Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Republican Lie #57: 50% of Americans Pay No Taxes

- Thread starter Sundial

- Start date

Well mine came from doing one of my subordinates taxes with him. Its from memory but if you have turbotax its pretty simple. The only difference is that he claimed zero dependents so he could get "a bigger return". I fixed that and told him to keep his money because he's just giving the govt an interest free loan.You're not going to provide a link, are you?

Whatever.

The poorest people in the country should pay no taxes. 0%.

According to Wikipedia, "According to the U.S. Census Bureau, approximately 43.6 million (14.3%) Americans were living in absolute poverty in 2009."

Therefore, my answer is 14.3%.

Why would I provide a link? I asked a question.

Mike

I asked you a question in post #30. I answered your question. Will you answer mine?

Mike

clevergirl

Gold Member

- Oct 22, 2009

- 2,721

- 554

- 153

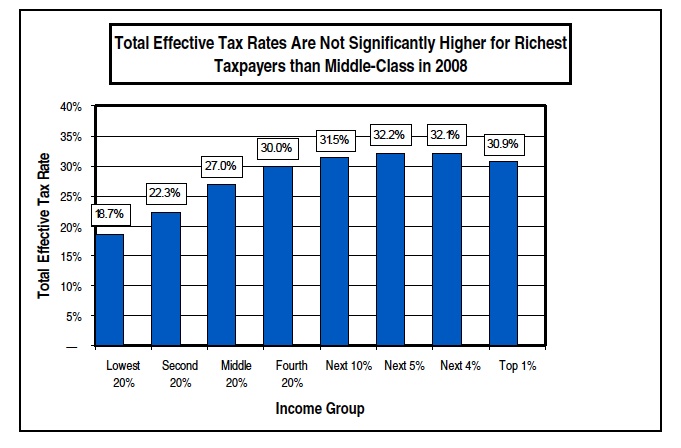

LOL...Citizens for Tax Justice really had to massage the data to come up with that mess.

Look at the pretzels they contort to make that math work.

Nice try.

That's it? That's all you have to say?

Yep, pretty much that's it.

In order for the chart to work out any differently, a can of peas that cost someone in the bottom 20% fifty cents with 7 cents in tax would have to cost the 1%ers 50 cents plus $8.42 in tax. A gallon of gas that's $3.00 would cost a 1%er around $62.50

It's statistical trickery...smoke and mirrors, nothing more.

Last edited:

Charles_Main

AR15 Owner

Source: http://www.ctj.org/pdf/taxday2009.pdf

In fact, nearly everyone in America pays taxes - including even the poorest people in the country.

Nobody says they pay no Taxes at all, if they do they are mistaken. They pay no FEDERAL INCOME tax. What is withheld they get back in a return. All they pay is FICA and MC and State Income Tax.

It's not a republican Lie, it is a fact that a short Visit to the IRS web site will confirm.

Not all of us pay state income tax.But, then we do pay property tax. Then again states with SIT also charge property tax.

Immie

As far as Property taxes go. There again the Rich Pay the most. The more your Property is worth. The More you pay, so all those fat cats in mansions and owning Multiple homes pay far more in Property Taxes then the Average joe.

auditor0007

Gold Member

The real issue is do they pay federal taxes. I could give a damn if somebody in NY is paying a boat load of sales/property taxes. I care if they are paying taxes to the federal government or not. If you are paying taxes in the city you live in then you have a little skin in the game when it comes to how the local government spends your money. It is the same at the state and federal level. If person A lives in Los Angles and person B lives in San Francisco and person A pays state and county taxes while person B pays county taxes but is responsible for no state taxes, then person A is paying for something and person B is the beneficiary. It doesn't matter if person B is paying 30,40,50% of sales tax in his city/county... that's his damn problem because that's his local government that he put in charge. When, however, he goes screaming "I'm paying too much in taxes, person A needs to pay more taxes" that's moronic. Person A isn't benefiting from person B's taxes. That's the same thing with this argument that "50% of people don't pay taxes".

I don't care what you pay in local/state taxes, the question is... do you pay federal taxes? If you make 24k/yr ($2k/month) and you pay 15% in payroll/income/ssi/whatever that is $300/month. At the end of the year you've paid 3600. If at the end of the year you have a wife and a child you're looking at zero tax liability (getting your 3600 back) plus your EIC which is in the neighborhood of 3K plus your making work pay credit $800 plus your child tax credit ($1k) you are looking at getting back 3600 + 3000 + 800 + 1000 or $8400 back. At the end of the year you're getting back almost $5000 that you didn't pay into the system. You need to buy a lot of gas/electricity to tell me that you paid more into the federal government than you got out of it.

Who cares if you paid $6000 in local, city and state taxes... you can't tell me that you need a federal tax break or more rebates, you need to take care of your own local election and stop demanding that I go further into a tax liability to pay for your existence.

Furthermore, I don't care if its 4%, 14% or 40%, its too damn high. Unless you are disabled you should pay taxes.

Mike

Kind of like they do in Texas, huh? Texas has a wonderful system where the poor pay almost four times more than the rich as a percentage of their income. I'm sure Perry would love to bring that system to the Federal Government.

Texas' low-income residents paying high share of taxes, study finds | Texas Legislature News - News for Dallas, Texas - The Dallas Morning News

Similar threads

- Replies

- 46

- Views

- 565

- Replies

- 3

- Views

- 92

- Replies

- 11

- Views

- 137

- Replies

- 27

- Views

- 344

Latest Discussions

- Replies

- 75

- Views

- 240

- Replies

- 40

- Views

- 361

- Replies

- 101

- Views

- 536

Forum List

-

-

-

-

-

Political Satire 8018

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 466

-

-

-

-

-

-

-

-

-

-