- Sep 14, 2011

- 63,931

- 9,965

- 2,040

Fact-checkers Sputter And Flop Attempting To Explain How Social Security Works, Affects Deficit

So, why do Rs want to take (previously earned and therefore entitled to) money away from the elderly?

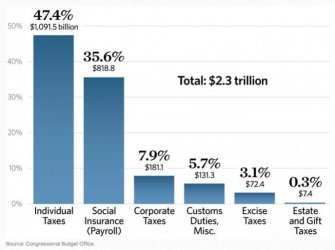

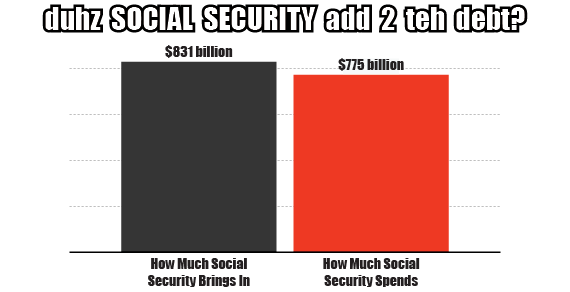

Social Security, by law, does not add to the deficit. It is not a driver of long-term debt. Weve been over this. The reason no one can get it right is because here in this season of the fiscal cliff, no one is getting anything right. Its a full-on headless chicken panic. Everyone needs to calm down, about a lot of things, but especially about Social Security, which does not even have to come up during the fiscal cliff talks because its totally irrelevant to the situation and will only complicate everything needlessly.

So, why do Rs want to take (previously earned and therefore entitled to) money away from the elderly?