ConservaDerrps

Rookie

- Thread starter

- Banned

- #61

Yes, it will.

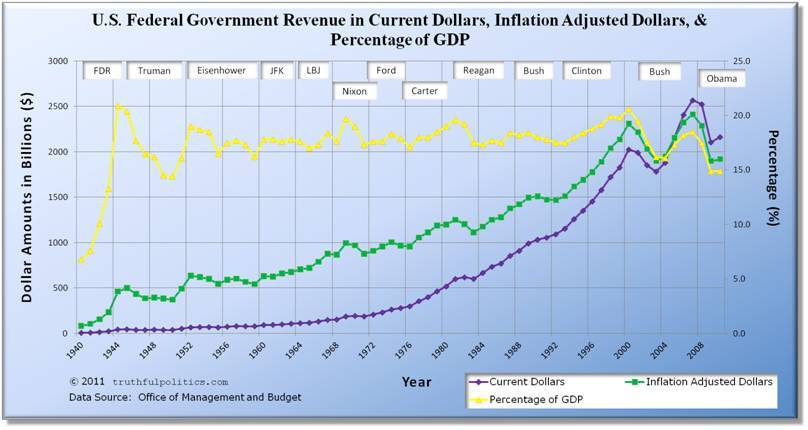

Bush cut taxes three times over three years and in all three years revenue dropped. This proved we are on the left side of the Laffer Curve, and therefore any increase in tax rates will result in increased revenue.

Revenues were higher after all the tax cuts were implemented than they were before them. That would lead a thinking person to wonder if increasing taxes might result in a drop in revenue.

100% false.

In 2003, revenue was lower than Clinton's last year.

In 2004, revenue was lower than Clinton's last year.

In 2005, revenue was $0.1T higher than Clinton's last year but as a share of GDP was lower than any year Clinton was in office.

In fact, since 2003, tax revenue, as share of GDP, has only twice been higher than Clinton's worst year, and has never come close to his average or his record high.

Historical Federal Receipt and Outlay Summary

Gee. I wonder how the Conservatives will respond to your factual data.

"Lies."

"Kenya."

"Birth certificate."

"Fast and Furious."

"Socialist."

"Kenya."

Those are the ones I could think of off the top of my head.