And don't forget president bush, who had the largest SS surplus monies collected to use to mask his deficit.NOT quite right there Becki....LBJ added SS to the fiscal budget so he could MASK the percentage of the budget used for Defense....the Viet Nam war....with SS as a part of the budget, it made the percentage paid out for defense spending appear much smaller.Social security is set up to be paid for by contributors' interest, not the government as granting something. It was taken out of people's paychecks, 7% and their employers were also required to pitch in a matching amount to provide for their old age. Congress was to keep this separate. In the 1960s, Lyndon Johnson changed that to up his financial numbers for his election. He literally expropriated people's retirement savings to use as part of his budget. Since then, all others have done the same thing. Now, it's used as "gift from the government" status as Obama stole Medicare money to start of Obama care with.

Obama has no honor in stealing money from me to give to his pet rock project. That was money taxpayers put there for their own pensions, and Obama took it upon himself to take that away because he doesn't understand that other people's money is not his ticket. He thinks everything belongs to him, and that he can withhold government services from Arizona and senior citizens' social security benefits into his pet rock project of taking all America's money and putting it in Democrat pockets. He gets his share in campaign contributions, or he doesn't play.

His overblown ego tells him he is priviledged to steal money through taxes and social security payments that other people made that is truly not his to take.

Obama is trouble, trouble, and nothing but trouble, stealing other people's money any which way he can.

HE DID NOT use or steal any SS funds to pay for anything other than SS....at the time SS taxes were only 3% plus employer match...

There was NO SURPLUS monies collected for SS, it was a PAY AS YOU GO system.

It was NOT UNTIL Reagan, who gave us a 100% TAX INCREASE on SS taxes, and DOUBLED what we and our employers had to pay in SS taxes, that a ''SS surplus'' became available for him and all other presidents and congresses there after to 'spend' or rather to mask their budget deficits with the SS surplus collected. ty Reagan, NOT!

Well Clinton sure did

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Setting the record straight on spending

- Thread starter P@triot

- Start date

There was no surplus except because clinton took funds from Social security and remember you just said clinon took money from SS, so don't back down from that.And don't forget president bush, who had the largest SS surplus monies collected to use to mask his deficit.NOT quite right there Becki....LBJ added SS to the fiscal budget so he could MASK the percentage of the budget used for Defense....the Viet Nam war....with SS as a part of the budget, it made the percentage paid out for defense spending appear much smaller.

HE DID NOT use or steal any SS funds to pay for anything other than SS....at the time SS taxes were only 3% plus employer match...

There was NO SURPLUS monies collected for SS, it was a PAY AS YOU GO system.

It was NOT UNTIL Reagan, who gave us a 100% TAX INCREASE on SS taxes, and DOUBLED what we and our employers had to pay in SS taxes, that a ''SS surplus'' became available for him and all other presidents and congresses there after to 'spend' or rather to mask their budget deficits with the SS surplus collected. ty Reagan, NOT!

Well Clinton sure did

America needs to change it's name to Amerigreece

We keep this up and we will be sending a delegation to Greece

to ask if we can borrow money from them because everyone else turned us down.

Obama will go before the American people and he will blame Bush and the Republicans

and the dopes will fall for it again....

there was a budget surplus according to the rules....since SS funds and payout are included in our federal budget since LBJ....There was no surplus except because clinton took funds from Social security and remember you just said clinon took money from SS, so don't back down from that.And don't forget president bush, who had the largest SS surplus monies collected to use to mask his deficit.Well Clinton sure did

but yes, the SS surplus masked the amount really spent on things that income taxes and corporate taxes and excise taxes should have paid for in the Clinton budget.... so, we did technically and legally have a budget surplus under Clinton, but we still added to our National Debt all 8 years.

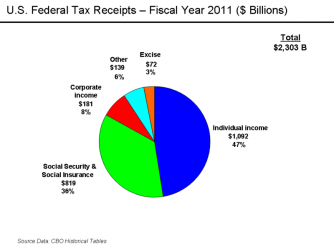

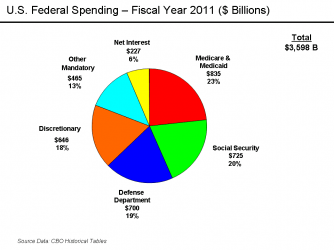

The left (many anyway), always claim that we spend the most on defense and scream that it is an "outrage". That fact is, we more than double the unconstitutional spending on the parasite class than we do on the #1 Constitutional responsibility of the federal government (defense - $500 billion and change).

Super misleading figure. The article counts state spending as part of the federal spending it's an extension of benefits provided by the federal program. That's a pretty dishonest accounting measure. Also, defense spending is closer to $700 billion.

Can't tell if trolling or just making vague statements instead of attacking the actual premise.

Neither are welfare

Social security is paid into by those who receive it. Are retirement plans welfare?

and Vet's have earned their benefits they receive after they retire.

Saying "Social Security is paid into by those who receive it" is misleading, because the amount of benefits they derive are far higher than the amount of money they put in.

LibertyLemming

VIP Member

They actually put in more money beforehand than they take out once they start drawing their checks. I feel like I linked this on a prior page, if not and you need one, just ask.

4Horsemen

Senior Member

- Oct 9, 2012

- 1,205

- 116

- 48

The GOP's definition of WELFARE inclues social security, and VETERANS benefits.

The GOP loves to play this semantics game.

How are those things not welfare?

I'm with you. Let's see what the response is. I bet it's stupid.

