skews13

Diamond Member

- Mar 18, 2017

- 9,428

- 11,837

- 2,265

The word on the street—Pennsylvania Avenue—is that the next big undertaking in the city that never wakes up to reality but always puts a good spin on a bad message, will be rewriting the tax code.

Here are two feel-good statements emanating from D.C.

The Nationals will win it all this year because their pitchers will have the lowest ERAs and the highest won-lost records and their hitters will score the most runs.

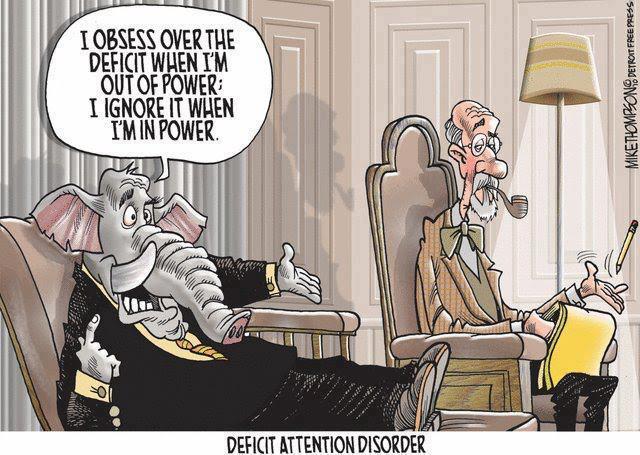

The tax reform bill will lower taxes on the middle class, create jobs, won’t reward special interests, and reduce the deficit. This is standard fare because tax reform is the scam that never gets old.

Neither statements is true but they aren’t both lies.

Whoever made the first statement—and were he a real person, he should be given the optimist of the year award—is guilty of wishful thinking.

Whoever made the second statement—and there are better than even odds that he will be a real person and most likely a Congressman—will be willfully lying.

A tax reform bill cannot pass without making indefensible claims. Detractors will claim it only helps the rich. No one will deny this but they’ll explain that the rich are also the job creators and everyone will win in the end.

When the last big tax reform measure was taken in 1986, these same promises were made—stronger middle class, more jobs, true the rich would receive benefits, but everyone would be winners—plus the deficit would go down.

The same promises made with George Bush’s tax reforms in 2001.

In 1986, there were 13 billionaires living in America, four times as many as I remember growing up in the fifties when there were three—J. Paul Getty, Howard Hughes, and the Rockefeller family. By 1987, there were 41. The number increased steadily to 149 in 1996 before dropping back to 49 in 2000.

Then came the Bush tax cut in 2001, where everyone got a $100 check in the mail and billionaires got their capital gains tax rate cut to 15 percent, the equivalent of what a family making $25,000-a-year might pay.

The number of billionaires quickly jumped to 272, decreased a bit following the 2008 Recession before rebounding to where it stands today at 565.

I know there has been many innovation over the last thirty years, a lot of opportunities created that have led to the current number of super wealthy Americans. I also know that favorable tax laws and a reluctance of job creators to share their wealth with the job doers has led to a shrinking middle class and a rather vibrant wealthy class. There are also more robots holding down jobs and God help us if they ever get to vote if Congress decides to call them people as they did with corporations.

However, this is not the whole story. Something else happened in 1986 that few Americans are aware of. Something that always seems to happen. In 1989, two reporters from the Philadelphia Inquirer, James B. Steele and Donald L. Barlett won the Pulitzer Prize for their reporting on the Tax Reform Act of 1986.

What they found was over a thousand pages of exemptions written into the law to benefit individual taxpayers and corporations.

This is what a tax exemption looks like when an American lawmaker wants to give special treatment to an American Corporation and doesn’t want anyone to know:

Subsection (f) of section 621of the Tax Reform Act of 1986 is amended by adding at the end thereof the following new paragraphs: For purposes applying section 382(k)(6) of the Internal Revenue Code of 1986, preferred stock issued by an integrated steel manufacturer incorporated on November 9, 1982, and reincorporated on February 11, 1983, and having its principal place of business in Trenton, Michigan, and mentioned in a letter of intent dated July 10, 1987, signed by such manufacturer, shall not be treated as stock.

