- Apr 12, 2011

- 3,814

- 758

- 130

Commentary

David Ranson 06.21.11, 4:15 PM ET

The attack on federal deficits has not gone according to plan since President Obama presented his first budget a couple of years ago. Partly it's because the government spent more than he thought it would. But partly, it's just miscalculation. That's not a surprise. Fiscal forecasting errors regularly result from misperceptions about how the economy works.

Washington, the city of legislators, is slow to recognize natural systemic laws. Government officials talk and act as if the economy were an unconscious patient on the operating table, waiting to be carved up by rival surgeons. Rather it is a living system complex enough to produce many unintended consequences.

In the field of taxation there is one natural law which policymakers persist in ignoring. Formulated by W. Kurt Hauser nearly twenty years ago, this is the empirical observation that even the most aggressive taxation has never succeeded in sustaining federal revenue beyond 19% of GDP. The top bracket rate has been as high as 94% (under Franklin Roosevelt) and as low as 28% (under Ronald Reagan) with no noticeable difference in the percentage tax take--that is, the ratio of revenue to GDP. It's not an exaggeration to describe this historical fact as Hauser's Law. Rates that exceed the economy's willingness to pay are self-defeating because they curb the economy enough to offset the revenue gain.

This effective revenue ceiling results as taxpayers learn how to game the tax system and/or to place their capital beyond Washington's reach. Collectively, they have never been willing to generate federal revenue at marginal rates higher than (at most) the Reagan-era top rate of 28%. In practice, it's not a question of patriotic duty or ability to pay, but of self-interest and ability to escape. The wealthier the income group, the more easily it can afford to employ advisers to find ways to pay less tax. The higher the marginal rate, the more this pays off. Their changed behavior tends to reduce output, income and employment in the United States, while likely boosting these measures of economic performance overseas.

Hauser used the top bracket of the U.S. personal income tax as a proxy measure of income-tax rates in general. It's easy to identify, and has a long and unstable history. He included all federal revenue and not just revenue from the income tax because, via its economic impact, an income-tax rate increase has feedback effects on revenues from all the other tax bases as well. Focusing too narrowly on income taxes in isolation misses these interactions. The impact on federal revenue as a whole shows that Hauser's Law imposes an even more stringent tax constraint than at first is evident--not to mention feedback effects on state and local tax revenue as well.

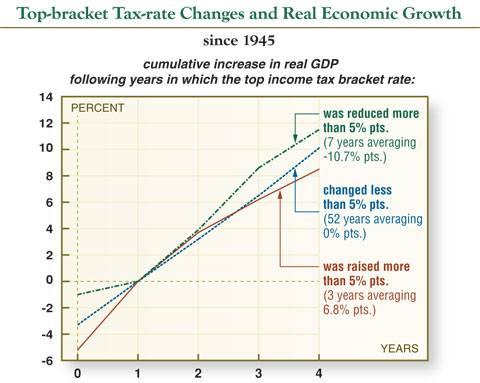

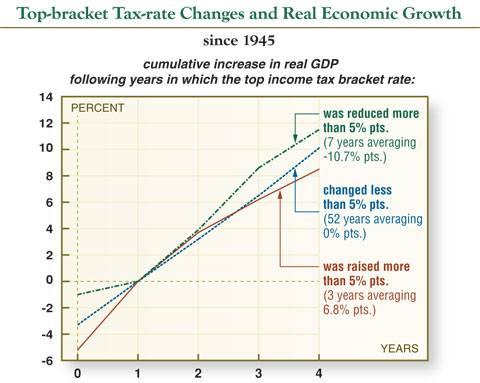

Our tax policymakers are at sea without realistic estimates of what happens to the economy and tax revenue when tax rates change, and over what time frame. They need to explore in detail the Hauser-Law limits to federal revenue. It just so happens that the impact of changes in the top bracket can be statistically identified and measured. The first of my graphs is drawn from over six decades of U.S. income-tax history, beginning in World War II, when federal tax efforts first collided with their capacity limits. The graph divides annual tax-rate changes into three categories according to whether the top marginal rate was cut more than 5 percentage points, changed less than that, or was raised more than 5 percentage points.

