OohPooPahDoo

Gold Member

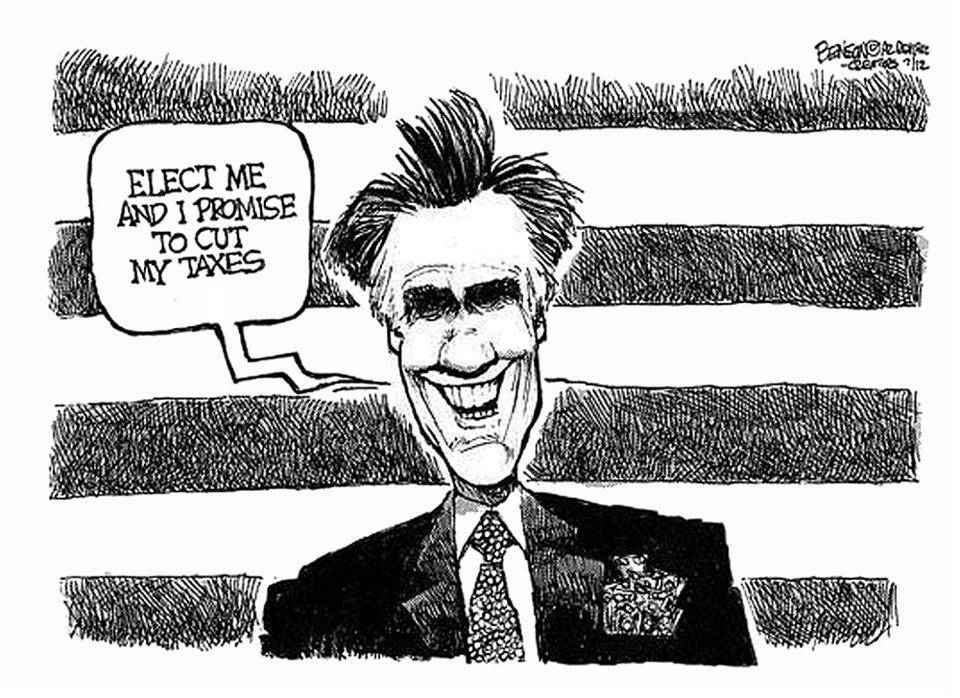

How is it "wrong" ? Its HIS MONEY! Sorry you're life is so miserable because you're jealous of other peoples' success - that doesn't give you the right to stick your hands in the wallets of productive people so you can buy your cigarettes and malt liquor! How dare you leach!Since I haven't read every single post I'll just ask,

was there even ONE conservative here who posted who simply said

a tax policy that would let a man of Mitt Romney's means and income pay ONE PERCENT on his federal taxes

is WRONG?

One? Any? How many?