- Apr 12, 2011

- 3,814

- 758

- 130

President Obama says the Occupy Wall Street protests show a "broad-based frustration" among Americans with the financial sector, which continues to kick against regulatory reforms three years after the financial crisis.

"You're seeing some of the same folks who acted irresponsibly trying to fight efforts to crack down on the abusive practices that got us into this in the first place," he complained earlier this month.

But what if government encouraged, even invented, those "abusive practices"?

Rewind to 1994. That year, the federal government declared war on an enemy the racist lender who officials claimed was to blame for differences in homeownership rate, and launched what would prove the costliest social crusade in U.S. history.

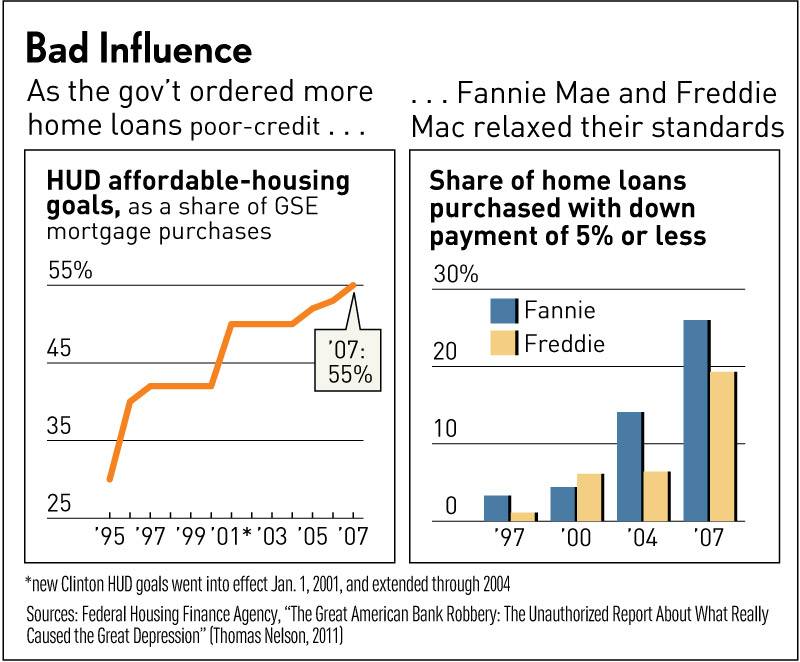

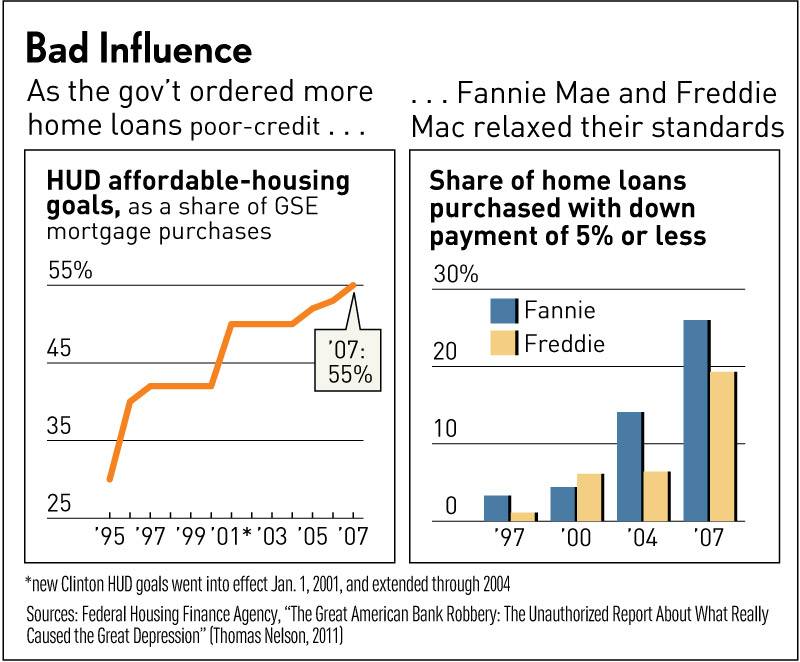

At President Clinton's direction, no fewer than 10 federal agencies issued a chilling ultimatum to banks and mortgage lenders to ease credit for lower-income minorities or face investigations for lending discrimination and suffer the related adverse publicity. They also were threatened with denial of access to the all-important secondary mortgage market and stiff fines, along with other penalties.

