Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Paul Ryan's Tax Plan vs. Obama's

- Thread starter Modbert

- Start date

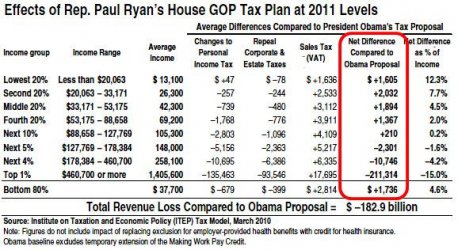

(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Do you think the people that are represented, SHOULD be taxed? Maybe with this setup, the middle class and "poor" will vote for smaller gov and lower taxes instead of voting for someone else to pay for the services they want.

- Sep 2, 2008

- 33,178

- 3,055

- 48

- Thread starter

- #4

Stunning example of the class war taking place in the tax debate, isn't it?

Good catch Dogbert.

Thanks. I found it posted elsewhere and I decided to post it here.

I was also able to find where the graph itself is originally posted.

Paul Ryan's Plan to Tax You More | Mother Jones

However, the source of all information here is the Institute on Taxation and Economic Policy (ITEP).

And for those at home wondering who they are:

About ITEP

The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research and education organization that works on government taxation and spending policy issues. ITEP's unique resources and capabilities enable it to provide policymakers, advocates, and the public with accurate, useful, and timely information regarding state and federal tax systems and how they affect taxpayers at different income levels.

ITEP's mission is to keep policymakers and the public informed of the effects of current and proposed tax polices on tax fairness, government budgets and sound economic policy.

- Sep 2, 2008

- 33,178

- 3,055

- 48

- Thread starter

- #5

Do you think the people that are represented, SHOULD be taxed? Maybe with this setup, the middle class and "poor" will vote for smaller gov and lower taxes instead of voting for someone else to pay for the services they want.

Are you saying that all these people getting tax increases are not taxed at the moment?

And so you're saying Paul "I worship Ayn Rand" Ryan's plan is perfect as a stick to bash the poor and middle over the head to vote not for lower taxes or smaller government but the way you want.

I get it.

You enjoying that class warfare against opponents who can't even afford a decent place to live, never mind internet?

NYcarbineer

Diamond Member

Ironically I heard Ryan on Foxnews earlier today and he was I think citing this same organization with tax numbers regarding the healthcare bill.

(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?

Showing a net reduction from a level that is not being paid in the real world is a little shifty.

Do you think that there are people whose intrinsic value to the society is such that they should pay no tax?

edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

Why are you too lazy to figure it out for yourself?(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?

Showing a net reduction from a level that is not being paid in the real world is a little shifty.

Do you think that there are people whose intrinsic value to the society is such that they should pay no tax?

If you had to ask the first question, how could you come to the conclusion in your second sentence?

Do you mean like Nelson A Rockefeller making a seven figure income and paying not one cent in taxes when he was appointed VP?

Total Federal Taxes

.......................Obama ............ Ryan

Lowest 20% .....$600 ............... $2,200

Second 20% .....$3,700 .............$5,700

Middle 20% ......$8,300 .............$10,200

Fourth 20% ......$15,100 ...........$16,400

Top 1% .......... $487,000 ..........$276,000

Why are you too lazy to figure it out for yourself?(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?

Showing a net reduction from a level that is not being paid in the real world is a little shifty.

Do you think that there are people whose intrinsic value to the society is such that they should pay no tax?

If you had to ask the first question, how could you come to the conclusion in your second sentence?

Do you mean like Nelson A Rockefeller making a seven figure income and paying not one cent in taxes when he was appointed VP?

Total Federal Taxes

.......................Obama ............ Ryan

Lowest 20% .....$600 ............... $2,200

Second 20% .....$3,700 .............$5,700

Middle 20% ......$8,300 .............$10,200

Fourth 20% ......$15,100 ...........$16,400

Top 1% .......... $487,000 ..........$276,000

From my post:

"Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?"

I was asking for a third category to be added, current taxes paid. As I said the two plans which are currently non-existant is an interesting, but meaningless diversion. Knowing what is currently being paid is the point of departure that would mean something.

I don't think anyone has the intrinsic value to society to avoid taxes. Do you?

In my way of thinking, if you live in a country, state, community, whatever, that requires taxation to provide benefits like sewers or roads or protection from the public enemy, you should bear a portion of the cost required to support same.

I have heard that about half of the adult population currently avoids Federal taxation. My assumption is that there are not that many Rockefellers. I could be wrong.

