A very interesting read. Should taxes really be focused on revenue generation?

Taxation, Government Spending, the National Debt and MMT

Taxation, Government Spending, the National Debt and MMT

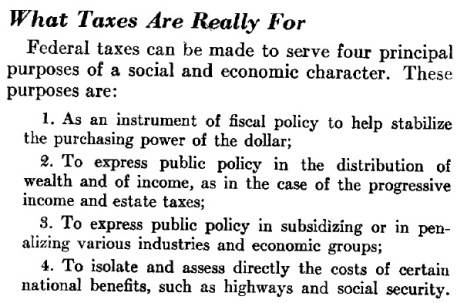

Basically Ruml is making the same case that the Modern Monetary Theorists (MMTers) make: a country that issues its own sovereign currency and is unconstrained by a gold standard does not require tax revenue in order to fund spending. This is because the central bank always stands by ready and able to buy any sovereign debt issued that might lead to the interest rate rising. Indeed, it does this automatically in the way that it conducts its interest rate policy. Ruml then outlines what taxation is really for in such a country.

So, what was it about this moment in history that allowed for such a clear-eyed view of government spending and taxation policies? The answer is simple: the war. World War II allowed economists, bankers and government officials to see clearly how the macroeconomy worked because the government was basically controlling the economy. World War II was perhaps the only time in history when capitalist economies were run on truly Keynesian principles. (You can make a case that the Nazi economy in the 1930s was also run on these principles, however, so perhaps it is better to say: a capitalist economy in a democratic state).

This meant that those working in government institutions and banks could see exactly what was happening and why it was happening. Because the central banks were exercising full control over the market for government debt and because the governments were running massive fiscal deficits it became crystal clear what the taxation system was really doing: first and foremost it was suppressing aggregate demand for goods and services in certain parts of the economy. In doing so it had two broad functions: an anti-inflation function and a redistribution function.

The experience of the war, I would argue, was the main reason why the neo-Keynesian economists in the US actually understood macroeconomic policy in a clear-sighted way. I do not believe that their theories would have allowed them to properly understand the economy. But their experiences in the war — from reading the daily newspapers to working in economic institutions — left a lasting impression that allowed them to properly understand the macroeconomic policy tools in the 1950s and 1960s. The textbooks that they were teaching said one thing but their experiences in the war told them another. (An exception to this might be James Tobin whose theoretical writings do reflect some of the war experiences).

When the younger generation came of age in the 1970s the mainstream economic theory ensured that they had absolutely no idea what they were talking about. They only had what they were being taught in the classroom and did not have the real-world experience that the older generation had. Everything went downhill from there and that, I think, is where the seeds were sown for the economic turmoil and confusion we live with today. It is also the key reason why the economists of the next generation must be taught in an entirely different way from the previous generation.