- Sep 19, 2011

- 28,403

- 9,975

- 900

Hard to tell for sure, but it looks like he might be confused over the difference between what comes in and what goes out. I don't usually read his posts because he seems to be confused about damn near everything but his confusion doesn't stop him for yammering about it.

You have a good point. All any of us can do is read and try to figure out whose version to trust.

The right won't trust the left and the left won't trust the right.

And so it goes.

CONFUSION????

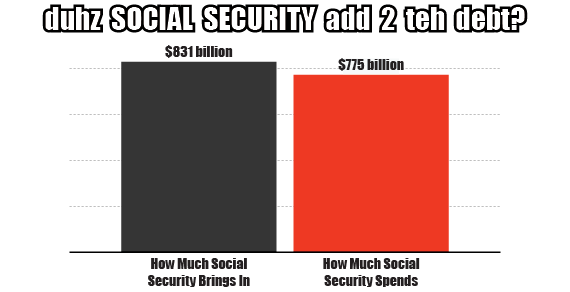

IDIOT... The graph clearly stated "SOCIAL SECURITY" $831 billion!

LIE!

It is a combination of Medicare AND SS and the total for 2011 was $818 billion ToTal!

Where in the f...k is the confusion in that???

Please point it out!!!

In fact please go to this site:Trustees Report Summary

WHAT DO the TRUSTEES SAY dumb f...K???

Social Securitys expenditures exceeded non-interest income in 2010 and 2011, the first such occurrences since 1983,and the Trustees estimate that these expenditures will remain greater than non-interest income throughout the 75-year projection period.

NOW dumb f...ks... what is their solution???

Redemption of trust fund assets from the General Fund of the Treasury will provide the resources needed to offset the annual cash-flow deficits

NOW dumb f...ks!!!

WHERE does the US government GET the money to pay SS when the redeem the TRUST FUND ASSETS??

"After 2020, Treasury will redeem trust fund assets in amounts that exceed interest earnings until exhaustion of trust fund reserves in 2033, three years earlier than projected last year. Thereafter, tax income would be sufficient to pay only about three-quarters of scheduled benefits through 2086.

DO YOU dummies understand that??? THERE IS MORE money going out then coming in so the TRUSTEES are redeeming assets to make up the difference!

That doesn't mean Social Security isn't paying its own way.

DID YOU NOT go to this site and READ what the trustees WROTE???

Redemption of trust fund assets from the General Fund of the Treasury will provide the resources needed to offset the annual cash-flow deficits

WHERE does the US TREASURY go if there IS LESS MONEY coming in then going out???

THEY BORROW IT!!! $16 trillion NoW!

So if the Trustees and their actuaries ARE PAYING OUT MORE then the TAX REVENUE coming in... they cash their assets!

When they cash their assets.. They ask the Treasury to pay up!

The Treasury says..."we don't have enough revenue... WE HAVE TO BORROW!

So again... if you go to the bank and you say I need a loan to pay out my expenses they will say you don't have enough income... cash some of your savings!

DO YOU UNDERSTAND THAT???? There is NOT enough revenue coming in so the Trustees are cashing in their assets!

Old-Age and Survivors Insurance (OASI) Disability Insurance (DI Hospital Insurance (HI)

Payroll taxes $482.4 $81.9 $195.6

They paid $596.2 $128.9 $252.9 $288.5 SMI...

out in benefits:

So which number is bigger???? top row which is the INCOME from tAXES

Or the bottom row which is WHAT THEY PAID OUT?????

Supplementary Medical Insurance (SMI) Trust Fund comprises two separate accounts: Part B, which pays for physician and outpatient services, and Part D,