I would love to hear your opinion from the world where a question is a conclusion.

Last edited:

More tax breaks for the superrich, the cost of which is passed off to the less wealthy or more likely to the FUTURE generations to cope with.

Yeah, that's been working out real well for us, so far, hasn't it?.

We ought to keep doing that.

Yeah, that's been working out real well for us, so far, hasn't it?.

We ought to keep doing that.

DiamondDave

Army Vet

(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Fine.. just make the taxation equal % across the board with all income taxed and nobody left out....

The "Superrich" as you put it already pay the majority of the taxes in this country. How much more would you like them to pay??? Under OL'BO if you make 250,00 or more your are RICH and your taxes will indeed go up.

You also have about 40% to 50% who pay nothing. They sure can't pay much less than they do now.

You also have about 40% to 50% who pay nothing. They sure can't pay much less than they do now.

The "Superrich" as you put it already pay the majority of the taxes in this country. ][

Correction...the majority of FEDERAL TAXES not including social security or medicade, or state taxes, or sales taxes, or even(I suspect) real estate taxes.

How much more would you like them to pay???

Depends on how much they need to keep society functional.

Under OL'BO if you make 250,00 or more your are RICH and your taxes will indeed go up.

If you're making 5 times the average FAMILY income, you are modestly affluent, not SUPER RICH.

It's those people making those sort of incomes who got MOST screwed by the superich tax cuts, BTW.

Of course, I don't expect you to believe that.

You assume I am some kind of commie or somethingm don't you?

Do some reading about how badly the upper middle class (that's people making 250K a year, BTW) got screwed when the economy designed amost exclsuively for the SUEPRRICH screwed up THEIR LIVES.

You also have about 40% to 50% who pay nothing. They sure can't pay much less than they do now.

Yeah that's the outcome of FREE TRADE in action.

And who benefitted most from FREE TRADE?

Some American doctor working his ass off in AMERICA to make his $250K income, or the superrich investors who make money from IMPORTING foreign made goods?

It's not the productive affluent who are getting more than their share.

They WORK DAMED HARD for their money, honey.

For them I have respect.

The "Superrich" as you put it already pay the majority of the taxes in this country. ][

Correction...the majority of FEDERAL TAXES not including social security or medicade, or state taxes, or sales taxes, or even(I suspect) real estate taxes.

How much more would you like them to pay???

Depends on how much they need to keep society functional.

Under OL'BO if you make 250,00 or more your are RICH and your taxes will indeed go up.

If you're making 5 times the average FAMILY income, you are modestly affluent, not SUPER RICH.

It's those people making those sort of incomes who got MOST screwed by the superich tax cuts, BTW.

Of course, I don't expect you to believe that.

You assume I am some kind of commie or somethingm don't you?

Do some reading about how badly the upper middle class (that's people making 250K a year, BTW) got screwed when the economy designed amost exclsuively for the SUEPRRICH screwed up THEIR LIVES.

You also have about 40% to 50% who pay nothing. They sure can't pay much less than they do now.

Yeah that's the outcome of FREE TRADE in action.

And who benefitted most from FREE TRADE?

Some American doctor working his ass off in AMERICA to make his $250K income, or the superrich investors who make money from IMPORTING foreign made goods?

It's not the productive affluent who are getting more than their share.

They WORK DAMED HARD for their money, honey.

For them I have respect.

Nope. Done't assume your a commie at all.

You just have a different view than I do.

You seem to think that those that have should support those that don't. Yes??

You have no problem with those that contribut nothing benefitting?? Yes????

I on the other hand have no problem with people being rich. In fact. I wish I were Rich. LOL

edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

Since your question was very unclear and contradictory, the figure I gave for Obama is what is currently being paid, not what is projected to be paid.Why are you too lazy to figure it out for yourself?Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?

Showing a net reduction from a level that is not being paid in the real world is a little shifty.

Do you think that there are people whose intrinsic value to the society is such that they should pay no tax?

If you had to ask the first question, how could you come to the conclusion in your second sentence?

Do you mean like Nelson A Rockefeller making a seven figure income and paying not one cent in taxes when he was appointed VP?

Total Federal Taxes

.......................Obama ............ Ryan

Lowest 20% .....$600 ............... $2,200

Second 20% .....$3,700 .............$5,700

Middle 20% ......$8,300 .............$10,200

Fourth 20% ......$15,100 ...........$16,400

Top 1% .......... $487,000 ..........$276,000

From my post:

"Do you have the tables of the actual projected paid tax by income level per person currently, under Ryan and under Obama?"

