NYcarbineer

Diamond Member

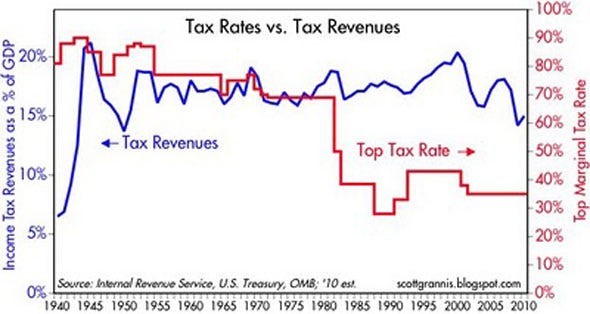

They said the same thing in 1980, yet the net result was more revenue for the government.

I think you are misinformed. The author of this was actually in the Reagan administration.

Reagan's Forgotten Tax Record | Capital Gains and Games

In case you aren't familiar with Bruce Bartlett

Bruce Bartlett - Wikipedia, the free encyclopedia

I never said Reagan did not raise taxes. He did cut the highest rate paid though, and spread the tax burden around. That, in case you missed it, is exactly what Ryan proposed.

What percent of households will pay no federal income tax under the Ryan plan?