eflatminor

Classical Liberal

- May 24, 2011

- 10,643

- 1,669

- 245

Your facts are questionable. From 1780 to 1913 the US most certainly tried to control prices through controlling trade. One of the reasons there was a civil war was the Federal manipulation of money.

Disagree. Tariffs and trade have nothing to do with the issue at hand. Further, I disagree Federal money manipulation, which was practically non existent compared to the Federal Reserve of today, was at all a significant factor that led to civil war. That war was about states nullifying Supreme Court orders to return property (slaves) to their owners. Good for them, but we're talking about sound money, not the civil war.

You then compare GDP growth of the past to today. The US conquered or took control over massive amounts of land during that time period. It was also a period of industrialization and massive immigration. Irrelevant The two time periods are not even remotely comparable for a lot of reasons but to claim that the gold standard worked then so it would work now is not established. Disagree. The time periods are absolutely comparable, especially with regard to debt and inflation, neither of which got out of control because we had a sound money policy. There is terribly weak causation for the time period itself let alone today. Disagree...strongly.

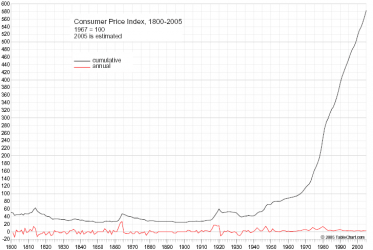

The equivocation of inflation to a tax is not established. It is a bad assumption. Awe come on! Who exactly is hurt most by relentless inflation? Rich guys or the poor? Call it what you want, inflation is death blow to the poor. That is absolutely undeniable.

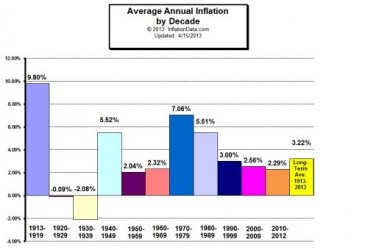

The swings have been less and the worse swing of all, (The Great Depression) was largely caused because of a limited money supply. One of the major problems with a gold standard. I disagree that "the swings have been less". Fewer swings? Sure, but absolutely more severe in terms of extended periods of growth, severe retractions and overly-prolonged recessions. The earlier period saw market driven swings that were less severe AND we saw flat inflation.

Further I strongly disagree that the Great Depression was caused by sound money policy. No frickin' way!!! Historians lack consensus in determining the causal relationship between government economic policy in causing the Depression, but hell, even the Keynesians believe it was caused by underconsumption and over investment, causing a bubble. Sorry, there is no way you can blame GD on sound money. NO WAY!

Our civilization has improved greatly from what it was in the 1800's or the early 1900's. Technological advancements, which have nothing to do with sound money Those improvements do cost money. Private capital...red herring alert! The fundamental premise of your argument is so flawed that it is unredeemable and you have said little to nothing about the gold standard itself.

We're just going to have to disagree on this one!

Government manipulation of the economy is relevant. Relevant to another discussion, sure. But let's stick with that point at hand, m'kay?

Conquering land, immigration, and industrialization are most certainly relevant to growth. As are many other things that distinguish one age to another. But have nothing to do with economic prosperity experienced due to sound money vs fiat currency. Sorry, you can't just attribute that which has been accounted for in countless economic comparisons.

Inflation is not a deathblow to the poor. Tell that to the guy seeing his purchasing power eroded.

The GDP growth of the past is under vastly different circumstances which you refuse to even consider relevant because you are trying desperately to assume that the gold standard had something to do with it. Wrong, I'm saying growth was fine under both circumstances only that now we deal with the debt, unfunded liabilities and inflation made possible by all this funny money.

The Great Depression was made significantly worse by effectively decreasing the money supply. This can happen when gold is the basis of your money supply because the speed of money slows down effectively lowering the money supply and making the recession/depression worse. You have ZERO evidence of this. That the economic community is unable to reach a consensus about the causes and exacerbations of the GP, but you're just SURE you have the answer speaks volumes about your arrogance and unreliability. You go with that.

You have said little to nothing substantial concerning money supply. You have described a period of time that was massively different than today Ah yes, the "modern times" argument...how tired that one is...and made a huge leap by simply assuming that all of the things that you consider to be good about the past and bad about the present are somehow due to the gold standard with absolutely zero evidence or logical reasoning that would suggest it had anything to do with the gold standard. And what exactly to you attribute to the relentless inflation that just happen to coincide with the formation of the Fed? How exactly do you think we were able to build this tremendous pile of debt and unfunded liabilities?

It is not that we are disagreeing Ah but we are , it is that you have not even started to approach the issue in a meaningful way.

Wrong again.

Last edited: