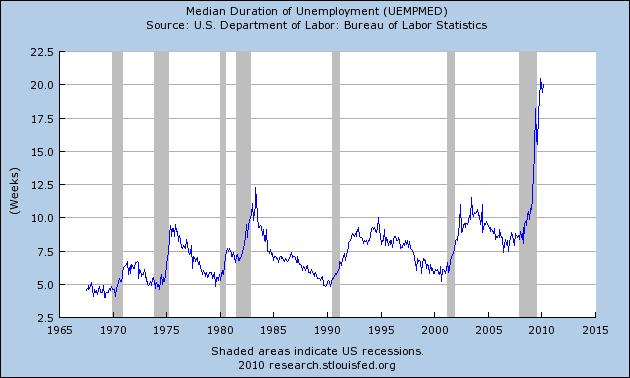

Check out this graph - what you see here is a look at the median duration of unemployed. At no time in the last 50 years have so many been unemployed for so long. Clearly President Obama and the Democrat Congress have only worsened the stagnant American economy with their ridiculous Big Government special interest "stimulus" programs.

_____

Here is what The Atlantic has to say about this graph...

The Scariest Unemployment Graph I've Seen Yet

The median duration of unemployment is higher today than any time in the last 50 years. That's an understatement. It is more than twice as high today than any time in the last 50 years.

http://www.theatlantic.com/business...ariest-unemployment-graph-ive-seen-yet/60086/

_____

_____

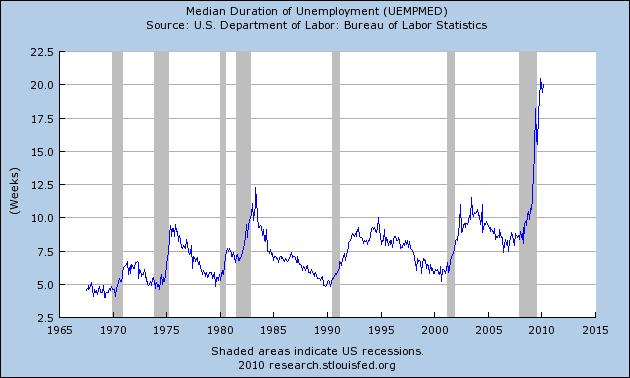

Here is what The Atlantic has to say about this graph...

The Scariest Unemployment Graph I've Seen Yet

The median duration of unemployment is higher today than any time in the last 50 years. That's an understatement. It is more than twice as high today than any time in the last 50 years.

http://www.theatlantic.com/business...ariest-unemployment-graph-ive-seen-yet/60086/

_____