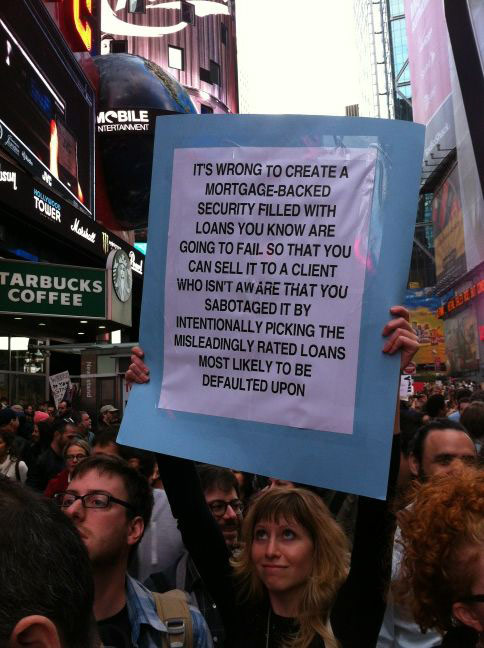

Are we ever gonna talk about the people running Fannie and Freddie were getting their bonus checkes based on how many mortgage's were given out...the more loans made the bigger the bonus.Wonder if they cared at all that a lot of people were barely making enough to live on much less afford a house.