Raoul_Duke

Member

- Sep 13, 2011

- 235

- 17

- 16

Uh. Bub. One of the most important metrics for a business is Cash Flow. Having large cash balances, especially in times of severe economic uncertainty, is just plain prudent management.

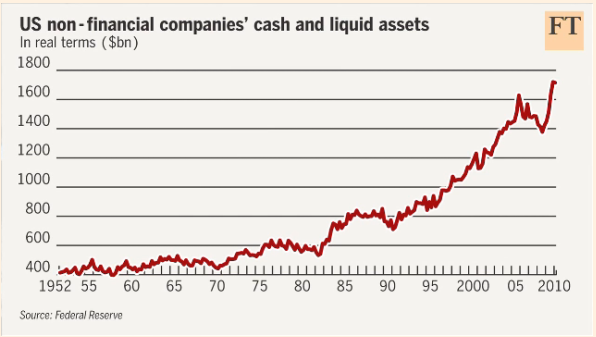

Like i said, they've been sitting on bigger and bigger piles of cash since the Reagan years. They can't find enough demand to cater to and invest to supply. And like I said, why is that?

Having Cash is a Good Thing, bub. It's a key component of working capital.

That's good to know. Can we rule out the idea that companies are just suddenly sitting on lots of cash because of the current government then?