- Aug 27, 2008

- 18,450

- 1,823

- 205

[youtube]O9cAvKSs1w0[/youtube]

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

[youtube]O9cAvKSs1w0[/youtube]

We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

Ame®icano;1205670 said:We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

Source?

As much I know he was damn right all the time.

I have talked with many who claim they have invested with Schiff and are down anywhere from 40% to 70% in 2008. There are many other such claims on the internet. They are entirely believable for the simple reason Schiff's investment thesis was flat out wrong.

Investors open accounts at Euro Pacific to take advantage of Mr. Schiff's investment advice, which generally involves shunning investments in dollars. Individual returns can vary. Some investors may like gold-mining stocks, while others prefer energy-focused stocks.

Most had one thing in common last year: heavy losses. A number of investors said their Euro Pacific portfolios lost 50% or more in 2008, worse than the 38% drop in the Standard & Poor's 500-stock index last year. People familiar with the firm say that hardly any securities recommended by Euro Pacific brokers gained ground in 2008. ...

Early last year, Richard De Gennaro, a retired Harvard University librarian, put $100,000, about 15% of his assets, into a Euro Pacific account that included Canadian Oil Sands Trust, which focuses on crude-oil projects in Canada, and the India Capital Growth Fund, which holds investments in companies that do business in India.

Both investments took big hits in 2008, compounded by the fact that the Canadian dollar and the Indian rupee fell 18% and 19%, respectively, against the U.S. dollar. The 83-year-old retiree's account is now worth about $37,000, a 63% plunge. Mr. Schiff "goes around saying that he was right," says Mr. De Gennaro. "He was right about one thing and wrong about everything else."

Among investors who turned to Mr. Schiff's firm just as his strategy began to falter, Brian Kullberg, a design engineer in Portland, Ore., says he started to worry about the state of the U.S. economy in early 2008. He put $70,000 into a Euro Pacific account, hoping it would benefit as the U.S. economy and the dollar weakened. By late January 2009, his investment had shrunk to about $25,000.

We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

doesn't matter who he is. it doesn't take a genius here - the stock market is going up at the same time as people are still being laid off in large numbers.

if all the businesses are doing so great - why are they laying people off ?

the stock market is thus an illusion. however that doesn't mean that it won't keep going up. why wouldn't it ? all the money being printed has to go SOMEWHERE ...

actually ONE THING could save the economy. at this point Asians know they will never get their money back ... and they know that in order for Americans to keep buying their crap they need to keep buying our worthless paper ... if they they decide to CONTINUE TO DO SO ( while knowing they will never get anything for that paper ) then the crisis will go away.

if the white house can bribe Chinese officials into doing this - awesome ! let's just hope they don't start assassinating Chinese politicians because WW3 would be bad ...

We'll see.

He was spectacularly wrong last year in his fund and his investors were crushed so his credibility isn't exactly solid.

doesn't matter who he is. it doesn't take a genius here - the stock market is going up at the same time as people are still being laid off in large numbers.

if all the businesses are doing so great - why are they laying people off ?

the stock market is thus an illusion. however that doesn't mean that it won't keep going up. why wouldn't it ? all the money being printed has to go SOMEWHERE ...

actually ONE THING could save the economy. at this point Asians know they will never get their money back ... and they know that in order for Americans to keep buying their crap they need to keep buying our worthless paper ... if they they decide to CONTINUE TO DO SO ( while knowing they will never get anything for that paper ) then the crisis will go away.

if the white house can bribe Chinese officials into doing this - awesome ! let's just hope they don't start assassinating Chinese politicians because WW3 would be bad ...

Every single stock market bottom has occurred when jobs losses were continuing. Every single one.

That's because the stock market is a leading indicator while employment is a lagging indicator. The stock market forecasts the turn in the economy while corporations react to an improving economy by stopping firing people and re-hiring again.

[FONT="]Peter Schiff: Market Boost An Illusion [/FONT]

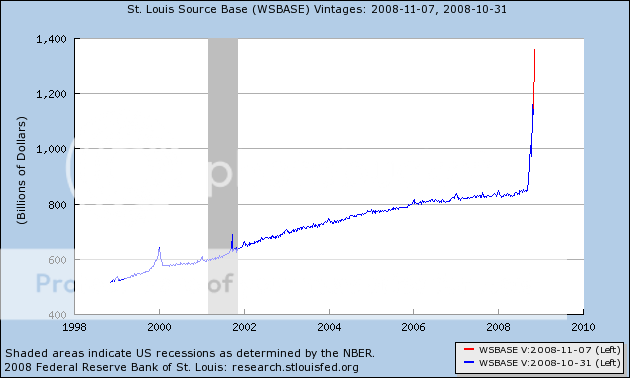

I think the market (and the gas prices) are responding to the new money going back into the system.

Recovery?

Hardly.

It is preposterous to define a recovery as merely that stock prices rise.

If the wellbeing of the people isn't THE important factor when defining how a nation is doing, why isnt it?

America has been declining for the last 40 years and I'm not especially impressed that some small segment of the population has gotten much much richer while the rest of us were steadily getting poorer...which both the middle and lower classes obviously were.

Defining the economic health of a nation based solely on how well the superrich are doing is a perfect example of the class war we've been having all along.

. . . Defining the economic health of a nation based solely on how well the superrich are doing is a perfect example of the class war we've been having all along.

[youtube]O9cAvKSs1w0[/youtube]

There's going to be a whole lot of people who are gonna be real upset when Great Depression 2.0 doesn't happen.

Even so, inflation will still be horrendous, equivalent to what was faced in the 1970s, if not worse.

.... So, we will face either really high inflation or a recession.

Even so, inflation will still be horrendous, equivalent to what was faced in the 1970s, if not worse.

.... So, we will face either really high inflation or a recession.

Does all that printed money in any way offset the disappearance of wealth because of the real estate fall in price across this great land.

If one shrinks and the other one expands, is that a wash?

I am not trying to cause an argument here. Please remember, I am the guy who has never studied one minute of economics and I don't understand ninty percent of what has happened in the past two years. All I know is that we have lost something like 30 Trillion dollars in home value (I believe that is called wealth) It just went away, POOOF! and is no where to be found. So if the Government prints a Trilion dolllars does that offset the 30 Trillion that disappeared? Or does the Government have to print 30 Trillion to make up for the 30 Trilllion that went away? If we only print one trillion when 30 Trillion is lost, would that be deflationary?

Could we see a massive wave of deflation instead of Inflation???