CentristFiasco

Member

- Sep 30, 2011

- 240

- 16

- 16

Hey Fellow Man:

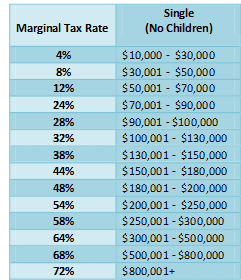

I've been pondering on this for a while and have decided to go through a decent tax policy in terms of progressive taxes for individuals and what I figured out that our current policy for the last twenty years is so half-assed and plain ole' illogical. Have you guys felt this too? You know as an up and coming politician I've decided to create my own tax policy on the likes of progressive taxes for individuals. Take a Look at My Proposal: Progressive Change: A Federalist's Approach on Progressive Taxes. Anyway, I would like to continue this conversation with you guys and hopefully you'll take a read when you have the time.

Petitions in the Process:

On Change.org: Support the Balance of Progressive Taxes for Prosperity!

On the White House's "We the People: Balance the Progressive Income Taxes for Prosperity

I've been pondering on this for a while and have decided to go through a decent tax policy in terms of progressive taxes for individuals and what I figured out that our current policy for the last twenty years is so half-assed and plain ole' illogical. Have you guys felt this too? You know as an up and coming politician I've decided to create my own tax policy on the likes of progressive taxes for individuals. Take a Look at My Proposal: Progressive Change: A Federalist's Approach on Progressive Taxes. Anyway, I would like to continue this conversation with you guys and hopefully you'll take a read when you have the time.

Petitions in the Process:

On Change.org: Support the Balance of Progressive Taxes for Prosperity!

On the White House's "We the People: Balance the Progressive Income Taxes for Prosperity

Last edited: