Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Obama Millionaire's Tax: President To Seek New Tax Rate For Wealthy

- Thread starter WillowTree

- Start date

Bullshit. Society does not necessitate complex tax code, bullshit social engineering necessitates a complex tax code. It is time for the government to stop bending over to bullshit special interests and use the tax code for what it is supposed to do: collect the necessary cash for government to operate. That is its sole purpose, not to pick specific industries as winners because they donated to your camping. There is not one single reason that our tax code is so complex. It does not need to be.EVerybody demands a "simple" tax code but I think that it isn't really possible.

Taxation is complex because the various businesses in society make it necessarily complex.

Deciding, for example, what a reasonable expense really is can't be done across all different kinds of businesses.

As to " simplifying " the tax codes as in having a FLAT RATE on all income levels?

Well, that's just a ridiculous idea in a society where the range of incomes is so vast.

I don't believe in a flat rate across all income levels but I do believe in a simple tiered system that is flat. Essentially, there is no reason for deductions to exist. Period. Even worse, there should absolutely NEVER be a tax credit. That is the most asinine idea ever. That includes corporations as well. Why are we paying anyone out of the tax code??? Taxes are a source of revenue for the government, not expenditure. If you want a welfare program, then it should be called that and stand on its own 2 feet, not buried in the tax code.

EVerybody demands a "simple" tax code but I think that it isn't really possible.

Taxation is complex because the various businesses in society make it necessarily complex.

Deciding, for example, what a reasonable expense really is can't be done across all different kinds of businesses.

As to " simplifying " the tax codes as in having a FLAT RATE on all income levels?

Well, that's just a ridiculous idea in a society where the range of incomes is so vast.

Here you go - 9% sales tax on all goods and resources purchased by the end user, 9% income tax on all personal income and 9% income tax on all business income with payroll as the only deduction.

Simple. Fair. Predictable.

and 9% income tax on all business income with payroll as the only deduction

Did he really say payroll as the only deduction, or is that your idea?

OK, here is what I am hearing. The top 400 people of wealth have more income than the bottom 1/2, or 150 million people in the US.

According to you Teabaggers the problem with that is that they should have more than the bottom 250 million people in the US.

At this point, the redistribution of wealth is not only a goal, it is a neccessity if this nation is to continue to be a world leader.

Do you have a source where you heard that?

Or are you simply confused?

chanel

Silver Member

In NJ, there are over 200,000. Interesting list here: the-richest-states-in-america: Personal Finance News from Yahoo! Finance

Note that the highest incomes are in the most expensive states to live in. Real estate probably accounts for the biggest chunk of assets.

Note that the highest incomes are in the most expensive states to live in. Real estate probably accounts for the biggest chunk of assets.

Full-Auto

Gold Member

- Jun 13, 2009

- 13,555

- 1,624

- 153

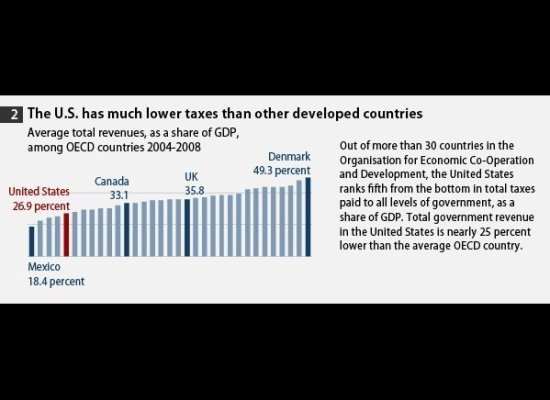

As a share to GDP.

With the difference in sizes it should be lower.

How about the income figures?

Oh NO!!! The President is proposing to do what the American people what us to? Oh, the horror of it...

23 Polls Say People Support Higher Taxes to Reduce the Deficit

If he cared about what the American people want, he'd be calling for the repeal of Obamacare.

Charles_Main

AR15 Owner

Does that graph take into account our Federal Republic? We have 50 States who all collect taxes as well you know.

I don't think Denmark has the same?

Charles_Main

AR15 Owner

I have very little doubt that many people whose incomes are in the $200,000 a year range (and have been for a while) probably ARE millionaires.

How can you make such an assumption? How long to you is "a while".

Most peoples monthly Bills are around 65% of their Income. that would mean these so called millionaires have about 70 grand a year that is disposable Income. With which they do things like Buy Food, go out to eat, send their kids to school. Etc Etc.

If they saved 20% of their disposable Income a year (14 Grand) it would still take over 30 years even with very good interest for them to actually have 1 million dollars.

Sorry no matter how many times Obama and the Dems say it. A person making 200k a year is NOT A MILLIONAIRE.

Dragon

Senior Member

- Sep 16, 2011

- 5,481

- 588

- 48

If he cared about what the American people want, he'd be calling for the repeal of Obamacare.

True, but only if in the same breath he called for replacement of it with a single-payer system or at least the public option.

