Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Recovery Summer Continues!!!!

- Thread starter KMAN

- Start date

I don't think this is something we should be happy about......And, Corporate America is a great-example of that!!

How DARE Obama upset their perpetual-RIP-OFF-gig???????

The high jobless rate provokes a fight between corporate America and the White House over regulations, taxes, and trade.

"This confrontation had inevitability written all over it. The only question was: When would the White House and Big Business really start to rumble?

Both sides are certainly clashing now over a crush of new rules to overhaul industries ranging from health care to financial services to offshore drilling. Verizon Communications (VZ) CEO Ivan Seidenberg says business leaders must make sure the Obama Administration's regulatory cures aren't "worse than the disease," adding that the Administration hasn't done enough to pry open foreign markets and keeps trying to raise corporate taxes. Mort Zuckerman, chairman of commercial real estate firm Boston Properties (BXP), calls the coming regulatory explosion "an economic Katrina."

President Barack Obama isn't being subtle, either. On July 7, he said new regulations are needed to control "unscrupulous and underhanded businesses who are unencumbered by any restrictions on activities that might harm the environment, or take advantage of middle-class families, or threaten to bring down the entire financial system."

Are there THAT MANY crooked-businesses, out there, worrying about Regulations??!!!!

Obviously NOT!!!!!!

"Caterpillar Inc., the worlds largest maker of construction equipment, raised its full-year earnings forecast and posted second-quarter profit that topped analysts estimates as demand rose in developing countries."

Hey...........how 'bout even more regulations so America can become a bonafide Third World country!!!!

jeffrockit

Senior Member

- Nov 16, 2008

- 1,341

- 165

- 48

Private sector employment rose slightly more than expected in July, easing some concerns about labor market weakness ahead of a key government jobs report later this week.

"Private employers added 42,000 jobs in July, compared with a revised gain of 19,000 in June, the report by a payrolls processor ADP Employer Services showed on Wednesday.

The rise in hiring was slightly higher than an estimate from economists surveyed by Reuters for a gain of 40,000 private-sector jobs. The June ADP figure originally was reported as a gain of 13,000 jobs."

And now the rest of the story:

"The U.S. economy lost an estimated 131,000 net jobs in July, worse than expectations of a 90,000 job decline. The loss of 143,000 temporary Census jobs was the culprit, with private businesses adding 71,000 jobs during the month. June job data was revised to show 96,000 additional lost jobs. The U.S. unemployment rate remained at 9.5% in July, as more than 180,000 people left the labor force."

Small Business Index for Idaho - Small Business Index for Idaho: Online

Your numbers look good until you examine the entire picture. You can't just present 1/2 the facts.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

"For all the signs of a slowdown in the U.S., investors are snapping up commodity stocks in a bet against a double-dip recession. The 32 mining companies, seed makers, and chemical suppliers in the Standard & Poor's 500 Materials Index rose 10 percent from the end of June to Aug. 20, while the broader S&P 500 index climbed 4 percent. The gains pushed the stock prices of the companies that make up the materials index to an average of 17.4 times annual profits, the highest price-earnings ratio of any industry, data compiled by Bloomberg show."

As-much-as corporate-America & the Chamber Of Commerce keep trying to push the U.S. economy back-into the ditch (until November), the commodities-investors are showin' some REAL American-balls!!!!!!!!!!!

NO GUTS; NO GLORY (you "conservative"-weenies!!)!!!!!!

NO GUTS; NO GLORY (you "conservative"-weenies!!)!!!!!!

LibocalypseNow

Senior Member

- Jul 30, 2009

- 12,337

- 1,368

- 48

Hey Hopey Changeys,don't make me list all the terrible things that have happened to our nation during this horrifying Obummer Summer. The list is long but i'll do it. I swear.

Private sector employment rose slightly more than expected in July, easing some concerns about labor market weakness ahead of a key government jobs report later this week.

"Private employers added 42,000 jobs in July, compared with a revised gain of 19,000 in June, the report by a payrolls processor ADP Employer Services showed on Wednesday.

Was this a report of the addition of jobs in one town?,One city?,One state..........OMG are you patting Obama on the back with a job well done for adding 42,000 jobs in the WHOLE COUNTRY.....

"Private employers added 42,000 jobs in July, compared with a revised gain of 19,000 in June, the report by a payrolls processor ADP Employer Services showed on Wednesday.

Was this a report of the addition of jobs in one town?,One city?,One state..........OMG are you patting Obama on the back with a job well done for adding 42,000 jobs in the WHOLE COUNTRY.....

