He has not been right all the time. He lost his clients a lot of money last year.

Thanks for your answer. Considering that many in US markets lost everything, Schiff did a good job.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

He has not been right all the time. He lost his clients a lot of money last year.

There's going to be a whole lot of people who are gonna be real upset when Great Depression 2.0 doesn't happen.

I expect a massive wave of deflation for the next half year. Since I have not studied economics, I can say that. Why? Simple, as I see it, we have had a tremendous reduction in wealth in America. Prices were set to a time when we had the wealth, so now that it is gone, the prices need to come down to the new reality. I'll give you a case in point. I have seen food prices nearly double in the past ten years do to numerous factors. Chicken that used to sell for 29 cents a pound is now selling for 89 cents a pound when it is on sale. When it is not on sale, I don't buy it.

Yesterday in San Diego, where I live, the Vons Super Market Chain advertised packages of Chicken theighs for 85 cents a pound. THey were sold out within a matter of minutes. Today, they got more theighs in and were again sold out within half an hour. I have not been able to buy any for two days. None of their top promotion availabe for most of two days to the public. I don't know if Vons knows how screwed up their markets are, but that tells me that there are a lot of people who are buying that chicken to feed their families. They are not interested in paying five to seven dollars a pound for beef when they can get Chicken for less than a dollar a pound. That, with the understanding that Chicken is over sixty percent water. It cooks down to less than half its size when it is cooked.

People are looking for and insisting on discounts.

Eventually Chicken will be back to 75 cents a pound most every day. Watch and see. Then it will move lower. The same will apply to most everything else. I expect that all the economists who don't seem to be in touch with reality don't know what drives the market.

You can't expect that will be good once credit markets thaw and consumers begin borrowing again.

That can grow to $14T, with fractional-reserve ratios of 10%, unless liquidity is drained. If liquidity is drained, another sharp recession will take hold.

If the reserve-ratios are increased, a lot of banks will become (more) insolvent than they are already, and they will go bankrupt. So, we will face either really high inflation or a recession.

I think the market (and the gas prices) are responding to the new money going back into the system.

Recovery?

Hardly.

It is preposterous to define a recovery as merely that stock prices rise.

If the wellbeing of the people isn't THE important factor when defining how a nation is doing, why isnt it?

America has been declining for the last 40 years and I'm not especially impressed that some small segment of the population has gotten much much richer while the rest of us were steadily getting poorer...which both the middle and lower classes obviously were.

Defining the economic health of a nation based solely on how well the superrich are doing is a perfect example of the class war we've been having all along.

If one prints enough money, people seem to be content with a rise in the nominal price of stocks and wages. Even if wages can buy much less than it could before, and a mother and father have to work to earn a decent living. Inflation is really, really cruel.

Of course that is only true if you are not already (as are most American families) in debt. If you ARE in debt and deflation hits, you are completely screwed.

The exact opposite, however, happened during the panic of 1873.

Yeah? Tell that to the FARMERS of middle America. They were in debt and not only were prices for their produce dropping, but the purchasing power of the money they had to pay back was greater than the purchaisng power of the dollars they'd borrowed.

See populist movement for further explanation about how deflation and inflation effect differenct classes differently

There was deflation, with the removal of silver from our bimetallic dollar, and a short recession occurred. People's nominal wealth seemingly went down, but deflation meant more and more could be bought. It was, in fact, a time period of enormous growth, as confirmed by even a Keynesian from the NY Times,

Nice half-truth...some people -- those WITH MONEY -- do very well during DEFLATIONARY periods.

"Historians long attributed the turmoil to a "great depression of the 1870's." But recent detailed reconstructions of 19th-century data by economic historians show that there was no 1870's depression: aside from a short recession in 1873, in fact, the decade saw possibly the fastest sustained growth in American history."

I love the way people look at MACROECONOMIC data and confuse that for how the PEOPLE ARE DOING.

Sustained growth for WHOM? For the captains of industry? Hell yeah! They enjoyed that guilded age just as today's captians have enjoyed this most recent guilded age we just went through.

Meanwhile, 8 years olds were dying in coal mine accidents and farmers were going broke.

Your economists may think of that as "sustained growth, but I think of that as something less than the ideal this nation should be striving for.

Deflation sets in the perception that we're losing wealth, while we're actually gaining.

For some people, certainly. for most people? Quite the contrary outcome is true.

Inflation sets in the perception that we're gaining wealth, while in reality, we're losing.

For some people, certainly. For other people INFLATION could very well be their best friend.

It REALLY depends on what your economic circumstances are while either of those events starts happening, does it not?