The linkage between a change in the top bracket and the growth of the economy is initially positive, as shown between years 0 and One. Washington is much more likely to raise tax rates when the economy has been growing than when it is struggling. But between years One and Four this is replaced by a negative linkage, the response of GDP to a tax-rate change. Taxpayers alter their tax-management and economic behavior so that their self-interested actions no longer make the contribution to collective output that they made before. This holds the economy back.

The delayed effect of changes in marginal tax rates is clearly visible, and illustrates how long it takes for taxpayers to discover and exploit ways of escaping higher tax demands. Cumulative growth following a 6.8 point increase in the top tax rate is more than 3% lower than following a 10.7 point cut. That's an annual average of one full percentage point of GDP growth. It could easily be the difference between falling and rising unemployment.

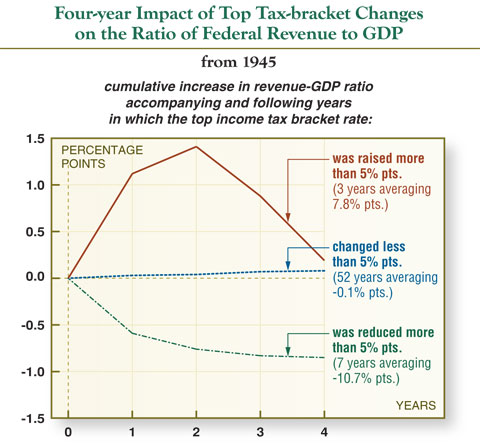

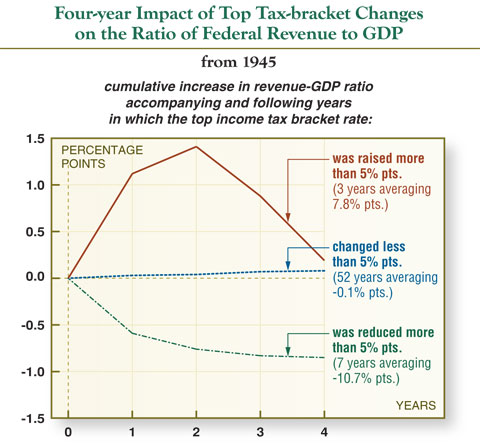

The second graph uses the same approach to analyze the tax take, and illustrates the timing of the feedback effects on federal revenue.

Sources: Highest federal income tax rate (Tax Foundation) and annual totals of total federal receipts and of nominal and real gross domestic product (Bureau of Economic Analysis).

We see that between years 0 and One, as a higher top tax rate is imposed, the tax take increases. But over the next few years the gain turns into a loss, and in the fourth year the cumulative change in the tax take is zero. Combined with a lower GDP, that means a net loss in revenue.

The pattern of responses to tax change is not symmetrical. In the same year that the top rate is lowered, the ratio of revenue to GDP also falls, with a slight additional fall one year later. After that there is no further change. So tax-rate cuts do not boost GDP to the same extent that tax hikes curb it. Why?

Perhaps the answer lies in the irreversibility of the learning curve. As taxpayers behave differently when motivated by a rate increase, the steps they have learned to take become permanent additions to their compliance toolbox. Having refrained from realizing income or having learned how to reclassify it, they might as well do the same in future years. Having discovered loopholes, they might as well keep exploiting them. Having figured out ways to transfer capital overseas or to other uses, they feel no urgency to repatriate it.

The lesson to be learned from all this is that to get the most revenue out of the tax system, rates must not only be moderate, but also stable. It is insane to treat tax policy as a political football. And it's hard to come up with anything more catastrophically foolish than to push the marginal tax rate on million-dollar incomes to 70%, as advocated recently by dreamy egalitarians. A flat, moderate and stable tax-rate structure would bring us a more prosperous economy than the one we have.

