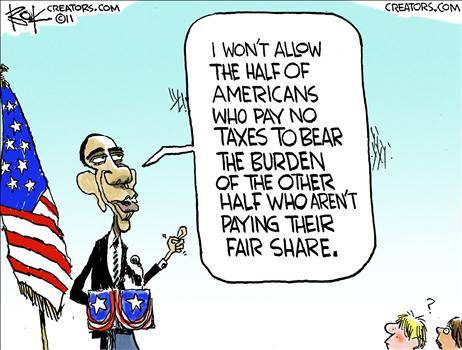

And oh my God! These parasites of the right pay no taxes or very little also, but let the RWer's beat up on old people, the poor and the crippled. typical hate from the right.

One problem with the Republican theory is that many big corporations actually pay little, if any, federal income tax. For example, The New York Times has reported that General Electric, the sixth-largest corporation in the United States, earned $14.2 billion in 2010, but disclosed in federal filings that it had no federal tax liability.

Bruce Bartlett: Some Big Corporations Don't Pay Taxes, Either - NYTimes.com

The lazy parasite come in Right and Left alike. Left poor do not have dibs on welfare. And poor people vote right and left.

Romney just don't give a fuck if they are right or left, he just hate poor people.

Romney just don't give a fuck if they are right or left, he just hate poor people.