- Thread starter

- #21

I thought we had settled this...

I wish we had.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

I thought we had settled this...

"The greatest single cause of the fiscal surplus of the 1990s was the stock market bubble, which led to an unsustainably high level of economic activity and tax revenues," said Ben S. Bernanke, the chairman of Bush's Council of Economic Advisers.

Alan Greenspan or as Matt Taibbi calls him "The Biggest Asshole in the Universe."

Did you happen to read Tabbi's book Griftopia Toro, and if so what did you think of it?

I haven't. I'm not a fan of Tiabbi. I've read some of his articles though.

So let's review. Here is a list thus far who say there were surpluses.

George W Bush, President of the United States

Alan Greenspan, Chairman of the Federal Open Market Committee

Ben Bernanke, Chairman of the Federal Open Market Committee and Chairman of the Council of Economic Advisers

Greg Mankiw, Chairman of the Council of Economic Advisers

Martin Feldstein, Chairman of the Council of Economic Advisers

Glen Hubbard, Chairman of the Council of Economic Advisers

Paul O'Neill, Secretary of the Treasury

Mitch Daniels, Chairman of the Office of Management and Budget and Governor of Indiana

Milton Friedman, Nobel Laureate

Stephen Moore, former President of the Club for Growth

Stephen Forbes, publisher of Forbes magazine and well-known anti-tax crusader

Kevin Hassert

Thomas Sowell

The Cato Institute

The American Enterprise Institute

The Heritage Foundation

And here is a list of people who say there was no surplus

Rush Limbaugh

Some software engineer

Quantum Windbag

Soggy, who said that saying there was a surplus is just "regurgitating MoveOn.org talking points."

So let's review. Here is a list thus far who say there were surpluses.

George W Bush, President of the United States

Alan Greenspan, Chairman of the Federal Open Market Committee

Ben Bernanke, Chairman of the Federal Open Market Committee and Chairman of the Council of Economic Advisers

Greg Mankiw, Chairman of the Council of Economic Advisers

Martin Feldstein, Chairman of the Council of Economic Advisers

Glen Hubbard, Chairman of the Council of Economic Advisers

Paul O'Neill, Secretary of the Treasury

Mitch Daniels, Chairman of the Office of Management and Budget and Governor of Indiana

Milton Friedman, Nobel Laureate

Stephen Moore, former President of the Club for Growth

Stephen Forbes, publisher of Forbes magazine and well-known anti-tax crusader

Kevin Hassert

Thomas Sowell

The Cato Institute

The American Enterprise Institute

The Heritage Foundation

And here is a list of people who say there was no surplus

Rush Limbaugh

Some software engineer

Quantum Windbag

Soggy, who said that saying there was a surplus is just "regurgitating MoveOn.org talking points."

Am I supposed to stop calling bullshit on an accounting trick that allows the government to borrow from itself and call it revenue just because you post a list of politicians (aka liars) that disagree with me?

I have to admit, I had to backtrack on one of my closely held beliefs; I had a belief that just paying your interest say on your CC while not paying the principal precluded a a genuine surplus, was a viable way to describe the issue,that is how I formally classified the 'surplus', that is incorrect.(imho)

his example makes sense to me ala the investment methodology they use ala handing the money to a firm how then hands to a manager who then invests it in bonds and other vehicles that are , in effect invested in ME ( notice it doesn't have to be invested at all, its "Me" which equals US the United States future productivity. I may not like it but......it has a sense all its own.

we can draw down the investments, pull them back thru the system yet my income or better yet output and security of my job is the investment to an extent dedicated to reestablishing them.

the system has got to go very south for a very long time to pull them all back, until we have to stop investing in me and use that to pay for groceries and the security of my 'job' or the US is at stake as well...that time, is however approaching.

I think I have that pretty much right?

So let's review. Here is a list thus far who say there were surpluses.

George W Bush, President of the United States

Alan Greenspan, Chairman of the Federal Open Market Committee

Ben Bernanke, Chairman of the Federal Open Market Committee and Chairman of the Council of Economic Advisers

Greg Mankiw, Chairman of the Council of Economic Advisers

Martin Feldstein, Chairman of the Council of Economic Advisers

Glen Hubbard, Chairman of the Council of Economic Advisers

Paul O'Neill, Secretary of the Treasury

Mitch Daniels, Chairman of the Office of Management and Budget and Governor of Indiana

Milton Friedman, Nobel Laureate

Stephen Moore, former President of the Club for Growth

Stephen Forbes, publisher of Forbes magazine and well-known anti-tax crusader

Kevin Hassert

Thomas Sowell

The Cato Institute

The American Enterprise Institute

The Heritage Foundation

And here is a list of people who say there was no surplus

Rush Limbaugh

Some software engineer

Quantum Windbag

Soggy, who said that saying there was a surplus is just "regurgitating MoveOn.org talking points."

Am I supposed to stop calling bullshit on an accounting trick that allows the government to borrow from itself and call it revenue just because you post a list of politicians (aka liars) that disagree with me?

It's not an accounting trick. The government was NOT borrowing from itself and calling it revenue. They were taking in tax receipts and calling it revenue. Period. Now, if you wish to offer a single shred of evidence, feel free to do so. Here are the US budgets. I've looked through many of these several times. Knock yourself out.

Most of those people aren't politicians. Many are economists who worked with the budget. And If you wish to continue engaging in massive confirmation bias and assume they are all "liars," these "liars" have a vested in making Bill Clinton look bad because they are all of the other party.

Here is a history of how social security has been budgeted.

Social Security Online - HISTORY: Budget Treatment of Social Security Trust Funds

Same on you Toro.