Bubble? Regulators Blew It

The threat was codified in a 20-page "Policy Statement on Discrimination in Lending" and entered into the Federal Register on April 15, 1994, by the Interagency Task Force on Fair Lending. Clinton set up the little-known body to coordinate an unprecedented crackdown on alleged bank redlining.

The edict completely overlooked by the Financial Crisis Inquiry Commission and the mainstream media was signed by then-HUD Secretary Henry Cisneros, Attorney General Janet Reno, Comptroller of the Currency Eugene Ludwig and Federal Reserve Chairman Alan Greenspan, along with the heads of six other financial regulatory agencies.

"The agencies will not tolerate lending discrimination in any form," the document warned financial institutions.

Ludwig at the time stated the ruling would be used by the agen cies as a fair-lending enforcement "tool," and would apply to "all lenders" including banks and thrifts, credit unions, mortgage brokers and finance companies.

The unusual full-court press was predicated on a Boston Fed study showing mortgage lenders rejecting blacks and Hispanics in greater proportion than whites. The author of the 1992 study, hired by the Clinton White House, claimed it was racial "discrimination." But it was simply good underwriting.

It took private analysts, as well as at least one FDIC economist, little time to determine the Boston Fed study was terminally flawed. In addition to finding embarrassing mistakes in the data, they concluded that more relevant measures of a borrower's credit history such as past delinquencies and whether the borrower met lenders credit standards explained the gap in lending between whites and blacks, who on average had poorer credit and higher defaults.

From Smoking-Gun Document Ties Policy To Housing Crisis - Latest Headlines - Investors.com

"You're seeing some of the same folks who acted irresponsibly trying to fight efforts to crack down on the abusive practices that got us into this in the first place," he complained earlier this month.

But what if government encouraged, even invented, those "abusive practices"?

Rewind to 1994. That year, the federal government declared war on an enemy the racist lender who officials claimed was to blame for differences in homeownership rate, and launched what would prove the costliest social crusade in U.S. history.

At President Clinton's direction, no fewer than 10 federal agencies issued a chilling ultimatum to banks and mortgage lenders to ease credit for lower-income minorities or face investigations for lending discrimination and suffer the related adverse publicity. They also were threatened with denial of access to the all-important secondary mortgage market and stiff fines, along with other penalties.

Bubble? Regulators Blew It

The threat was codified in a 20-page "Policy Statement on Discrimination in Lending" and entered into the Federal Register on April 15, 1994, by the Interagency Task Force on Fair Lending. Clinton set up the little-known body to coordinate an unprecedented crackdown on alleged bank redlining.

The edict completely overlooked by the Financial Crisis Inquiry Commission and the mainstream media was signed by then-HUD Secretary Henry Cisneros, Attorney General Janet Reno, Comptroller of the Currency Eugene Ludwig and Federal Reserve Chairman Alan Greenspan, along with the heads of six other financial regulatory agencies.

"The agencies will not tolerate lending discrimination in any form," the document warned financial institutions.

Ludwig at the time stated the ruling would be used by the agen cies as a fair-lending enforcement "tool," and would apply to "all lenders" including banks and thrifts, credit unions, mortgage brokers and finance companies.

The unusual full-court press was predicated on a Boston Fed study showing mortgage lenders rejecting blacks and Hispanics in greater proportion than whites. The author of the 1992 study, hired by the Clinton White House, claimed it was racial "discrimination." But it was simply good underwriting.

It took private analysts, as well as at least one FDIC economist, little time to determine the Boston Fed study was terminally flawed. In addition to finding embarrassing mistakes in the data, they concluded that more relevant measures of a borrower's credit history such as past delinquencies and whether the borrower met lenders credit standards explained the gap in lending between whites and blacks, who on average had poorer credit and higher defaults.

From Smoking-Gun Document Ties Policy To Housing Crisis - Latest Headlines - Investors.com