"People are not rushing into stocks, they're rushing out of cash"

Perceptive...given that cash is an illusion which works only so long as the amount of it is in some kind of sound realtionship to the amount of goods and services, he might be spot on.

How can the stock market be healthy while the labor market is in panic retreat mode?

if you print money faster than people can spend it the extra will go into "investing"

unfortunately this "investing" will be nothing but a bubble. or in our case we are trying to re-inflate a bubble that has popped by pumping air through a bigger hose than is the size of the hole in the bubble.

i like his prognosis for when the depression will end - NEVER

good one !

We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

doesn't matter who he is. it doesn't take a genius here - the stock market is going up at the same time as people are still being laid off in large numbers.

if all the businesses are doing so great - why are they laying people off ?

the stock market is thus an illusion. however that doesn't mean that it won't keep going up. why wouldn't it ? all the money being printed has to go SOMEWHERE ...

actually ONE THING could save the economy. at this point Asians know they will never get their money back ... and they know that in order for Americans to keep buying their crap they need to keep buying our worthless paper ... if they they decide to CONTINUE TO DO SO ( while knowing they will never get anything for that paper ) then the crisis will go away.

if the white house can bribe Chinese officials into doinng this - awesome ! let's just hope they don't start assassinating Chinese politicians because WW3 would be bad ...

Hi Kevin:

[FONT="]Peter Schiff: Market Boost An Illusion [/FONT]

I do believe what Peter Schiff is trying to say in his video interview is, "The Market Boost is based upon Govt-created illusion and deception." Liars stand in front of TV cameras every day and lie like hell in saying the economy is getting better, when in reality things are far worse than reported and getting even worse. In the old days, money migrated back and forth from Real Estate to Stocks and Bonds; but the Real Estate component has been destroyed by deflation, which means the Stock Market is artificially overbought and a price bubble is being formed right before your eyes.

More and more Americans are aware of the fact that the U.S. Dollar will suffer hyperinflation and then ultimate death, when China, Russia, the Arabs and everybody else begins dumping dollars onto the open market. Therefore, the smart people are transferring liquid assets into hard assets in anticipation of the dollar losing value in the months to come. Everyone from Bernanke to Tim Geithner and Senor Obama is trying to convince you that the Stock Market will go up, when we are still looking at 10,000 foreclosures every damned day and more than a half million Americans lost JOBS last month and will again this month, so on and so forth.

The US Economy has been wired for IMPLOSION (my thread), like the World Trade Center Twin Towers and Building 7, only the Controlled Demolition is taking place in slow motion. We can use the Stock Market as a measuring rod of whether or not the general public is buying Obama Administration LIES. The idiot day traders are being tricked into pouring new money into a Dow Jones Stock Market that should be in the neighborhood of 5000 to 6000. However, reality will set in during the summer and fall and the Dow Jones will make the correction and leave many investors ruined, as their reward for being so stupid and naive. Gerald Celente (Trends Research.com) is predicting the same Economic Collapse that Peter Schiff can see on the horizon:

[ame]http://www.youtube.com/watch?v=aaSKJ75EMoc[/ame]

[ame="http://www.youtube.com/watch?v=IM-Zwqa2WyA&feature=related"]Celente Explains False Flag Recovery Part 1[/ame]

[ame="http://www.youtube.com/watch?v=7FzK4RvdDTc&feature=related"]Celente Explains False Flag Recovery Part 2[/ame]

[ame="http://www.youtube.com/watch?v=RXkevPuuZG0&feature=related"]Celente Explains False Flag Recovery Part 3[/ame]

[ame="http://www.youtube.com/watch?v=bsowQVFXNjo&feature=related"]Celente Explains False Flag Recovery Part 4[/ame]

[ame=http://www.youtube.com/watch?v=6AyQwvbcdgk&feature=related]Full Economic Collapse 2009[/ame]

GL,

Terral

I think the market (and the gas prices) are responding to the new money going back into the system.

Recovery?

Hardly.

It is preposterous to define a recovery as merely that stock prices rise.

If the wellbeing of the people isn't THE important factor when defining how a nation is doing, why isnt it?

America has been declining for the last 40 years and I'm not especially impressed that some small segment of the population has gotten much much richer while the rest of us were steadily getting poorer...which both the middle and lower classes obviously were.

Defining the economic health of a nation based solely on how well the superrich are doing is a perfect example of the class war we've been having all along.

If one prints enough money, people seem to be content with a rise in the nominal price of stocks and wages. Even if wages can buy much less than it could before, and a mother and father have to work to earn a decent living. Inflation is really, really cruel.