Hauser and others have attempted on numerous occasions to warn of these limits to taxation. But nothing seems to have made a dent in the way the tax authorities make their calculations. Politicians base their plans on bad information. Democrats want to increase tax rates for the highest income groups. They erroneously expect this to generate revenue, easing the need for austerity on the spending side. They are wildly optimistic. Republicans want to reduce both income and corporate tax rates, a step which conventional tax analysis wrongly assumes will reduce revenue and require even deeper spending cuts. They tend to be too pessimistic.

Bringing Hauser's Law into public consciousness would greatly shift the fiscal debate. Revenue projections would be drastically affected, because it would be necessary to recognize the relationship between tax rates and tax revenue as highly non-linear. As things stand, a long-term budget plan that increases the highest tax rates will over-predict GDP and revenue; whereas, a plan that reduces the highest tax rates will tend to boost GDP and under-predict revenue.

The government's grasp of how the economy reacts to changes in the tax code is tragically inadequate. It's high time to explode high-minded fantasies on both left and right that Washington can bring the budget closer to balance by raising the highest income tax rates. Natural laws of economic behavior dictate that the attempt will actually push it deeper into deficit.

David Ranson is head of research at H. C. Wainwright & Co. Economics Inc.

David Ranson 06.21.11, 4:15 PM ET

The attack on federal deficits has not gone according to plan since President Obama presented his first budget a couple of years ago. Partly it's because the government spent more than he thought it would. But partly, it's just miscalculation. That's not a surprise. Fiscal forecasting errors regularly result from misperceptions about how the economy works.

Washington, the city of legislators, is slow to recognize natural systemic laws. Government officials talk and act as if the economy were an unconscious patient on the operating table, waiting to be carved up by rival surgeons. Rather it is a living system complex enough to produce many unintended consequences.

In the field of taxation there is one natural law which policymakers persist in ignoring. Formulated by W. Kurt Hauser nearly twenty years ago, this is the empirical observation that even the most aggressive taxation has never succeeded in sustaining federal revenue beyond 19% of GDP. The top bracket rate has been as high as 94% (under Franklin Roosevelt) and as low as 28% (under Ronald Reagan) with no noticeable difference in the percentage tax take--that is, the ratio of revenue to GDP. It's not an exaggeration to describe this historical fact as Hauser's Law. Rates that exceed the economy's willingness to pay are self-defeating because they curb the economy enough to offset the revenue gain.

This effective revenue ceiling results as taxpayers learn how to game the tax system and/or to place their capital beyond Washington's reach. Collectively, they have never been willing to generate federal revenue at marginal rates higher than (at most) the Reagan-era top rate of 28%. In practice, it's not a question of patriotic duty or ability to pay, but of self-interest and ability to escape. The wealthier the income group, the more easily it can afford to employ advisers to find ways to pay less tax. The higher the marginal rate, the more this pays off. Their changed behavior tends to reduce output, income and employment in the United States, while likely boosting these measures of economic performance overseas.

Hauser used the top bracket of the U.S. personal income tax as a proxy measure of income-tax rates in general. It's easy to identify, and has a long and unstable history. He included all federal revenue and not just revenue from the income tax because, via its economic impact, an income-tax rate increase has feedback effects on revenues from all the other tax bases as well. Focusing too narrowly on income taxes in isolation misses these interactions. The impact on federal revenue as a whole shows that Hauser's Law imposes an even more stringent tax constraint than at first is evident--not to mention feedback effects on state and local tax revenue as well.

