4 steps to ensure the program is properly funded:

1) Gradually Raise "Full" retirement age to 68 - then index to life expectancy going forward.

2) Raise the cap on taxable earnings to cover 90% of earning (about $275,000 today) - index to wage growth so that it remains at 90%

3) Increase payroll tax by 1% (1/2% employer and 1/2% employee)

4) Use chained CPI for COLA increases.

Viola!! Social Security is fixed for 100 years minimum.

Not sure I want to see 68 yr old roofers forced to work to age 68. This is an asinine requirement for getting your benefits. Especially if you WRECK your health getting to retirement.

Raising caps just destroys this whole UNIVERSAL deal. It makes it another welfare program. If that's done, America will never trust any "UNIVERSAL" program again. MAKE it a welfare program. Don't fuck around the edges.

Going to 14% of income for self-employed is a non-starter. It was originally PROMISED never to exceed 1 or 2% of income. So much for the analytics and projections of ANY Govt program.. Chimps could be more prescient.

Current "full" retirement age is 67 for folks born after 1960 so, adding 1 year is not an "asinine" requirement.

The tax for Social security is currently 6.2% for the employee and 6.2% for the employer. Going to 6.7% each is not going to bankrupt anyone. If it does, you're a financial moron. At any rate, TANSTAAFL!!

Do I love the program? Hell no! I'd like to see workers be able to permanently opt out and invest the money into their own retirement accounts. But that ain't gonna happen in my lifetime. Our society views "government" as their daddy......and the sheeple are too stupid to handle their own finances.

PS- Most Roofers don't continue roofing after a certain age, they become Superintendents, Estimators, or Salesmen.

Any owner of a roofing company that's NOT out on the job sites --- is gonna lose his business. An Obama commission in 2010 recommended not ONE year -- but raising the full vesting age to 69.. There's not much savings for doing this since EVERY year is on a sliding scale from "early retirement" to age 70 already..

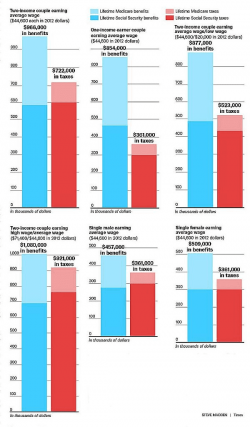

Self employed folks like me pay the ENTIRE FICA tax. It's not just increase of SS tax. It's the proposed hike in Medicare Tax as well. Right now -- that's 15.3% of my income. At that rate, I'd have to live to 110 to break even. In fact, most people whose EMPLOYER pays the 1/2 -- are in the same boat. They just don't KNOW it.

SOMEBODY is paying it. And the point is -- the TOTAL BENEFITS RECVD for all that money are getting to the point where you just as well might stuff it a mattress and do a better investment.