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

Hey Hopey Changeys,don't make me list all the terrible things that have happened to our nation during this horrifying Obummer Summer. The list is long but i'll do it. I swear.

You're STILL lookin' for Porky Limbaugh's talking-points?????

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

Private sector employment rose slightly more than expected in July, easing some concerns about labor market weakness ahead of a key government jobs report later this week.

"Private employers added 42,000 jobs in July, compared with a revised gain of 19,000 in June, the report by a payrolls processor ADP Employer Services showed on Wednesday.

Was this a report of the addition of jobs in one town?,One city?,One state..........OMG are you patting Obama on the back with a job well done for adding 42,000 jobs in the WHOLE COUNTRY.....

....Compared to BUSHCO's job-LOSSES?????

You BETCHA'!!!!!

[ame=http://www.youtube.com/watch?v=1y04g6OPLnQ]YouTube - Obama Dismantles Republican Caucus Part 1 of 7[/ame]

You BETCHA'!!!!!

[ame=http://www.youtube.com/watch?v=1y04g6OPLnQ]YouTube - Obama Dismantles Republican Caucus Part 1 of 7[/ame]

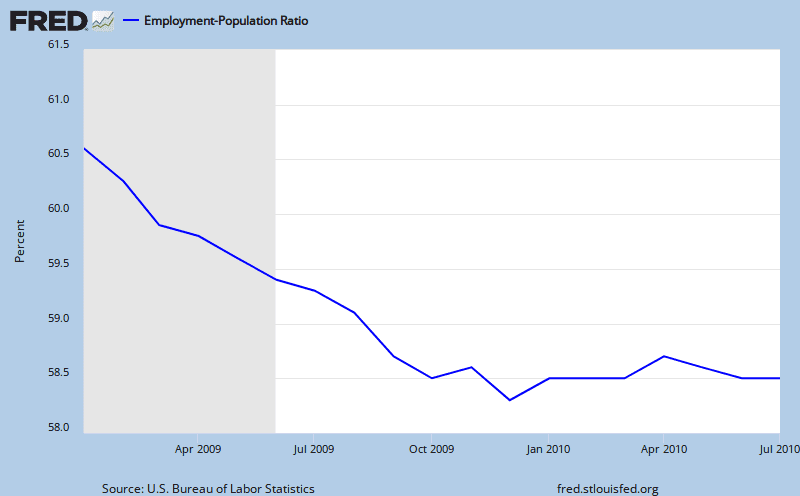

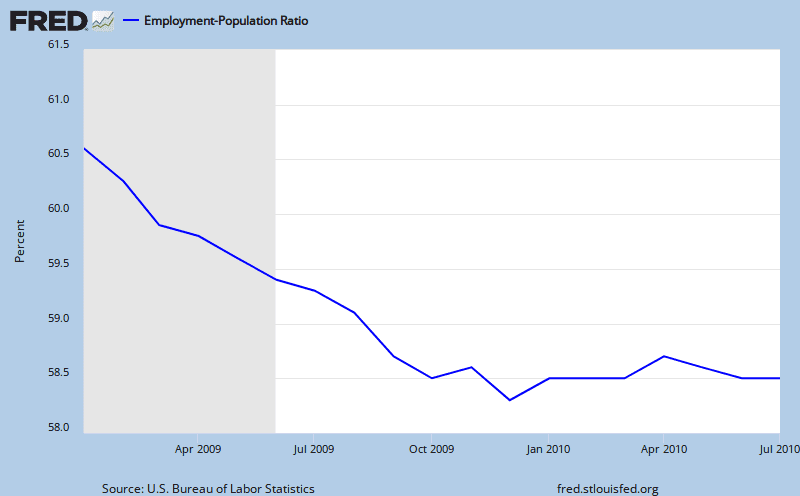

Workforce Since Obama became President

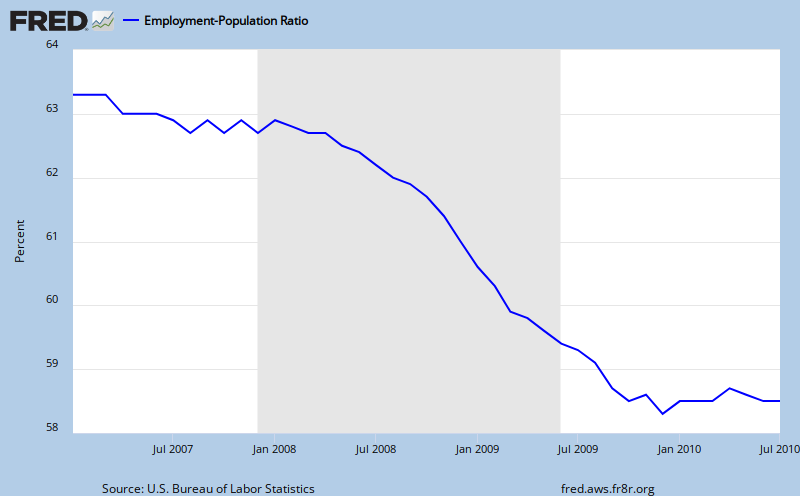

Workforce Since Democrats took over Congress

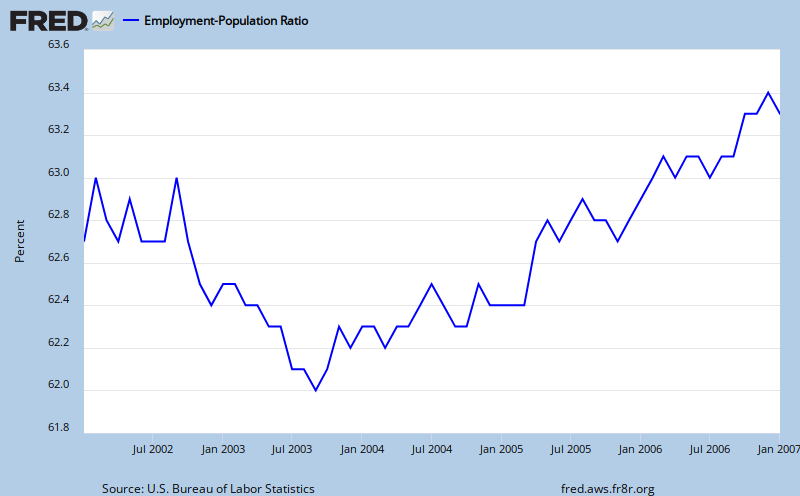

Workforce Since Tech Bubble Crash & 9/11. With Repub / Dem Balanced Congress & Bush as President

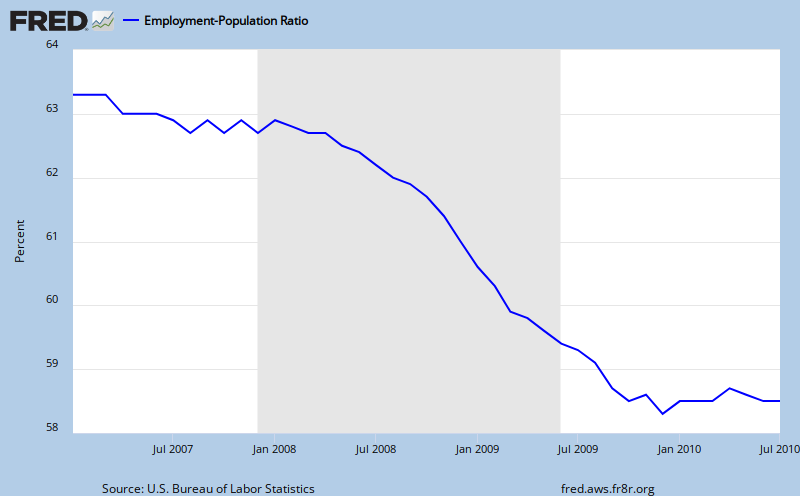

Workforce Since Democrats took over Congress

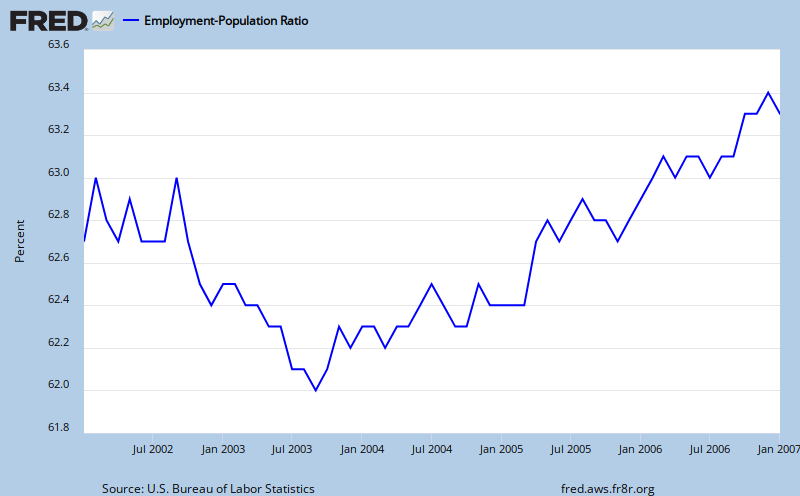

Workforce Since Tech Bubble Crash & 9/11. With Repub / Dem Balanced Congress & Bush as President

Last edited:

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

"The manufacturing sector grew faster than expected in August, chalking up a 13th straight month of expansion, helping to calm fears that economic growth was stagnating.

