kissmy....lack of demand drove the prices down, i vaguely remember the news on it....

the supply did not increase with Bush's announcement, it takes years on new finds....and you are not even talking about a new find....you are talking about just getting permission to look for a new find.....not even a find...there is no way this could have affected the prices....in the way you have speculated.

seriously, the reduction in demand, drove prices downward...which is how it works....and increased demand would have increased prices...

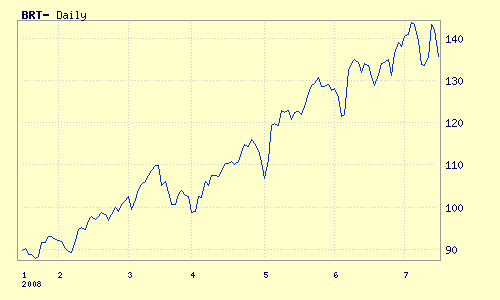

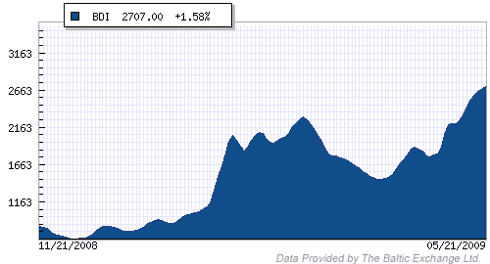

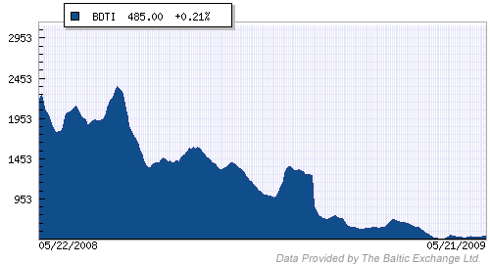

Bush caused the speculators hoarding oil in floating storage to panic & that drove the price down. The demand was already lower than supply for a very, very long time & it never affected price because the Crushing Oklahoma storage was not climbing. Where do you think all the floating storage oil came from? Even though there was an over-supply & slack demand of oil the price kept going higher & higher. The US dollar was getting so weak for many years prior due to excess subprime loans that investors wanted to hold oil & gold instead of the value losing US dollars.

Also read up on how the Enron power scam worked. This was the same thing was done on a global scale. The tankers that are normally used to transport oil to markets were used up to park oil out in the ocean where it would not show up in inventory. This gave the illusion of a shortage & reduced the amount of available tankers to transport oil to the USA.

You have no clue dude!

You have no clue dude!