Quantum Windbag

Gold Member

- May 9, 2010

- 58,308

- 5,099

- 245

I knew it was bad, but it turns out that the numbers I have been looking at depend on an erroneous assumption about life expectancy. It seems they expect everyone my age to be dead by 2028.

http://www.nytimes.com/2013/01/06/opinion/sunday/social-security-its-worse-than-you-think.html?_r=1&

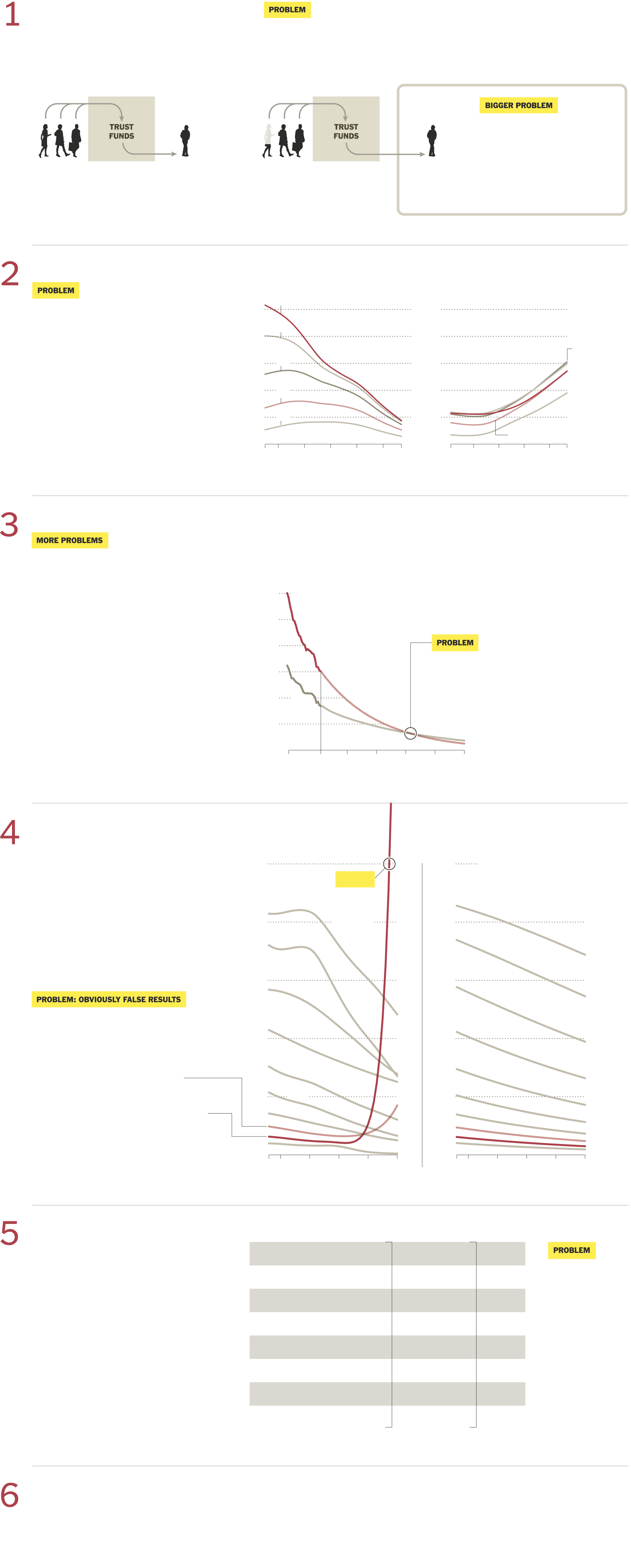

There are charts at this link.

Social Security?s Flawed Forecasting - Graphic - NYTimes.com

CONGRESS and President Obama have pushed through a relatively modest stopgap measure to avoid the fiscal cliff, but over the coming years, the United States will confront another huge cliff: Social Security. In the first presidential debate, Mr. Obama described Social Security as structurally sound, and Mitt Romney said that neither the president nor I are proposing any changes to the program. It was a rare issue on which both men agreed and both were utterly wrong.

For the first time in more than a quarter-century, Social Security ran a deficit in 2010: It spent $49 billion dollars more in benefits than it received in revenues, and drew from its trust funds to cover the shortfall. Those funds a $2.7 trillion buffer built in anticipation of retiring baby boomers will be exhausted by 2033, the government currently projects.

Those facts are widely known. Whats not is that the Social Security Administration underestimates how long Americans will live and how much the trust funds will need to pay out to the tune of $800 billion by 2031, more than the current annual defense budget and that the trust funds will run out, if nothing is done, two years earlier than the government has predicted.

We reached these conclusions, and presented them in an article in the journal Demography, after finding that the governments methods for forecasting Americans longevity were outdated and omitted crucial health and demographic factors. Historic declines in smoking and improvements in the prevention and treatment of cardiovascular disease are adding years of life that the government hasnt accounted for. (While obesity has rapidly increased, it is not likely, at this point, to offset these public health and medical successes.) More retirees will receive benefits for longer than predicted, supported by the payroll taxes of relatively fewer working adults than projected.

http://www.nytimes.com/2013/01/06/opinion/sunday/social-security-its-worse-than-you-think.html?_r=1&

There are charts at this link.

Social Security?s Flawed Forecasting - Graphic - NYTimes.com