Trajan

conscientia mille testes

Highlights of Obamas Plan can be found here;

Obama Proposes New Plan to Cut Deficit - WSJ.com

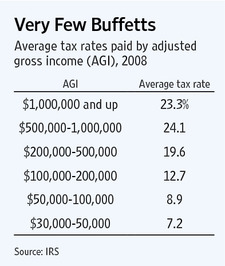

First- investment income; capital gains, dividends ,( taxed presently at a flat 15%) is 90% of Buffetts “income”, as opposed to the income tax rate(s) which uses as an example of how badly taxs are skewed as he pays less of a RATE than his secretary.

Well Warren, for a smart guy you sound awfully dumb or you are in fact being willfully duplicitous.

Investment income is taxed at a lower rate than the progressive income (job) tax rates BECAUSE they are investments, long term vehicles that may OR not pay off, INCOME via a job is taxed on the progressive scale because it is straight pay for work, a known, short term quantity that needs little encouragement as we all must work, where in investments are rewarded with a lower rate as they incur risk.

Further he conveniently slides by the fact that this income stream was already taxed once as corporate income at the 35% rate (- deductions). The 15% on capital gains and dividends to individuals is in effect a second tax on the same money, which takes the rate closer to 45%.

200k/250K the new ‘Millionaires’ – the Tale of the tape;

Lets see;

-In 2009, 8,274 filers had income above $10 million, and they paid apporx. $54 billion in taxes.

-In 2009, 237,000 taxpayers had incomes above $1 million and they paid approx. $178 billion in taxes.

-In 2009, there were 3.9 million people who reported income over $200,000, there net tax’s?

$434 billion.

So, some back of the envelope numbers …….it appears approximately 90% of the tax filers who would pay more under Mr. Obama's plan, are the 200/250Ker’s, NOT the millionaires and 99.99% aren't billionaires…..

I am just a schmuck in my jami's behind a keyboard and I can find this information and the WH can’t?

Item-

Jan 2013-

>an Obamacare 3.8 % surtax on investment income on the 200/250ker's goes into effect.

>Medicare payroll tax on the 200/250ker's goes up 1.45% to 2.35%.

Why this is never discussed or part of the conversation?

Item-

>The expiration of the Bush tax cuts would push capital gains rates to 20%, a 25% increase.

> Dividends will be taxed at the 'income tax rate' , as high as 39%.

The 200/250k and above set already pays 90% of the fed.

taxes collected, 48% of folks pay no NET Federal taxes and half of those get taxes 'refunds' ( earned income 'EIC's') back, which in effect refunds their Fica contributions thereby taking them off the hook for their social security insurance and Medicare ….so who picks up that tab?

The 'evil rich' have shared the sacrifice I’d say. In fact, I'd say their is a lack of responsibility by those under that threshold.

Item-

His plan includes a 1.1 Trillion “cut” (which in effect already cooked into the books), for the Iraq and Afghanistan draw down, this nonsense was tried by Harry Reid back in the April/May dust up over closing the 2010 budget, it was rightly dismissed even by the left as BS to be kind.

And of course his plan calls for these taxes to start AFTER 2012 btw.

Unless there is some unknown Entitlement cuts, restructuring etc. we have not heard about? This is just Chicago soup kitchen Community Organizing populism, nothing more.

Here we are near 3 years in and hes never ever had one original idea/thought on the economy, seriously, this is just another punt, who saw that coming?

I didn’t, I thought at the very least he’d exhibit some outside the box thinking, what a sap I was, AND even after seeing the original debate on the you-tube below, goes to show how easy it is to be led when the media is completely in the tank and the populist bandwagon is running full steam ahead.

