Vlad_Russian

Rookie

- Aug 9, 2011

- 38

- 1

- 1

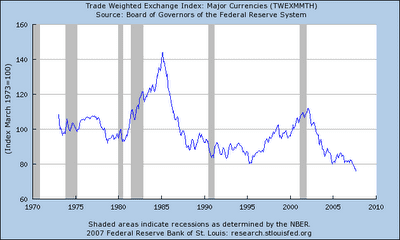

People around the world get rid of the dollar due to a default in the U.S.

The dollar is a big pyramid scheme that has existed for many years due to the inclusion of new members - the poor countries where America is planted his capitalist "democracy." Any pyramid scheme collapses when the end members. The dollar is just paper.

You mean there's more?

You mean there's more?