Judicial review

Gold Member

- Banned

- #41

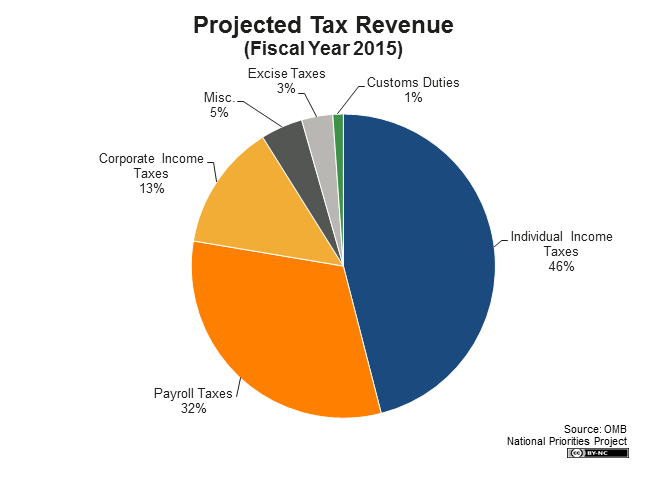

The Right might have credibility on taxes if they were as equally against the regressive payroll taxes because they tax the poor more than the rich, as they are against the progressive income tax because it taxes the rich more than the poor. But they are not so the Right has no credibility when it comes to taxes!

The payroll tax is a flat tax, everyone is taxed the same so how could the poor be paying more?

You eliminate the payroll tax and simply make the corporate tax rate based on business income a flat tax you will CREATE JOBS, which means MORE TAX REVENUE!!!!!!!

There zero reason to double tax any person or business on the federal level.