auditor0007

Gold Member

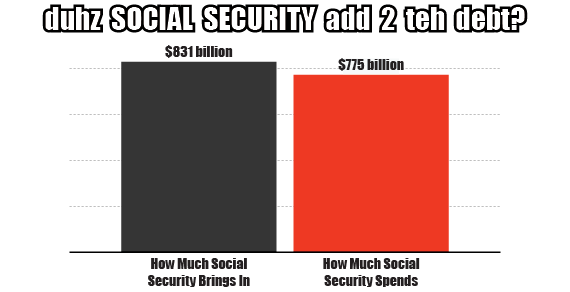

Yes it does, and this is why. According to the Social Security Trust Fund (SSTF), in 2011 it took in 45 billion less than it paid out. That is a deficit that must be paid for by borrowing money and adding to the deficit. Democrats love to play word games to convince the public there is no problem, but in fact the US Treasury had to borrow money to transfer to the SSTF to cover the $45 billion deficit last year. And in the future that deficit will become larger.

If I'm not mistaken they have had to borrow to cover the SS short fall for last 3-4 years. Maobama payroll tax cut played a huge roll in that. Ya cut funding to a program that was just barely sustaining itself without reducing expenditures you have to cover the difference and pay interest on the borrowed money.

While I agree completely with what you're saying, this shit has gone on for a long time and by Republicans just as much as Dems. I mean seriously, do we need to discuss paying for two wars while cutting tax rates?