- May 17, 2013

- 67,509

- 32,636

- 2,290

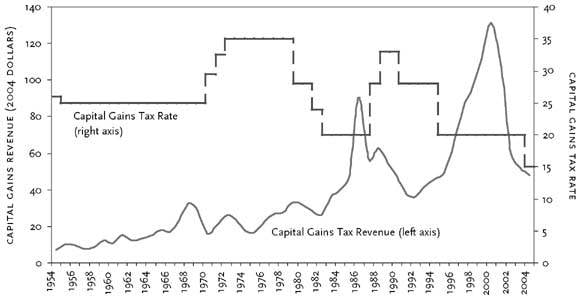

Most capital gains are in the Markets............and jobs haven't followed the markets because the markets are based on fiction and monopoly money to inflate large bubbles.............Capital Gains tax is a punishment for investing and again for investing well. Of course it should be repealed. And if a repeal and resulting encouraging to invest more happened that we got more benefit then there's even more incentive to repeal it.

Wr're never going to pay off the National Debt, that ship sailed a long time ago. So clinging to taxes out of some nonsensical wish of being able to pay down the debt is just counter-productive.

The labor participation rate...........aka jobs...........has been dying since 2000............as has the Velocity of Money................

The jobs will not follow the markets......................they haven't been and still will not have massive increases of employment as a result of getting rid of Capital Gains taxes................

To me, the bottom line problem of the downward trend in America is FREE TRADE................Which started the massive down trend. and also the price increases for pretty much everything we buy that the Gov't misinterprets by changing the way they calculate the basket of goods.