WASHINGTON -- President Barack Obama is expected to seek a new base tax rate for the wealthy to ensure that millionaires pay at least at the same percentage as middle income taxpayers.

A White House official said the proposal would be included in the president's proposal for long term deficit reduction that he will announce Monday. The official spoke anonymously because the plan has not been officially announced.

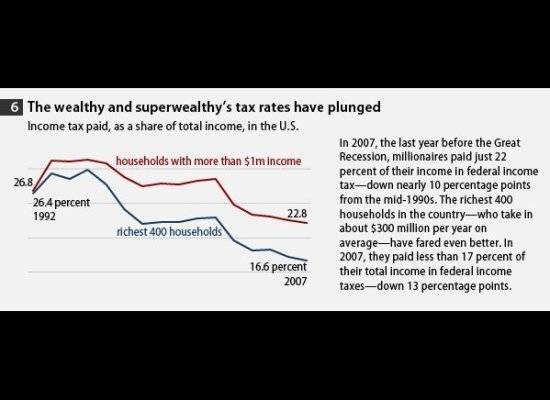

Obama is going to call it the "Buffett Rule" for Warren Buffett, the billionaire investor who has complained that rich people like him pay a smaller share of their income in federal taxes than middle-class taxpayers.

Buffett wrote in a New York Times op-ed piece last month that he and his rich friends "have been coddled long enough by a billionaire-friendly Congress."

The measure would be in addition to $447 billion in new tax revenue that Obama is seeking to pay for his short-term spending and tax cutting plan to jump start the economy.

House Speaker John Boehner said Thursday he would oppose tax increases to reduce the deficit. Boehner has urged Congress' deficit "supercommittee" to lay the groundwork for a broad overhaul of the U.S. tax code.

The panel has almost unlimited authority to recommend changes in federal spending and taxes and is working against a deadline of Nov. 23.

Obama Millionaire's Tax: President To Seek New Tax Rate For Wealthy

brick wall,,, meeet head.

Buffett rule? If it's to be named in honor of Warren Buffett it should reflect the taxes he pays 15 percent, and to top that off he owes ONE BILLION dollars in back taxes. Is that what obama wants rich paying just 15 percent and owing back taxes?

chanel

Silver Member

I think what editec is saying is that in areas where real estate prices are high, it is not unusual for someone making $200K to own a $500K house; a $100K boat or expensive cars; and have pension money and other investments put away. Esp. here in NJ.

A "millionaire" and someone MAKING a million dollars a YEAR, are quite different. I wouldn't be surprised if the income redistributors start to go after wealth and assets soon. The $200K guy who has invested wisely, might end up worse off than the $500K guy who spends every friggin dime. And of course neither of those guys have the same accountants and lawyers as the Buffetts and Hollywood celebutards.

A "millionaire" and someone MAKING a million dollars a YEAR, are quite different. I wouldn't be surprised if the income redistributors start to go after wealth and assets soon. The $200K guy who has invested wisely, might end up worse off than the $500K guy who spends every friggin dime. And of course neither of those guys have the same accountants and lawyers as the Buffetts and Hollywood celebutards.

Full-Auto

Gold Member

- Jun 13, 2009

- 13,555

- 1,624

- 153

Prove it.

Go do the research, asshole. I'm not here to do the work for you.

Keep in mind that many studies do not include gov't benefits as income.

you made the claim, back it up pussy

Our poor have gotten richer - Bing

You sort through it.

Cold hard facts. The rich pay federal income tax. 50% of you leeches do not pay federal income tax. quit leeching and pay your fair share.

The poor get poorer.

Actually the poor have gotten richer. Just not as fast as the rich.

rabbi how can that be? whn we now have record numbers below the poverty level?

If he cared about what the American people want, he'd be calling for the repeal of Obamacare.

True, but only if in the same breath he called for replacement of it with a single-payer system or at least the public option.

The American people want single-payer or public option?

Photonic

Ad astra!

Go do the research, asshole. I'm not here to do the work for you.

Keep in mind that many studies do not include gov't benefits as income.

You made an absurd claim and now you need to back it up. But you know what. I'll give you a pass JUST THIS ONCE to shut you up. Though undoubtedly you'll open your mouth and out from it will spew blinded nonsense.

Up until 1970's income inequality was decreasing. Since then it has risen. To give you a more global perspective on the problem...

File:Gini Coefficient World CIA Report 2009.png - Wikipedia, the free encyclopedia

The Gini Coefficient is a way to rate income distribution of the population of a country. With 0 being perfect distribution and 1 stating that a single person has all the income.

More from the US Census: File:US poverty rate timeline.gif - Wikipedia, the free encyclopedia

Here's some NEW info too!

In addition, according to U.S. Census Bureau data released Tuesday September 13th, 2011, the nation's poverty rate rose to 15.1% in 2010, up from 14.3% in 2009 and to its highest level since 1993. [(United States Census Bureau|U.S. Census Bureau]]

I did your job for you. I want a reasonable response in compensation.

