Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recovery !

- Thread starter Douger

- Start date

Granny says, "Dat's right - Uncle Ferd needs a pay raise so' he can move his g/f outta the trailer...

US job market's lingering weak spot: Stagnant pay

Sep 8,`14 WASHINGTON (AP) -- The U.S. job market has steadily improved by pretty much every gauge except the one Americans probably care about most: Pay.

US job market's lingering weak spot: Stagnant pay

Sep 8,`14 WASHINGTON (AP) -- The U.S. job market has steadily improved by pretty much every gauge except the one Americans probably care about most: Pay.

The unemployment rate has sunk to a nearly normal 6.1 percent. Employers have added a robust 2.5 million jobs the past 12 months. Layoffs have tumbled. Yet most people are still waiting for a decent raise. Friday's August jobs report confirmed that average hourly pay has crept up only about 2 percent a year since the recession ended five years ago - barely above inflation and far below the gains in most recoveries. Just why pay has been so weak and when it might strengthen are key issues for the Federal Reserve in deciding when to raise interest rates. The trend has mystified analysts. "This is the primary economic and policy puzzle facing policymakers right now: Why have wages remained so low in the face of an improving economy?" said Joe Brusuelas, chief economist at McGladrey, a tax and accounting firm.

Some economists expect pay to pick up eventually as the job market keeps improving. They think wages have lagged because millions of people are still out of work - many of whom aren't counted in the unemployment rate because they're no longer looking for a job. But others say they fear that pay has stagnated because of trends that will persist even after the economy has moved closer to full health. They note that companies have been making more use of temporary and part-time workers, usually at lower pay, to replace full-time permanent jobs. And newer technologies have enabled businesses to produce more with fewer employees. A survey of Harvard Business School graduates released Monday lends weight to that notion. Nearly half the respondents said they'd rather invest in technology than in workers. Just over 40 percent expect wages and benefits to decline over the next three years.

Economists are flummoxed by the way the historical relationship between pay and unemployment has eroded since the recession ended. Based on historical trends, the steady drop in unemployment should have raised inflation-adjusted wages by 3.6 percent by June, according to researchers at the Federal Reserve Bank of Chicago. That's because employers have had to fill jobs from a smaller pool of unemployed people - a trend that normally forces them to pay more. Instead, overall inflation-adjusted wages have essentially flattened since 2009. That said, workers in some industries have fared better. For those in a category that includes data processing and analytics, as well as broadcasting, film and publishing, hourly wages have surged 4.6 percent in the past year. And pay is up at least 3 percent for financial services workers and wholesalers. By contrast, wages are up just 1.3 percent for employees in education and health care.

So why has overall wage growth been so weak? Economists point to several factors. The biggest is that there are still too many people desperate for work than is typical for a healthy economy. That makes it easier for employers to fill jobs without raising pay. There are 227,000 fewer people with jobs than in November 2007, just before the recession began. Yet the working-age population is up 15.3 million since then. That's kept the number of unemployed elevated: 9.6 million Americans, up from 7.6 million when the recession began. But it's not just unemployment that's holding down wages. The many part-timers who would prefer full-time work are also competing with those who are out of work. There are 7.2 million involuntary part-timers, up from just 4.6 million in late 2007.

MORE

Mr. H.

Diamond Member

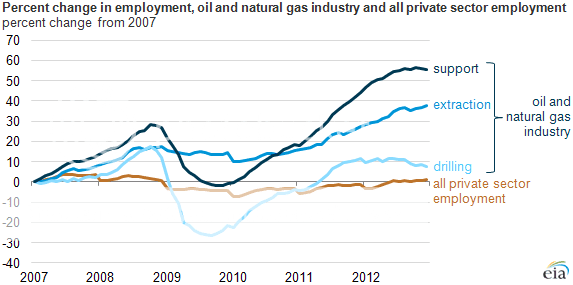

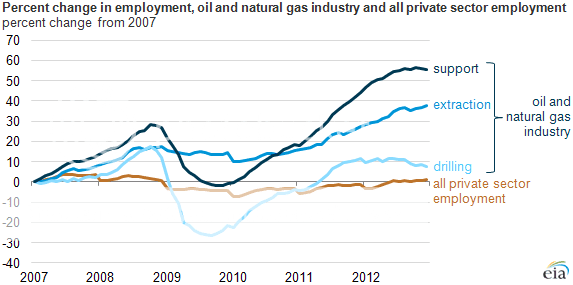

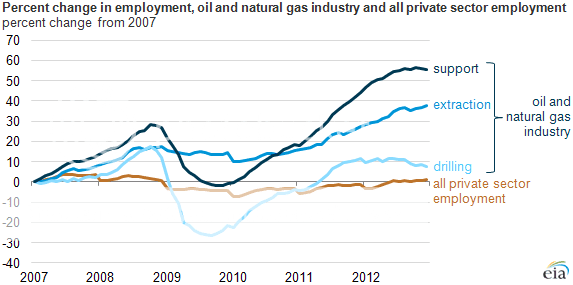

The pay isn't stagnant in the oil and gas sectors.

In fact, it appears they're the only one's hiring these days...

In fact, it appears they're the only one's hiring these days...

shart_attack

Gold Member

The pay isn't stagnant in the oil and gas sectors.

In fact, it appears they're the only one's hiring these days...

Yeah, them — and the state and federal prisons.

Imagine that.

Similar threads

- Replies

- 32

- Views

- 331

- Replies

- 29

- Views

- 453

- Replies

- 61

- Views

- 690

- Replies

- 19

- Views

- 807

Latest Discussions

- Replies

- 17

- Views

- 34

- Replies

- 94

- Views

- 597

Forum List

-

-

-

-

-

Political Satire 8029

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-