1 percentage point would yield an additional $480 billion over 10 years. By contrast, raising the top two rates by 1 percentage point would yield just $115 billion.

What Obama has said: In his most recent budget request, the president proposed letting the top two income tax rates revert to 39.6% and 36%, up from 35% and 33% today. He also called for an increase in the capital gains and dividend rates to 20% that high-income households pay, up from 15% today. And he would reduce the value of their itemized deductions and personal exemptions. All told, those proposals -- which would affect individuals making at least $200,000 and couples making $250,000 and up -- would reduce deficits by just under $1 trillion over 10 years. That's only about a third of the deficit reduction that would occur if lawmakers just let all of the Bush-era tax cuts expire.

MORE

See also:

Obama urged to protect Social Security

April 12, 2011 -- The battle lines over Social Security are being drawn a day before President Obama delivers a major speech on the nation's long-term fiscal dilemma.

In a letter sent Tuesday to Obama, a group of over 250 academics, policy experts and economists argued that Social Security does not contribute to the federal deficit and that shortfalls "should be eliminated without cutting benefits, including without raising the retirement age." Another group, the Strengthen Social Security Campaign, sent a letter to the President urging him to not even introduce the subject. "Social Security should not be part of deficit discussions or any deficit package or process," the letter said.

Obama is widely expected to outline on Wednesday his plan to reduce long-term deficits in a speech in Washington, and many worry that Social Security could get a haircut. The push to protect the program is just one component in a broader fight between Democrats and Republicans in Washington about how to put the nation back on a path towards fiscal sustainability. It comes days after Congress approved an 11th hour plan to fund the government, as they narrowly averted a shutdown. But bigger legislative issues remain unresolved, including a proposal to lift the nation's$14 trillion debt ceiling.

Supporters say Social Security is an independent, self-financing program that has no authority to borrow, and therefore cannot deficit spend. But critics say the program is already adding to the shortfall because the federal government must issue new debt to pay back money it borrowed from the Social Security trust fund. Regardless, both sides generally agree that Social Security needs to be reformed as the nation's population gets older and the number of Americans collecting benefits outpaces the amount of money flowing into the system.

MORE

... an' use dem richfolks taxes to pay for Social Security."

Last edited:

Democrats

Democrats