The one corporation fitting this description received a three-year $26-million tax break.

There are hundreds of pages of these embarrassing give-a-ways in the tax codes.

Politicians, always in need of funding, do everything they can to hide the identities of the billionaires and special interests. These breaks are a significant reason why government can’t keep its head above water. Five hundred and sixty-five billionaires will attest, “It’s not what you know but who you know and if no one knows who you are, that’s even better.

Congress will talk about the middle class and jobs, but will be silent about billionaires and special interests. Voters should pay attention to whom—and what--isn't being discussed.

Tax Reform: Always the same old thing

Here are two feel-good statements emanating from D.C.

The Nationals will win it all this year because their pitchers will have the lowest ERAs and the highest won-lost records and their hitters will score the most runs.

The tax reform bill will lower taxes on the middle class, create jobs, won’t reward special interests, and reduce the deficit. This is standard fare because tax reform is the scam that never gets old.

Neither statements is true but they aren’t both lies.

Whoever made the first statement—and were he a real person, he should be given the optimist of the year award—is guilty of wishful thinking.

Whoever made the second statement—and there are better than even odds that he will be a real person and most likely a Congressman—will be willfully lying.

A tax reform bill cannot pass without making indefensible claims. Detractors will claim it only helps the rich. No one will deny this but they’ll explain that the rich are also the job creators and everyone will win in the end.

When the last big tax reform measure was taken in 1986, these same promises were made—stronger middle class, more jobs, true the rich would receive benefits, but everyone would be winners—plus the deficit would go down.

The same promises made with George Bush’s tax reforms in 2001.

In 1986, there were 13 billionaires living in America, four times as many as I remember growing up in the fifties when there were three—J. Paul Getty, Howard Hughes, and the Rockefeller family. By 1987, there were 41. The number increased steadily to 149 in 1996 before dropping back to 49 in 2000.

Then came the Bush tax cut in 2001, where everyone got a $100 check in the mail and billionaires got their capital gains tax rate cut to 15 percent, the equivalent of what a family making $25,000-a-year might pay.

The number of billionaires quickly jumped to 272, decreased a bit following the 2008 Recession before rebounding to where it stands today at 565.

I know there has been many innovation over the last thirty years, a lot of opportunities created that have led to the current number of super wealthy Americans. I also know that favorable tax laws and a reluctance of job creators to share their wealth with the job doers has led to a shrinking middle class and a rather vibrant wealthy class. There are also more robots holding down jobs and God help us if they ever get to vote if Congress decides to call them people as they did with corporations.

However, this is not the whole story. Something else happened in 1986 that few Americans are aware of. Something that always seems to happen. In 1989, two reporters from the Philadelphia Inquirer, James B. Steele and Donald L. Barlett won the Pulitzer Prize for their reporting on the Tax Reform Act of 1986.

What they found was over a thousand pages of exemptions written into the law to benefit individual taxpayers and corporations.

This is what a tax exemption looks like when an American lawmaker wants to give special treatment to an American Corporation and doesn’t want anyone to know:

Subsection (f) of section 621of the Tax Reform Act of 1986 is amended by adding at the end thereof the following new paragraphs: For purposes applying section 382(k)(6) of the Internal Revenue Code of 1986, preferred stock issued by an integrated steel manufacturer incorporated on November 9, 1982, and reincorporated on February 11, 1983, and having its principal place of business in Trenton, Michigan, and mentioned in a letter of intent dated July 10, 1987, signed by such manufacturer, shall not be treated as stock.

The one corporation fitting this description received a three-year $26-million tax break.

There are hundreds of pages of these embarrassing give-a-ways in the tax codes.

Politicians, always in need of funding, do everything they can to hide the identities of the billionaires and special interests. These breaks are a significant reason why government can’t keep its head above water. Five hundred and sixty-five billionaires will attest, “It’s not what you know but who you know and if no one knows who you are, that’s even better.

Congress will talk about the middle class and jobs, but will be silent about billionaires and special interests. Voters should pay attention to whom—and what--isn't being discussed.

Tax Reform: Always the same old thing