Conservative

Type 40

RealClearMarkets - Government Spending, and the 18% of GDP Myth

Human nature drives people to believe and repeat information they hear as a method of simplification. Social psychologists call these cognitive shortcuts, heuristics. By and large they serve us well in helping to tame a complicated world.

Unfortunately, in circumstance that impact the daily struggle of American citizens, mindlessly spewing out disinformation as though it is fact can be a recipe for disaster. One notable example of a falsehood being perpetuated is the question of appropriate levels of government spending.

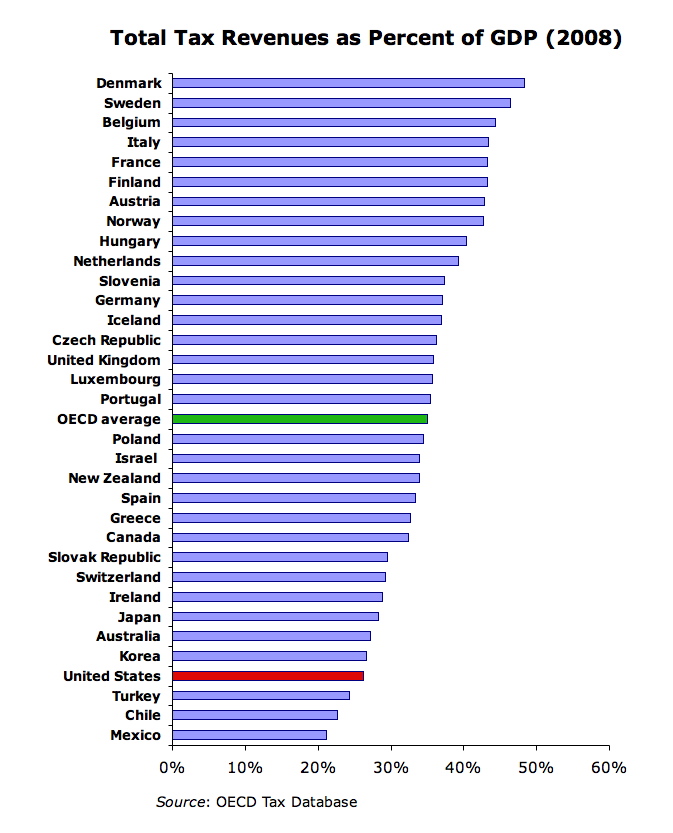

The Democrats and President Obama have increased federal spending as a percentage of gross domestic product (GDP) to 25.3%. On the other side of the aisle, Rep. Paul Ryan's budget plan looks to cap government spending at 18% of GDP. The claim is that the 18 percent number mirrors historic average levels of government spending.

The truth here is that the U.S. has thrived with far less government spending. Indeed, a look at times when we as a nation were imperiled offers a far different story than what you have been told.

Why should we care? Because government spending is taken directly out of your pocket, or out of the economy. Spending is today's burden becaue every dollar consumed by our profligate government is one less that could fund productive advancement in the private economy.

Every dime needlessly spent by government comes at the cost of efficiency in moving scarce resources to their most valuable use. As Milton Friedman said, "nobody spends somebody else's money as carefully as he spends his own. Nobody uses somebody else's resources as carefully as he uses his own." So any policy that reduces personal freedom in economic decision making inhibits economic growth which forces people to suffer needlessly.

In short, for the first 130 years of the U.S.'s 224 year existence, federal spending as a percentage of GDP averaged around 2.5%!

The just and proper fiscal balance is to give the state what it needs to protect you and your property while at the same time protecting you and your property from the state. ...A good rule of thumb would be to give half of what the politicians ask for.