grunt11b

VIP Member

You're forgetting the trucking companies and railroads also charge tolls. Their tolls are higher than the ones pipelines charge. The pipeline will make oil cheaper, not more expensive. You're assuming that the oil will magically get to market at no cost if the pipeline isn't built. Why would any oil producer use the pipeline if trucks and railroads were cheaper?

Who said anything about trucking and railroads? The construction alone will require Trans Canada to pass the expense along and charge the oil companies more. Expanding piping when there is not actually a need will cause prices to increase also, because they will need to increase their tolls even more to cover the costs of their vast infrastructure that they operate.

IF the oil isn't going to market via pipeline or truck or rail, then how is it getting to the market? The cost of transporting the oil is always passed on to the consumer, but the cost of transporting it by pipeline is the lowest. Who is going to "increase the cost of their tolls?" When you build a new toll highway 'A,' does that force you to increase the fair on toll highway 'B?' How did you determine there wasn't a need?

Does anything you say have any connection with reality?

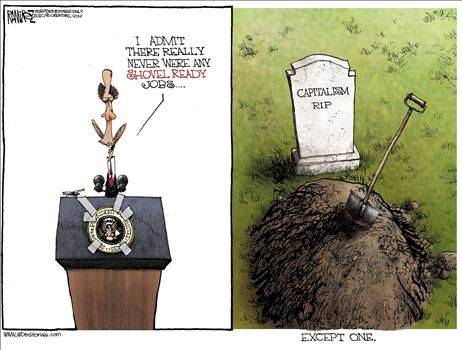

You and I both know that Obama is full of shit on this, and we will never convince these lefty nutcases otherwise. The only reason Obama will not sign off on this yet is because he is probably holding it over the heads of the unions for some reason or other. One of those "You either do this for me or you will not get the pipeline job" deals. He is a dirty prick and I would not put it past him to keep Americans from jobs for his own political agenda.