But other reports on Wednesday showing private employers unexpectedly cut jobs last month (Whew! The Chamber O' Commerce has THAT kind o' influence??) and construction spending tumbled to a 10-year low in July indicated the recovery from the worst recession since the 1930s faced major headwinds.

"We're in the middle of what is typically a growth scare, where the economic cycle slows down after an initial run up as stimulus fades and we transition from stimulus to having the economy standing on its own,"** said Jason Pride, director of investment strategy at Glenmede Investment and Wealth Management in Philadelphia.

The Institute for Supply Management said its index of national factory activity rose to 56.3 from 55.5 in July. That was above financial market expectations for 53.0. A reading above 50 indicates expansion in the sector.

U.S. stock indexes rallied on the manufacturing report, while prices for safe-haven government debt fell. The U.S. dollar rose versus the yen.

In other data on Wednesday, U.S. mortgage applications for home purchasing and refinancing increased last week as interest rates hit a new low, a glimmer of hope for a housing market that has failed to find footing in the absence of government support.

Demand for home loan refinancing rose for a fifth straight week, a development that may provide a much-needed jolt to a flailing economy as it could portend an increase in consumer spending."

** "Unfortunately, over the last decade, we have not done what is necessary to shore up the foundation of our own prosperity. We have spent a trillion dollars at war, often financed by borrowing from overseas. This, in turn, has short-changed investments in our own people, and contributed to record deficits. For too long, we have put off tough decisions on everything from our manufacturing base to our energy policy to education reform. As a result, too many middle-class families find themselves working harder for less, while our nation's long-term competitiveness is put at risk.

And so at this moment, as we wind down the war in Iraq, we must tackle those challenges at home with as much energy, and grit, and sense of common purpose as our men and women in uniform who have served abroad. They have met every test that they faced. Now, it is our turn. Now, it is our responsibility to honor them by coming together, all of us, and working to secure the dream that so many generations have fought for - the dream that a better life awaits anyone who is willing to work for it and reach for it."

Get off your dead-asses, "conservatives".

Vacate your bunkers and try to re-locate those "bootstraps" you keep braggin'-about.

Vacate your bunkers and try to re-locate those "bootstraps" you keep braggin'-about.

Last edited:

"The manufacturing sector grew faster than expected in August, chalking up a 13th straight month of expansion, helping to calm fears that economic growth was stagnating.

But other reports on Wednesday showing private employers unexpectedly cut jobs last month (Whew! The Chamber O' Commerce has THAT kind o' influence??) and construction spending tumbled to a 10-year low in July indicated the recovery from the worst recession since the 1930s faced major headwinds.

"We're in the middle of what is typically a growth scare, where the economic cycle slows down after an initial run up as stimulus fades and we transition from stimulus to having the economy standing on its own,"** said Jason Pride, director of investment strategy at Glenmede Investment and Wealth Management in Philadelphia.

The Institute for Supply Management said its index of national factory activity rose to 56.3 from 55.5 in July. That was above financial market expectations for 53.0. A reading above 50 indicates expansion in the sector.

U.S. stock indexes rallied on the manufacturing report, while prices for safe-haven government debt fell. The U.S. dollar rose versus the yen.

In other data on Wednesday, U.S. mortgage applications for home purchasing and refinancing increased last week as interest rates hit a new low, a glimmer of hope for a housing market that has failed to find footing in the absence of government support.

Demand for home loan refinancing rose for a fifth straight week, a development that may provide a much-needed jolt to a flailing economy as it could portend an increase in consumer spending."

** "Unfortunately, over the last decade, we have not done what is necessary to shore up the foundation of our own prosperity. We have spent a trillion dollars at war, often financed by borrowing from overseas. This, in turn, has short-changed investments in our own people, and contributed to record deficits. For too long, we have put off tough decisions on everything from our manufacturing base to our energy policy to education reform. As a result, too many middle-class families find themselves working harder for less, while our nation's long-term competitiveness is put at risk.

