And in other news, the sun rises in the east and sets in the west.

From the Pew Foundation.

http://www.pewtrusts.org/uploadedFi...ic_Policy/drivers_federal_debt_since_2001.pdf

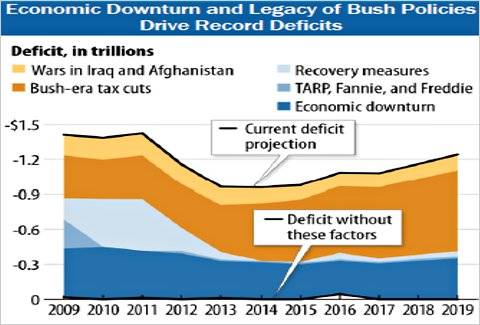

In 2001, the CBO estimated that the budget would have an accumulated surplus of $2.3 trillion in 2011. Instead, we have an accumulated debt of $10.4 trillion, a $12.7 trillion swing. The Pew Foundation estimates that 68% ($8.7 trillion) is due to legislation over the past decade. Pew broke down the causes for this swing as follows (dollars in trillions).

Bush tax cuts 13% $1.7

Interest on increased borrowing 11% $1.4

Iraq/Afghanistan wars 10% $1.3

Other non-defense spending 10% $1.3

Stimulus 6% $0.8

Other tax cuts 5% $0.6

Other defense spending 5% $0.6

Extension of Bush tax cuts 3% $0.4

Medicare Part D 2% $0.3

Total 65% $8.3

Other means of financing 6% $0.8

Incorrect forecasting 29% $3.7

Stimulus, extension of Bush cuts 9% $1.1

Tax cuts 23% $2.9

Non-defense spending 16% $2.0

War/defense spending 15% $1.9

Interest on increased borrowing 11% $1.4

I did not attribute the changes in the means of financing, which Pew allocates 50% to legislation over the past decade. Half of 6% added to 65% is the 68% cited by Pew.

Had there been no war, no tax cuts and no increased spending, the accumulated deficit would have been $1.4 trillion instead of a $2.3 trillion surplus forecasted by the CBO in 2001. This is due to lower than expected baseline economic growth.

Tax cuts contributed $2.9 trillion to the increase in debt, non-defense spending $2 trillion and war and defense $1.9 trillion. Allocating the $1.4 trillion of interest on increased borrowing to the three categories, tax cuts contributed $3.5 trillion (43% of total excluding financing changes), non-defense spending $2.4 trillion (30%) and war and defense $2.3 trillion (28%).

From the Pew Foundation.

In January 2001, the Congressional Budget Office (CBO) projected under a current law baseline that the federal government would erase its debt in 2006. By 2011, the U.S. government would be $2.3 trillion in the black.

The reality, of course, has turned out to be far different: the U.S. will likely owe $10.4 trillion this year, its largest debt relative to the economy since 1950.

What caused this $12.7 trillion shift? This fiscal fact sheet by the non-partisan Pew Fiscal Analysis Initiative … shows that the main drivers of the debt, by far, are the tax cuts and spending increases enacted since 2001. …

Between 2001 and 2011, about two-thirds (68 percent) of the $12.7 trillion growth in federal debt has been due to new legislation. Forty percent of this legislative growth was the result of tax cuts enacted after January 2001, and 60 percent resulted from spending increases. Technical and economic revisions combined caused about one quarter (27 percent) of the growth, and changes in other means of financing accounted for 6 percent.

Specific Policies & Legislation

Legislative drivers can be further broken down using CBO cost estimates for six high-profile laws enacted over the last 10 years as well as the cost of the operations in Iraq and Afghanistan …

The five most significant legislative drivers are the 2001/2003 tax cuts (13 percent of the 10-year shift), growth in net interest due to legislative changes (11 percent), growth in nondefense spending (10 percent), the operations in Iraq and Afghanistan (10 percent), and the 2009 stimulus (6 percent). The non-defense spending growth is mostly the result of annual discretionary appropriations increasing faster than CBO anticipated back in January 2001. Of the other tax cuts, about half of the debt effect is accounted for by the combined cost of three pieces of tax legislation. The rest is due to other legislation.

http://www.pewtrusts.org/uploadedFi...ic_Policy/drivers_federal_debt_since_2001.pdf

In 2001, the CBO estimated that the budget would have an accumulated surplus of $2.3 trillion in 2011. Instead, we have an accumulated debt of $10.4 trillion, a $12.7 trillion swing. The Pew Foundation estimates that 68% ($8.7 trillion) is due to legislation over the past decade. Pew broke down the causes for this swing as follows (dollars in trillions).

Bush tax cuts 13% $1.7

Interest on increased borrowing 11% $1.4

Iraq/Afghanistan wars 10% $1.3

Other non-defense spending 10% $1.3

Stimulus 6% $0.8

Other tax cuts 5% $0.6

Other defense spending 5% $0.6

Extension of Bush tax cuts 3% $0.4

Medicare Part D 2% $0.3

Total 65% $8.3

Other means of financing 6% $0.8

Incorrect forecasting 29% $3.7

Stimulus, extension of Bush cuts 9% $1.1

Tax cuts 23% $2.9

Non-defense spending 16% $2.0

War/defense spending 15% $1.9

Interest on increased borrowing 11% $1.4

I did not attribute the changes in the means of financing, which Pew allocates 50% to legislation over the past decade. Half of 6% added to 65% is the 68% cited by Pew.

Had there been no war, no tax cuts and no increased spending, the accumulated deficit would have been $1.4 trillion instead of a $2.3 trillion surplus forecasted by the CBO in 2001. This is due to lower than expected baseline economic growth.

Tax cuts contributed $2.9 trillion to the increase in debt, non-defense spending $2 trillion and war and defense $1.9 trillion. Allocating the $1.4 trillion of interest on increased borrowing to the three categories, tax cuts contributed $3.5 trillion (43% of total excluding financing changes), non-defense spending $2.4 trillion (30%) and war and defense $2.3 trillion (28%).