Poor, poor rich man. Hell, give the bastards another tax break so they can ship some more factories overseas. Yep, that's the Republican ticket.

Letting people keep more of their own money is not "giving" them anything, twit.

Letting people not pay for what they owe IS.

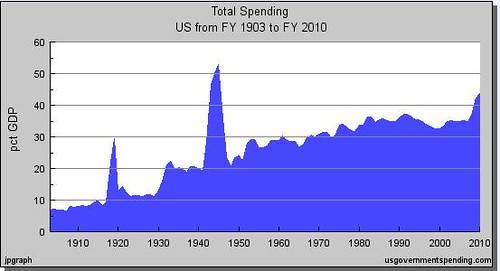

We owe 12 trillion in debt. Who do you want to pay that off?

Really? Where did I sign any agreement to borrow that money? Where did anyone?

Is this honestly the best argument you can come up with? Because it's pretty piss-poor, even by your low standards.