You did no job at all. You merely presented facts that were not responsive to my claim. You claim there is income inequality. That is true. You claim it is rising. That is also true.

My claim had nothing to do with that. Rather, my claim is that the lowest quintile in income also experienced growth over the last 10-15 years, just not as fast as higher income groups. The most recent three years of course show regression, since Obama's policies have utterly failed.

Even so, that growth does not count gov't transfers and in-kind payments like Section 8 vouchers, WIC etc.

Household income in the United States - Wikipedia, the free encyclopedia

Personally income inequality doesn't bother me in the least since it is a matter that the most productive people are earning more and more money. It is generally not the result of gov't policies, which is the case in South American countries, African dictatorships etc.

The problem is inflation also kills what small gain occurs in poor income.

Charles_Main

AR15 Owner

I think what editec is saying is that in areas where real estate prices are high, it is not unusual for someone making $200K to own a $500K house; a $100K boat or expensive cars; and have pension money and other investments put away. Esp. here in NJ.

A "millionaire" and someone MAKING a million dollars a YEAR, are quite different. I wouldn't be surprised if the income redistributors start to go after wealth and assets soon. The $200K guy who has invested wisely, might end up worse off than the $500K guy who spends every friggin dime. And of course neither of those guys have the same accountants and lawyers as the Buffetts and Hollywood celebutards.

Bullshit, Just because their house if worth 500k their a millionaire? The Vast majority do not actually own the home yet. They owe Hundreds of thousands of dollars on it, and pay a mortgage.

WASHINGTON -- President Barack Obama is expected to seek a new base tax rate for the wealthy to ensure that millionaires pay at least at the same percentage as middle income taxpayers.

A White House official said the proposal would be included in the president's proposal for long term deficit reduction that he will announce Monday. The official spoke anonymously because the plan has not been officially announced.

Obama is going to call it the "Buffett Rule" for Warren Buffett, the billionaire investor who has complained that rich people like him pay a smaller share of their income in federal taxes than middle-class taxpayers.

Buffett wrote in a New York Times op-ed piece last month that he and his rich friends "have been coddled long enough by a billionaire-friendly Congress."

The measure would be in addition to $447 billion in new tax revenue that Obama is seeking to pay for his short-term spending and tax cutting plan to jump start the economy.

House Speaker John Boehner said Thursday he would oppose tax increases to reduce the deficit. Boehner has urged Congress' deficit "supercommittee" to lay the groundwork for a broad overhaul of the U.S. tax code.

The panel has almost unlimited authority to recommend changes in federal spending and taxes and is working against a deadline of Nov. 23.

Obama Millionaire's Tax: President To Seek New Tax Rate For Wealthy

brick wall,,, meeet head.

You give the Federal Government more money--they just spend that and waste more. As far as Warren Buffet--I don't know why he just doesn't start making out a pay-check to himself so he will get hammered like the rest of us?

Indeed the tax code needs to be changed to where it is fair--and along with raising taxes aka capital gains on people who make over 1 million dollars a year (in capital gains)---then lets start looking also at the 47% of working Americans who pay no federal income tax what-so-ever. Many of which are in the 60 to 70K income levels--but because they have a couple of kids and a mortgage get out of paying federal income tax.

Boehner's right--THE TAX CODE NEEDS TO BE CHANGED.

Last edited:

pgm

Member

I didn't read this thread, so I'll just give my initial impressions divorced from this discussion.

When I first saw this, I thought it was a bad idea because I oppose tax increases when the economy is depressed. When I found out that this tax will replace the alternative minimum tax, I felt a little better.

Still, the best way to fix the deficit is by raising revenues and the best way to do that is not with taxes, but with economic growth.

When I first saw this, I thought it was a bad idea because I oppose tax increases when the economy is depressed. When I found out that this tax will replace the alternative minimum tax, I felt a little better.

Still, the best way to fix the deficit is by raising revenues and the best way to do that is not with taxes, but with economic growth.

chanel

Silver Member

I just saw Bill Clinton on TV and he said three things:

1. economic growth

2. decreased spending

3. increased revenue (taxes?)

He is right. Unfortunately, there are too many differing opinions on how to achieve #1. And 2. And 3.

1. economic growth

2. decreased spending

3. increased revenue (taxes?)

He is right. Unfortunately, there are too many differing opinions on how to achieve #1. And 2. And 3.

Similar threads

- Replies

- 47

- Views

- 652

- Replies

- 49

- Views

- 499

- Replies

- 40

- Views

- 417

- Replies

- 133

- Views

- 1K

- Replies

- 69

- Views

- 625

Latest Discussions

- Replies

- 30

- Views

- 115

- Replies

- 186

- Views

- 1K

- Replies

- 5

- Views

- 9

Forum List

-

-

-

-

-

Political Satire 8039

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 469

-

-

-

-

-

-

-

-

-

-