- Apr 12, 2011

- 3,814

- 758

- 130

Investor's Business Daily said:President Obama has been traveling the country selling what he calls a "balanced plan" to reduce the nation's gargantuan debt.

It would cut the debt a total of $4 trillion over 12 years, relying on tax hikes on the rich for $1 trillion of that. Rep. Paul Ryan, R-Wis., in contrast, would cut the debt by $4.4 trillion in 10 years without raising any taxes. Obama has described that plan as "radical."

But in making the case for tax hikes, Obama has made several claims that, while they may strike a chord with voters, perpetuate myths about taxes and the rich.

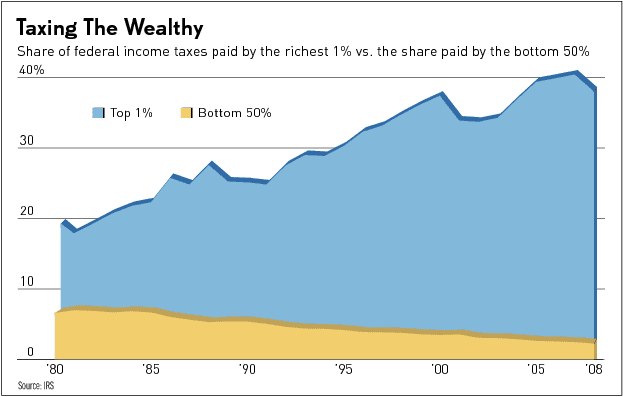

More at Investor's Business Daily, includes graphic: