Oneiromancer

Rookie

- Feb 26, 2010

- 7

- 0

- 1

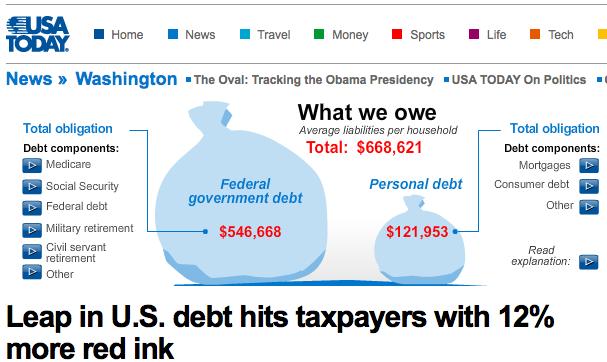

What percentage of the US population is in any form of debt?

Also, if you know what this percentage is for other countries, or globally, I'd be interested.

Also, if you know what this percentage is for other countries, or globally, I'd be interested.