And a blast from the past, Charlie Rose puts the magic investment income question to Obama during a debate ( he drags out the higher rate sec. crap here to in 2008)…..this whole segment, as seen now is surreal, talk about coming full circle;

[ame=http://www.youtube.com/watch?v=WpSDBu35K-8]Obama: Raise Taxes, Capital Gains - "For Purposes of Fairness" - YouTube[/ame]

Obama Proposes New Plan to Cut Deficit - WSJ.com

First- investment income; capital gains, dividends ,( taxed presently at a flat 15%) is 90% of Buffetts “income”, as opposed to the income tax rate(s) which uses as an example of how badly taxs are skewed as he pays less of a RATE than his secretary.

Well Warren, for a smart guy you sound awfully dumb or you are in fact being willfully duplicitous.

Investment income is taxed at a lower rate than the progressive income (job) tax rates BECAUSE they are investments, long term vehicles that may OR not pay off, INCOME via a job is taxed on the progressive scale because it is straight pay for work, a known, short term quantity that needs little encouragement as we all must work, where in investments are rewarded with a lower rate as they incur risk.

Further he conveniently slides by the fact that this income stream was already taxed once as corporate income at the 35% rate (- deductions). The 15% on capital gains and dividends to individuals is in effect a second tax on the same money, which takes the rate closer to 45%.

200k/250K the new ‘Millionaires’ – the Tale of the tape;

Lets see;

-In 2009, 8,274 filers had income above $10 million, and they paid apporx. $54 billion in taxes.

-In 2009, 237,000 taxpayers had incomes above $1 million and they paid approx. $178 billion in taxes.

-In 2009, there were 3.9 million people who reported income over $200,000, there net tax’s?

$434 billion.

So, some back of the envelope numbers …….it appears approximately 90% of the tax filers who would pay more under Mr. Obama's plan, are the 200/250Ker’s, NOT the millionaires and 99.99% aren't billionaires…..

I am just a schmuck in my jami's behind a keyboard and I can find this information and the WH can’t?

Item-

Jan 2013-

>an Obamacare 3.8 % surtax on investment income on the 200/250ker's goes into effect.

>Medicare payroll tax on the 200/250ker's goes up 1.45% to 2.35%.

Why this is never discussed or part of the conversation?

Item-

>The expiration of the Bush tax cuts would push capital gains rates to 20%, a 25% increase.

> Dividends will be taxed at the 'income tax rate' , as high as 39%.

The 200/250k and above set already pays 90% of the fed.

taxes collected, 48% of folks pay no NET Federal taxes and half of those get taxes 'refunds' ( earned income 'EIC's') back, which in effect refunds their Fica contributions thereby taking them off the hook for their social security insurance and Medicare ….so who picks up that tab?

The 'evil rich' have shared the sacrifice I’d say. In fact, I'd say their is a lack of responsibility by those under that threshold.

Item-

His plan includes a 1.1 Trillion “cut” (which in effect already cooked into the books), for the Iraq and Afghanistan draw down, this nonsense was tried by Harry Reid back in the April/May dust up over closing the 2010 budget, it was rightly dismissed even by the left as BS to be kind.

And of course his plan calls for these taxes to start AFTER 2012 btw.

Unless there is some unknown Entitlement cuts, restructuring etc. we have not heard about? This is just Chicago soup kitchen Community Organizing populism, nothing more.

Here we are near 3 years in and hes never ever had one original idea/thought on the economy, seriously, this is just another punt, who saw that coming?

I didn’t, I thought at the very least he’d exhibit some outside the box thinking, what a sap I was, AND even after seeing the original debate on the you-tube below, goes to show how easy it is to be led when the media is completely in the tank and the populist bandwagon is running full steam ahead.

And a blast from the past, Charlie Rose puts the magic investment income question to Obama during a debate ( he drags out the higher rate sec. crap here to in 2008)…..this whole segment, as seen now is surreal, talk about coming full circle;

[ame=http://www.youtube.com/watch?v=WpSDBu35K-8]Obama: Raise Taxes, Capital Gains - "For Purposes of Fairness" - YouTube[/ame]

Last edited:

????

????

Well, if I may borrow this, in Jillian's view- someone with a Fox viewer level IQ.

Well, if I may borrow this, in Jillian's view- someone with a Fox viewer level IQ.