And so at this moment, as we wind down the war in Iraq, we must tackle those challenges at home with as much energy, and grit, and sense of common purpose as our men and women in uniform who have served abroad. They have met every test that they faced. Now, it is our turn. Now, it is our responsibility to honor them by coming together, all of us, and working to secure the dream that so many generations have fought for - the dream that a better life awaits anyone who is willing to work for it and reach for it."

Get off your dead-asses, "conservatives".

Vacate your bunkers and try to re-locate those "bootstraps" you keep braggin'-about.

"New orders dropped to 53.1 percent in August from 53.5 percent in July. Production edged up to 59.9 percent in August from 57 percent in July."

Just keep praising the Obamacrats for increasing inventories. New orders are down!

Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

Ya gotta love this Admin... out declaring victory the same day GDP gets slashed... in half. These kids are clueless.

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

"The manufacturing sector grew faster than expected in August, chalking up a 13th straight month of expansion, helping to calm fears that economic growth was stagnating.

But other reports on Wednesday showing private employers unexpectedly cut jobs last month (Whew! The Chamber O' Commerce has THAT kind o' influence??) and construction spending tumbled to a 10-year low in July indicated the recovery from the worst recession since the 1930s faced major headwinds.

"We're in the middle of what is typically a growth scare, where the economic cycle slows down after an initial run up as stimulus fades and we transition from stimulus to having the economy standing on its own,"** said Jason Pride, director of investment strategy at Glenmede Investment and Wealth Management in Philadelphia.

The Institute for Supply Management said its index of national factory activity rose to 56.3 from 55.5 in July. That was above financial market expectations for 53.0. A reading above 50 indicates expansion in the sector.

U.S. stock indexes rallied on the manufacturing report, while prices for safe-haven government debt fell. The U.S. dollar rose versus the yen.

In other data on Wednesday, U.S. mortgage applications for home purchasing and refinancing increased last week as interest rates hit a new low, a glimmer of hope for a housing market that has failed to find footing in the absence of government support.

Demand for home loan refinancing rose for a fifth straight week, a development that may provide a much-needed jolt to a flailing economy as it could portend an increase in consumer spending."

Get off your dead-asses, "conservatives".

Vacate your bunkers and try to re-locate those "bootstraps" you keep braggin'-about.

"New orders dropped to 53.1 percent in August from 53.5 percent in July. Production edged up to 59.9 percent in August from 57 percent in July."

Just keep praising the Obamacrats for increasing inventories. New orders are down!

Orders and business [are] still strong,but a respondent in the electrical equipment sector reported, Still experiencing intermittent delays in electronic components due to capacity and raw materials.

"And employment reached 60.4 percent in August, up from 58.6 percent in July."

Wanna try, AGAIN??!!!!

wow Obama spent how much money a few years ago and we got 42,000 new jobs to show for it?

Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

wow Obama spent how much money a few years ago and we got 42,000 new jobs to show for it?

I guess that's about $19,000,000 per job. AWESOME!!! Shit.. send me a check for, say $5,000,000... I'll never work again.

Soggy in NOLA

Diamond Member

- Jul 31, 2009

- 40,565

- 5,358

- 1,830

Sheman looks like he gets his news from barackobama.org

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

September 3, 2010

"Wall Street closed a stellar week on Friday after recent economic data, including a stronger-than-expected labor market report, bolstered optimism that the economy would not fall back into recession."

*

"The Labor data sent bond prices lower and stocks higher.

"We've seen some pretty hefty asset allocation trades out of bonds and into stocks," said Kim Rupert, managing director of global fixed income analysis at Action Economics LLC in San Francisco."

*

"Goldman Sachs, which says about 10 percent of its revenue comes from proprietary trading, is grappling with a provision of the Dodd-Frank financial-overhaul act that prohibits banks from risking capital by betting for their own accounts."

"Proprietary Trading Will Be Separated From The Business of Banking

"The Volcker Rule will ensure that banks are no longer allowed to own, invest, or sponsor hedge funds, private equity funds, or proprietary trading operations for their own profit, unrelated to serving their customers. Responsible trading is a good thing for the markets and the economy, but firms should not be allowed to run hedge funds and private equity funds while running a bank."

[ame]http://www.youtube.com/watch?v=f2iHksmF7m4[/ame]

Last edited:

Mr. Shaman

Senior Member

- May 4, 2010

- 23,892

- 822

- 48

Similar threads

- Replies

- 9

- Views

- 254

- Replies

- 5

- Views

- 97

- Replies

- 7

- Views

- 126

Latest Discussions

- Replies

- 33

- Views

- 224

Forum List

-

-

-

-

-

Political Satire 8018

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 467

-

-

-

-

-

-

-

-

-

-