NYcarbineer

Diamond Member

Some people have always told the truth about the budget.

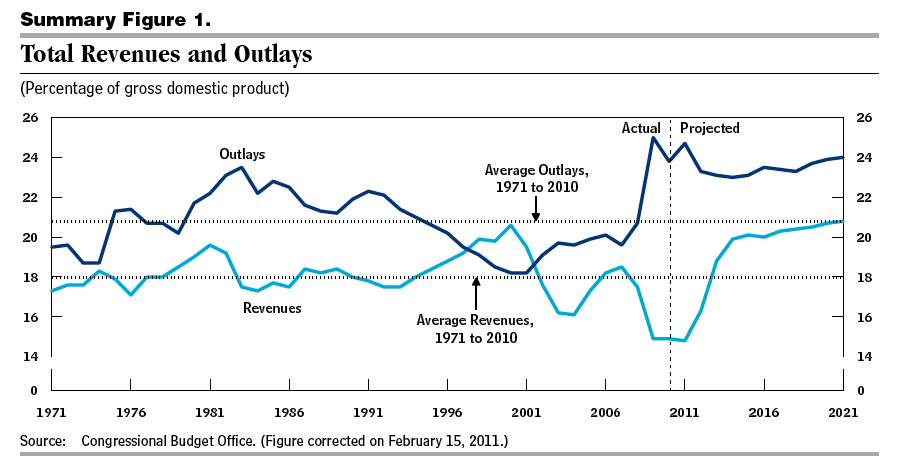

The truth is that Reagan and the two Bushes created 93% of the National Debt by lowering taxes for the rich.

Go to ReaganBushDebt.org

That leads to another point, which is the hidden tax INCREASES that Reagan and Bush and Bush created,

by adding trillions to the national debt:

The Interest on the Debt. The annual interest on the Debt is effectively a government spending program that costs the taxpayers hundreds of billions of dollars every year, and for all practical purposes, is a perpetual tax, unless by some miracle the debt is ever paid off.