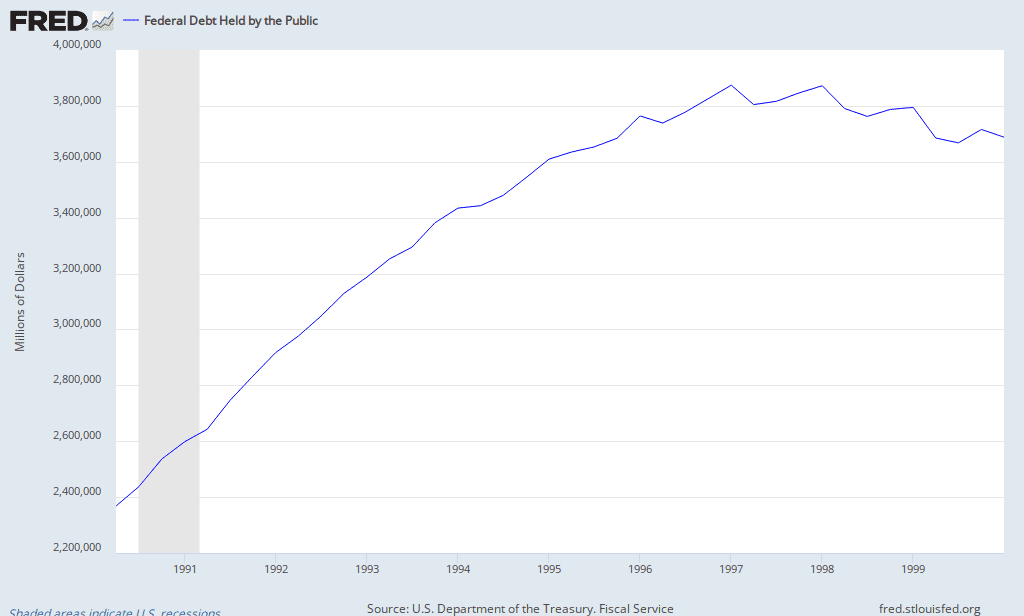

The government is borrowing from itself, which is why total debt went up during the surplus. The Social Security and Medicare trust funds are separate from the general fund, and, by law, cannot be counted toward the general fund. The trust fund is required, by law, to invest in treasuries. This is perfectly legal, and the technical and legal equivalent of sticking the cash in a bank and letting it accrue interest.

The treasury does not count the FICA and Medicare taxes as revenue because that is illegal, it does count all sales of treasures, including those it sells to SS, as revenue. That, whether you like it or not, is an accounting gimmick. It is perfectly legal to do so under a cash accounting system, but it is still a gimmick.

States do stuff like this all the time, and it is often reported as a gimmick, yet the economists who work with those budgets say they are balanced.

Candidate George W Bush promises to return the budget surplus to the voters in the form of tax cuts during the 2000 election.

"Governor Bush believes that roughly one-quarter of the surplus should be returned to the people who earned it through broad tax cuts -- otherwise, Washington will spend it. His plan will promote economic growth and increase access to the middle class by cutting high marginal rates. It will also double the child credit, eliminate the death tax, reduce the marriage penalty, and expand Education Savings Accounts and charitable deductions. The largest percentage cuts will go to the lowest income earners. As a result, 6 million families will no longer pay federal income tax."

George W. Bush on the Issues

Same on you Toro.

The government is borrowing from itself, which is why total debt went up during the surplus. The Social Security and Medicare trust funds are separate from the general fund, and, by law, cannot be counted toward the general fund. The trust fund is required, by law, to invest in treasuries. This is perfectly legal, and the technical and legal equivalent of sticking the cash in a bank and letting it accrue interest.

The treasury does not count the FICA and Medicare taxes as revenue because that is illegal, it does count all sales of treasures, including those it sells to SS, as revenue. That, whether you like it or not, is an accounting gimmick. It is perfectly legal to do so under a cash accounting system, but it is still a gimmick.

States do stuff like this all the time, and it is often reported as a gimmick, yet the economists who work with those budgets say they are balanced.

Well, you better put out indictments on all those politicians then, because everyone has been breaking the law for the at least the past two decades. The budget is reported as unified, and has been for decades, whether or not the trusts were carved out. It is what dominates our political discourse, and it is what everyone refers to. If you want to argue that we wouldn't have balanced the budget without the social security trusts, fine, I'd agree with you. But a surplus is all money coming in exceeding all money going out. It is not an accounting gimmick or trick. It is keeping track of where all the money goes.

And once again, total debt did not go up because the government borrowed against itself. Total debt went up because total debt counts all government indebtedness, including liabilities of the trusts, which rose because of a surge in employment and payroll taxes. It doesn't count the assets of the government. That money was then diverted out of the trusts and used to pay down publicly traded debt. If you want to criticize that, fine. That's fair. But if what you say were true, then net debt would have risen as well. But net debt fell as the surge in SS liabilities was offset by a surge in SS assets.

Edit - Summary tables begin on page 169 on this year's budget. The first reference to social security receipts and outlays is on page 174. It proceeds throughout. That is the unified budget.

http://www.gpoaccess.gov/usbudget/fy12/pdf/BUDGET-2012-BUD.pdf

If only it were that simple.

I thought I made clear that what they are doing is legal, I just view it as an accounting gimmick similar to states deferring payments on some bills until the next year to balance this years budget. That is also legitimate, perfectly legal, actually balances the budget, and is still an accounting gimmick.

Intergovernmental debt, the money the government owes itself, went up under Clinton. As for government assets, if we actually counted those the government would be forced to use an accrual accounting method in order to deal with depreciation and the fact that it routinely gives away surplus equipment under Homeland Security's efforts to equip local law enforcement to fight battles they will never have.