Their Constitutional duty? WHAT on Earth would they know about THAT? And just who made it their "Constitutional duty"? THEY did.

Has nothing to do with unfair taxation.

what i am referring to gunny is the house of reps duties to appropriate....

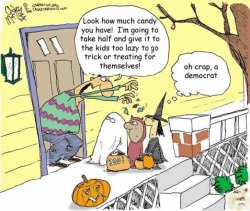

any of that appropriation, is the appropiation of money they TOOK from you and me, via taxation....and with my money, they decide who is going to get it...

they took it from me, to give it to someone else...they took my wealth and they gave it to someone else who benefited from it, whether that someone was Halliburton employees or ceos or your senators salary or your representatives healthcare plan or my father's health care benefits or pension that he receives from the government...this is wealth of mine that is a part of a redistribution to someone else.

It IS what our government does, specifically the responsibility of the House of Representatives.

And OF COURSE this should not mean that this gives them free reign to spend on unsound things or things not within their constitutional duties, which Congress imho has been doing for the last 100 years, worse the last decade or 2...

But it is a redistribution of wealth, even if they did just spend on legitimate programs imo....

this is what i was trying to say...

care