4Horsemen

Senior Member

- Oct 9, 2012

- 1,205

- 116

- 48

Can't tell if trolling or just making vague statements instead of attacking the actual premise.

Neither are welfare

Social security is paid into by those who receive it. Are retirement plans welfare?

and Vet's have earned their benefits they receive after they retire.

Who told you this bullshit?

Social security is set up to be paid for by contributors' interest, not the government as granting something. It was taken out of people's paychecks, 7% and their employers were also required to pitch in a matching amount to provide for their old age. Congress was to keep this separate. In the 1960s, Lyndon Johnson changed that to up his financial numbers for his election. He literally expropriated people's retirement savings to use as part of his budget. Since then, all others have done the same thing. Now, it's used as "gift from the government" status as Obama stole Medicare money to start of Obama care with.The GOP's definition of WELFARE inclues social security, and VETERANS benefits.

The GOP loves to play this semantics game.

How are those things not welfare?

Obama has no honor in stealing money from me to give to his pet rock project. That was money taxpayers put there for their own pensions, and Obama took it upon himself to take that away because he doesn't understand that other people's money is not his ticket. He thinks everything belongs to him, and that he can withhold government services from Arizona and senior citizens' social security benefits into his pet rock project of taking all America's money and putting it in Democrat pockets. He gets his share in campaign contributions, or he doesn't play.

His overblown ego tells him he is priviledged to steal money through taxes and social security payments that other people made that is truly not his to take.

Obama is trouble, trouble, and nothing but trouble, stealing other people's money any which way he can.

The switch to a unified budget in the 1960s actually creates a more honest accounting of the government's fiscal position. Johnson didn't "expropriated people's retirement savings", he just counted total federal liability in the same ledger. Borrowing against the trust fund was an invention of the Reagan administration.

They actually put in more money beforehand than they take out once they start drawing their checks. I feel like I linked this on a prior page, if not and you need one, just ask.

I looked back and found your article. I was thinking of the Social Security/Medicare combined figure.

PaulS1950

Senior Member

- Sep 14, 2011

- 63,931

- 9,964

- 2,040

A list please of those 83 welfare programs your article is referring to.

It does not list them.

Well, we know the rw's want the elderly and children taken off food stamps. And, they're still mad about Big Bird.

I'm sure they'll tell us the rest.

Any minute now.

LibertyLemming

VIP Member

Welfare is wrong because it violates liberty in the sense that you have to take by force from people to have it. You basically are making slaves of people by giving partial ownership of the their labor to other people.

Your link isn't a direct link that refutes my source or what I said.

I didn't read every piece of content on your page. You linked me to an overview of the system which doesn't really tell me much. My link however directly shows that people are paying in (arbitrary number) 1000$ in their lifetime and only receiving (arbitrary number) 750$ back. That more or less proves that they are not getting what THEY put in.

EDIT: I'd prefer you just say what you are trying to say and if I find it ridiculous I'll ask you to prove it or just go ahead and dispute it with facts of my own.

Which still does not refute what I said

Social Security is not welfare it's a system that recipients pay into until they retire.

I asked earlier is a retirement plan welfare.

A retirement plan and SS are not the same thing. No, a retirement plan is not welfare. The reason being you own the money that goes into your 401k, Roth, or whatever. The money you put in is earmarked for YOU when you retire. The dollar you put in when you were 25 is the same dollar you'll get out when you draw from whenever you retire.

Social Security on the other hand, the money you're putting in now is NOT earmarked or set aside for you when you retire. The money you put in now is being given to someone else who is elgible now. Not at all that different from any other type of government assistance such as unemplyment insurance or foodstamps. The difference essentially is the source. Social security is welfare because it comes from someone other than you. A retirement account is not welfare because the money you get from it came from you.

Oh goody a redacted report from the "Republican Side" of the aisle.

I am sure we can trust the numbers and methodology here.

Yessiree..

Anyone interested in Florida swamp land or a bridge in brooklyn?

I am sure we can trust the numbers and methodology here.

Yessiree..

Anyone interested in Florida swamp land or a bridge in brooklyn?

Welfare is wrong because it violates liberty in the sense that you have to take by force from people to have it. You basically are making slaves of people by giving partial ownership of the their labor to other people.

No one takes anything by force.

Taxes are part of the social compact within the Constitution.

Don't like it? You are free to move out of the country.

LibertyLemming

VIP Member

Welfare is wrong because it violates liberty in the sense that you have to take by force from people to have it. You basically are making slaves of people by giving partial ownership of the their labor to other people.

No one takes anything by force.

Taxes are part of the social compact within the Constitution.

Don't like it? You are free to move out of the country.

Ah but that alone will not help anything as our government, along with North Korea's, will tax any labor you do outside of the country as well.

I love the argument that it is just because it is on paper somewhere. Good thing you weren't around for slavery huh? Some abolitionist woulda been all like "you man fuck this slavery shit it violates freedom" and you'd be all like "bro its social contract in the constitution and shit"

Similar threads

- Replies

- 76

- Views

- 936

- Replies

- 4

- Views

- 652

- Replies

- 2

- Views

- 91

- Replies

- 6

- Views

- 114

Latest Discussions

- Replies

- 112

- Views

- 544

- Replies

- 38

- Views

- 197

- Replies

- 41

- Views

- 319

- Replies

- 240

- Views

- 1K

Forum List

-

-

-

-

-

Political Satire 8005

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 466

-

-

-

-

-

-

-

-

-

-