I was asking for a third category to be added, current taxes paid. As I said the two plans which are currently non-existant is an interesting, but meaningless diversion. Knowing what is currently being paid is the point of departure that would mean something.

I have heard that about half of the adult population currently avoids Federal taxation. My assumption is that there are not that many Rockefellers. I could be wrong.

And you are always wrong when you parrot what you "heard" on GOP hate media. This is why I say CON$ are STUPID rather than ignorant. No matter how many times GOP hate media is shown to be lying and no matter how obvious the lie, CON$ still swallow every lie whole. Ignorant people are capable of learning, but stupid CON$ never learn.

The very chart above shows the bottom 20% and 40% PAYING Federal taxes, so obviously you "heard" wrong.

edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

Damn that Commie Jesus!Nope. Done't assume your a commie at all.

You just have a different view than I do.

You seem to think that those that have should support those that don't. Yes??

Acts 4:32 Now the whole group of those who believed were of one heart and soul, and no one claimed private ownership of any possessions, but everything they owned was held in common.

4:34 There was not a needy person among them, for as many as owned lands or houses sold them and brought the proceeds of what was sold.

4:35 They laid it at the apostles' feet, and it was distributed to each as any had need.

(New Revised Standard version)

DiamondDave

Army Vet

Damn that Commie Jesus!Nope. Done't assume your a commie at all.

You just have a different view than I do.

You seem to think that those that have should support those that don't. Yes??

Acts 4:32 Now the whole group of those who believed were of one heart and soul, and no one claimed private ownership of any possessions, but everything they owned was held in common.

4:34 There was not a needy person among them, for as many as owned lands or houses sold them and brought the proceeds of what was sold.

4:35 They laid it at the apostles' feet, and it was distributed to each as any had need.

(New Revised Standard version)

Funny... don't see anything about Jesus advocating the forceful submission of others into giving up their possessions

Damn that Commie Jesus!Nope. Done't assume your a commie at all.

You just have a different view than I do.

You seem to think that those that have should support those that don't. Yes??

Acts 4:32 Now the whole group of those who believed were of one heart and soul, and no one claimed private ownership of any possessions, but everything they owned was held in common.

4:34 There was not a needy person among them, for as many as owned lands or houses sold them and brought the proceeds of what was sold.

4:35 They laid it at the apostles' feet, and it was distributed to each as any had need.

(New Revised Standard version)

Well Golly there Ed. If you and all likeminded folks want to pool your possessions,your wealth, your property then by all means feel free. Just think you could then just spread that around to your hearts content. Share it with all the downtrodden. Go for it.!!

I, on the other hand, would prefer to hang onto my possessions and any small wealth that I have. I guess I'm just the selfish type. LOL

(Click on the picture to see the graph better.)

View attachment 9655

If you listen closely enough, you may hear Mr. Ryan's laughter as he and the rest of his pals take a piss on the poor and middle class.

Do you think the people that are represented, SHOULD be taxed? Maybe with this setup, the middle class and "poor" will vote for smaller gov and lower taxes instead of voting for someone else to pay for the services they want.

What makes you think the middle class and poor would react differently than the rich. The rich don't vote for smaller government. The simply want a bigger government that gives them the keys to the treasury.

Last edited:

edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

More like the non-Christian type.Damn that Commie Jesus!Nope. Done't assume your a commie at all.

You just have a different view than I do.

You seem to think that those that have should support those that don't. Yes??

Acts 4:32 Now the whole group of those who believed were of one heart and soul, and no one claimed private ownership of any possessions, but everything they owned was held in common.

4:34 There was not a needy person among them, for as many as owned lands or houses sold them and brought the proceeds of what was sold.

4:35 They laid it at the apostles' feet, and it was distributed to each as any had need.

(New Revised Standard version)

Well Golly there Ed. If you and all likeminded folks want to pool your possessions,your wealth, your property then by all means feel free. Just think you could then just spread that around to your hearts content. Share it with all the downtrodden. Go for it.!!

I, on the other hand, would prefer to hang onto my possessions and any small wealth that I have. I guess I'm just the selfish type. LOL

Similar threads

- Replies

- 69

- Views

- 621

- Replies

- 56

- Views

- 2K

Latest Discussions

- Replies

- 2K

- Views

- 67K

- Poll

- Replies

- 45

- Views

- 303

- Replies

- 107

- Views

- 291

- Replies

- 170

- Views

- 2K

Forum List

-

-

-

-

-

Political Satire 8029

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-