Our tax policymakers are at sea without realistic estimates of what happens to the economy and tax revenue when tax rates change, and over what time frame. They need to explore in detail the Hauser-Law limits to federal revenue. It just so happens that the impact of changes in the top bracket can be statistically identified and measured. The first of my graphs is drawn from over six decades of U.S. income-tax history, beginning in World War II, when federal tax efforts first collided with their capacity limits. The graph divides annual tax-rate changes into three categories according to whether the top marginal rate was cut more than 5 percentage points, changed less than that, or was raised more than 5 percentage points.

The linkage between a change in the top bracket and the growth of the economy is initially positive, as shown between years 0 and One. Washington is much more likely to raise tax rates when the economy has been growing than when it is struggling. But between years One and Four this is replaced by a negative linkage, the response of GDP to a tax-rate change. Taxpayers alter their tax-management and economic behavior so that their self-interested actions no longer make the contribution to collective output that they made before. This holds the economy back.

The delayed effect of changes in marginal tax rates is clearly visible, and illustrates how long it takes for taxpayers to discover and exploit ways of escaping higher tax demands. Cumulative growth following a 6.8 point increase in the top tax rate is more than 3% lower than following a 10.7 point cut. That's an annual average of one full percentage point of GDP growth. It could easily be the difference between falling and rising unemployment.

The second graph uses the same approach to analyze the tax take, and illustrates the timing of the feedback effects on federal revenue.

Sources: Highest federal income tax rate (Tax Foundation) and annual totals of total federal receipts and of nominal and real gross domestic product (Bureau of Economic Analysis).

We see that between years 0 and One, as a higher top tax rate is imposed, the tax take increases. But over the next few years the gain turns into a loss, and in the fourth year the cumulative change in the tax take is zero. Combined with a lower GDP, that means a net loss in revenue.

The pattern of responses to tax change is not symmetrical. In the same year that the top rate is lowered, the ratio of revenue to GDP also falls, with a slight additional fall one year later. After that there is no further change. So tax-rate cuts do not boost GDP to the same extent that tax hikes curb it. Why?

Perhaps the answer lies in the irreversibility of the learning curve. As taxpayers behave differently when motivated by a rate increase, the steps they have learned to take become permanent additions to their compliance toolbox. Having refrained from realizing income or having learned how to reclassify it, they might as well do the same in future years. Having discovered loopholes, they might as well keep exploiting them. Having figured out ways to transfer capital overseas or to other uses, they feel no urgency to repatriate it.

The lesson to be learned from all this is that to get the most revenue out of the tax system, rates must not only be moderate, but also stable. It is insane to treat tax policy as a political football. And it's hard to come up with anything more catastrophically foolish than to push the marginal tax rate on million-dollar incomes to 70%, as advocated recently by dreamy egalitarians. A flat, moderate and stable tax-rate structure would bring us a more prosperous economy than the one we have.

Hauser and others have attempted on numerous occasions to warn of these limits to taxation. But nothing seems to have made a dent in the way the tax authorities make their calculations. Politicians base their plans on bad information. Democrats want to increase tax rates for the highest income groups. They erroneously expect this to generate revenue, easing the need for austerity on the spending side. They are wildly optimistic. Republicans want to reduce both income and corporate tax rates, a step which conventional tax analysis wrongly assumes will reduce revenue and require even deeper spending cuts. They tend to be too pessimistic.

Bringing Hauser's Law into public consciousness would greatly shift the fiscal debate. Revenue projections would be drastically affected, because it would be necessary to recognize the relationship between tax rates and tax revenue as highly non-linear. As things stand, a long-term budget plan that increases the highest tax rates will over-predict GDP and revenue; whereas, a plan that reduces the highest tax rates will tend to boost GDP and under-predict revenue.

The government's grasp of how the economy reacts to changes in the tax code is tragically inadequate. It's high time to explode high-minded fantasies on both left and right that Washington can bring the budget closer to balance by raising the highest income tax rates. Natural laws of economic behavior dictate that the attempt will actually push it deeper into deficit.

David Ranson is head of research at H. C. Wainwright & Co. Economics Inc.