The exact opposite, however, happened during the panic of 1873. There was deflation, with the removal of silver from our bimetallic dollar, and a short recession occurred. People's nominal wealth seemingly went down, but deflation meant more and more could be bought. It was, in fact, a time period of enormous growth, as confirmed by even a Keynesian from the NY Times,

"Historians long attributed the turmoil to a "great depression of the 1870's." But recent detailed reconstructions of 19th-century data by economic historians show that there was no 1870's depression: aside from a short recession in 1873, in fact, the decade saw possibly the fastest sustained growth in American history."

Freakoutonomics - New York Times

Deflation sets in the perception that we're losing wealth, while we're actually gaining. Inflation sets in the perception that we're gaining wealth, while in reality, we're losing.

There's going to be a whole lot of people who are gonna be real upset when Great Depression 2.0 doesn't happen.

Even so, inflation will still be horrendous, equivalent to what was faced in the 1970s, if not worse.

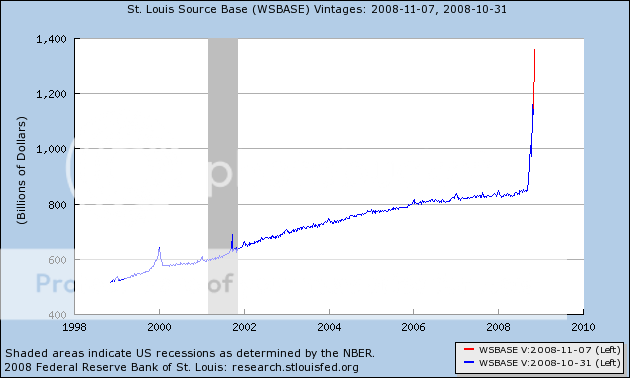

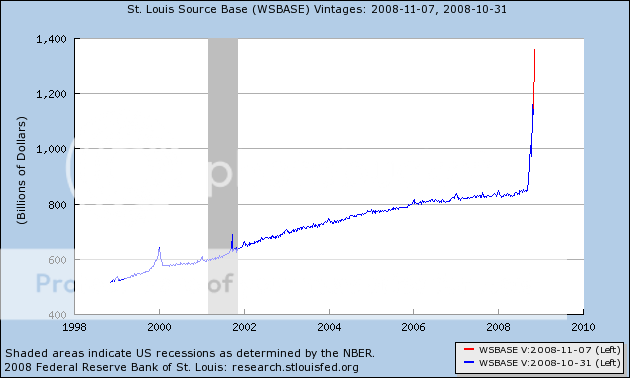

You can't expect that will be good once credit markets thaw and consumers begin borrowing again. That can grow to $14T, with fractional-reserve ratios of 10%, unless liquidity is drained. If liquidity is drained, another sharp recession will take hold. If the reserve-ratios are increased, a lot of banks will become (more) insolvent than they are already, and they will go bankrupt. So, we will face either really high inflation or a recession.

Ame®icano;1207213 said:He has not been right all the time. He lost his clients a lot of money last year.

Thanks for your answer. Considering that many in US markets lost everything, Schiff did a good job.

Reserve ratios are not a factor as they are no longer enforced. Potential bank leverage these days is determined via capital ratios.There's going to be a whole lot of people who are gonna be real upset when Great Depression 2.0 doesn't happen.

Even so, inflation will still be horrendous, equivalent to what was faced in the 1970s, if not worse.

You can't expect that will be good once credit markets thaw and consumers begin borrowing again. That can grow to $14T, with fractional-reserve ratios of 10%, unless liquidity is drained. If liquidity is drained, another sharp recession will take hold. If the reserve-ratios are increased, a lot of banks will become (more) insolvent than they are already, and they will go bankrupt. So, we will face either really high inflation or a recession.

Ame®icano;1207213 said:He has not been right all the time. He lost his clients a lot of money last year.

Thanks for your answer. Considering that many in US markets lost everything, Schiff did a good job.

The average stock invested 401k lost 46% in the downturn. His average investment lost 58% over the same time.....

Ame®icano;1218128 said:Ame®icano;1207213 said:Thanks for your answer. Considering that many in US markets lost everything, Schiff did a good job.

The average stock invested 401k lost 46% in the downturn. His average investment lost 58% over the same time.....

True. If you look just on downturn from it's peak. Now, if you look on actual data from the time Schiff recommended buying gold and foreign stocks, he made pretty fat profits. And if you look on indexes today, they already gained back over 30%. You have to look at the whole picture, not just at the piece that suits your theory.

About as wrong an economic outlook as one could have.....