ScreamingEagle

Gold Member

- Jul 5, 2004

- 13,399

- 1,706

- 245

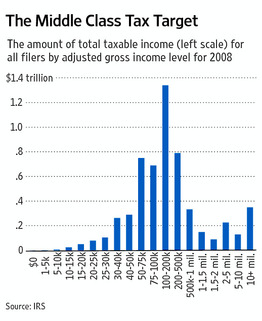

Barack Obama told the nation last Wednesday that improvements in Medicare and hiking taxes on the wealthy would stabilize government spending and bring deficit spending to what can charitably be described as a dull roar. The Wall Street Journal does some fact checking on these claims and finds them entirely false. Even if the rich gets defined down to the top 10% of filers whose average annual household income is $114,000 the level of revenue from even a 100% tax would still not close the budget gap:

WSJ shows taxing the rich wont cover the bill « Hot Air

WSJ shows taxing the rich wont cover the bill « Hot Air