Mad Scientist

Feels Good!

- Sep 15, 2008

- 24,196

- 5,431

- 270

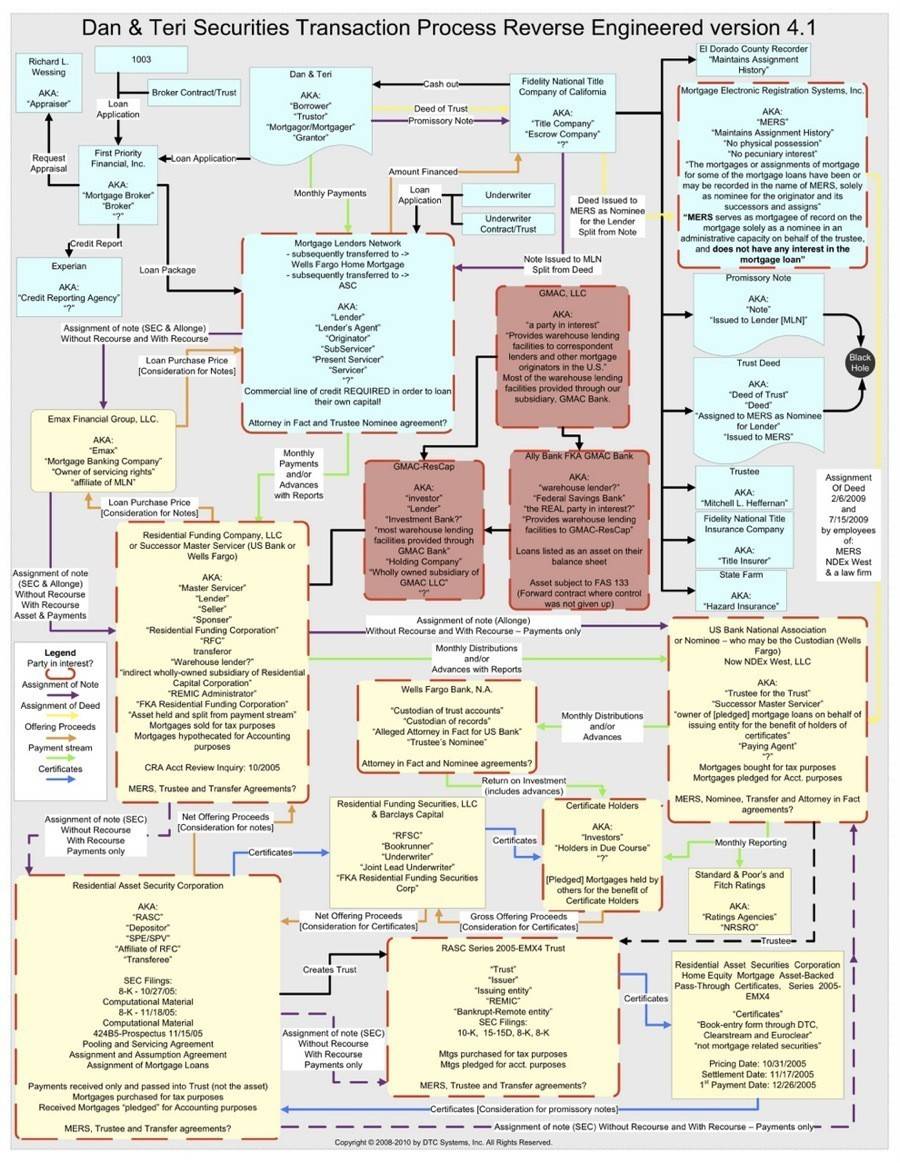

Ok first it was; "Give us a huge bailout NOW! The sky is falling". Now it's: "Umm, we don't know who owns the title to your house. Oops!"

Report: Foreclosure mess could threaten banks - Yahoo! Finance

You bank may have sold your mortgage multiple times, like 10-20 times, to different investors.

But that's ok, I'm sure the Federal Reserve can come to the rescue by printing the banks some money that we the tax payers have to pay back right? We already have 13 trillion in debt what's 6.4 trillion more?

Report: Foreclosure mess could threaten banks - Yahoo! Finance

That means if you re-fied your house or if the bank sold the mortgage as a financial instrument (mortgage backed securities, remember those?) multiple banks and lending institutions may try to foreclose on you.Revelations that several big mortgage issuers sped through thousands of home foreclosures without properly checking paperwork already has raised alarm in Washington.

"Clear and uncontested property rights are the foundation of the housing market," the report says. "If these rights fall into question, that foundation could collapse."

It lays out the possible scenarios: Borrowers may not be able to ascertain if they're sending their mortgage payments to the right party. Judges may block all foreclosures. Prospective buyers and sellers could be in left in limbo.

You bank may have sold your mortgage multiple times, like 10-20 times, to different investors.

But that's ok, I'm sure the Federal Reserve can come to the rescue by printing the banks some money that we the tax payers have to pay back right? We already have 13 trillion in debt what's 6.4 trillion more?