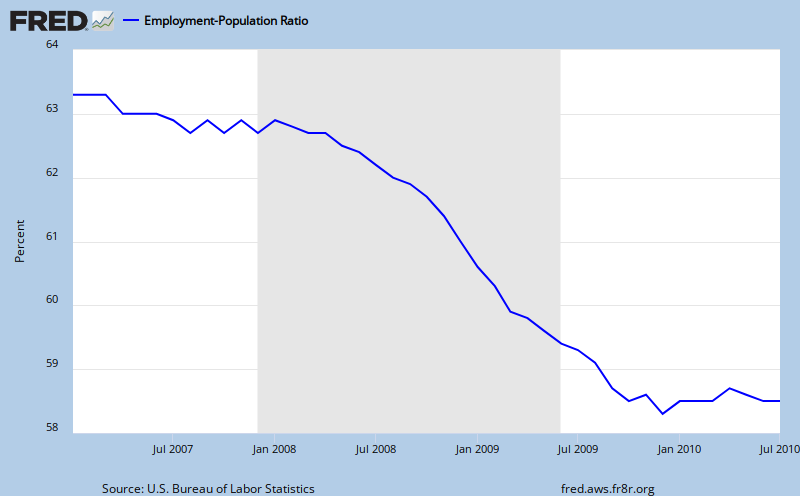

Actually it does vanish. If I show a balance sheet with a $200,000 house and $100,000 mortgage then my net worth is 100k. I can borrow against that. I can sell the asset. If the value falls to 100k then I don't have that. This is the entire basis of this recession, a balance sheet meltdown.Wow.

Just wow.

ANd I thought I was the only one who saw it that way.

TARP...a Bush idea...well...enodrsed by Bush....and then doubled down by Obama saved the banks from themselves. At the cost of tax payer money and at the cost of honest bankers who could not compete with the unscrupulous during the re-fi boom.

Recall that the projected failure of the banking system (which was well underway, btw) would have caused the entire economy to seize up.

I was in favor of the initial TARP, aimed at backstopping the banks to restore confidence. I was opposed to the indiscriminate extensions of TARP (under Bush and Obama) to every sector of the economy.

There is a big differernce between the failure of some major banks and the failure of the banking system.

When a bank fails, the money does not vanish. I believe people actually think it does.

If I lend you 300K and you spend it and then you default on your debt to me.....I lose the 300k,...yes.....but that 300k is still in the economy as you spent it elsewhere.

If I lend you 300K and your house is worth 400K and it is collateral. And then your house goes down in value and worth only 200K and you default....yes, I lose 100K on paper...but that money is still in the economy as you spent it elsewhere.

There was no imminent failure of the banking system. There was the likely failure of the major banks.

There were plenty of smaller institutions ready willing and able to pick up the slack.

There was indeed an imminent failure. Banks were refusing to lend to each other overnight. That is a sign the system is seizing up.