Dad2three

Gold Member

Got it, as usual with you when your first talking points are DEMOLISHED with credible and logical links, you go in another direction.

Demolished... right.

I think I've got the gist of your clown posts. You agree with Forbes and the banking cabal that eliminating the Glass-Steagall act was inconsequential. You're on the record saying that deficits are not due to spike again after FY 2015. You lay the entire blame for the financial crisis at the feet of Republicans. You think that Obama is one of the most frugal presidents in history. And, you think that spamming threads with bold all caps in 16 font makes your arguments more effective. Wow, you DEMOLISHED everyone.

Moving along...

So NO, you can't refute OR BRING ANYTHING CREDIBLE to show G/S was more than a side note to the Bankster WORLD WIDE CREDIT BUBBLE AND BUST, one Dubya cheered on and ignored regulator warnings of it. Got it

Try again Bubba

lol

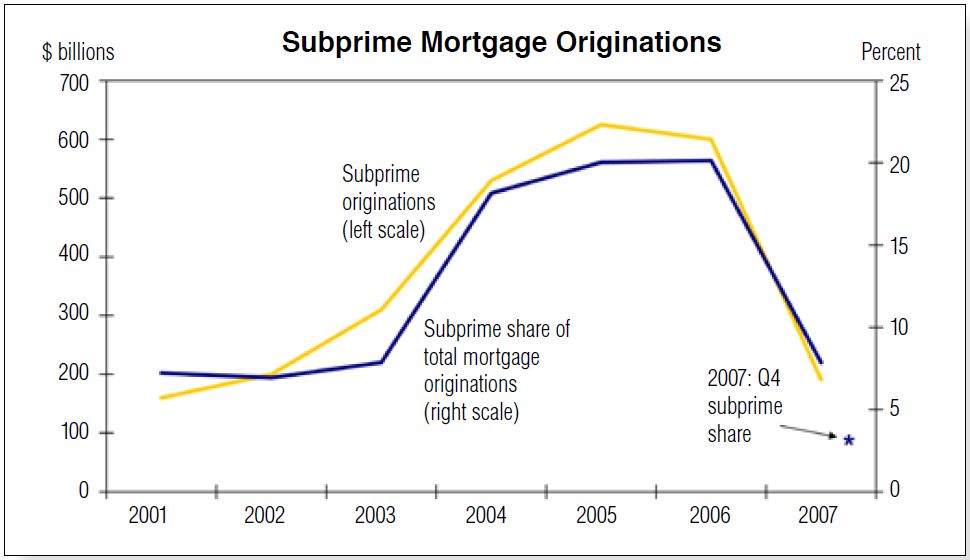

Percentage increase from 2003: 292%

Percentage increase from 2003: 292%