No, Gov. Pawlenty, Tax Cuts Don't Pay for Themselves

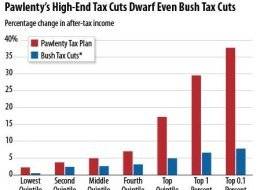

Republicans claim to be deeply concerned about the budget deficit and the national debt, yet repeatedly demand additional large tax cuts. For example, former Minnesota Gov. Tim Pawlenty, a candidate for the Republican presidential nomination, supports a balanced budget amendment to the Constitution but also wants an $8 trillion tax cut. He rationalizes this contradiction by asserting that his tax cut will not actually lose any revenue. As Pawlenty told Slate reporter Dave Weigel on June 13:

When Ronald Reagan cut taxes in a significant way, revenues actually increased by almost 100 percent during his eight years as president. So this idea that significant, big tax cuts necessarily result in lower revenues history does not [bear] that out.

In point of fact, this assertion is completely untrue. Federal revenues were $599.3 billion in fiscal year 1981 and were $991.1 billion in fiscal year 1989. Thats an increase of just 65 percent. But of course a lot of that represented inflation. If 1981 revenues had only risen by the rate of inflation, they would have been $798 billion by 1989. Thus the real revenue increase was just 24 percent. However, the population also grew. Looking at real revenues per capita, we see that they rose from $3,470 in 1981 to $4,006 in 1989, an increase of just 15 percent. Finally, it is important to remember that Ronald Reagan raised taxes 11 times, increasing revenues by $133 billion per year as of 1988 about a third of the nominal revenue increase during Reagans presidency.

No, Gov. Pawlenty, Tax Cuts Don't Pay for Themselves | Capital Gains and Games

The bolding is mine. But somehow we need to try and destroy the myth that Reagan cut taxes and revenue increased. It's just a myth and keeps hanging on. Zombie economics.

Republicans claim to be deeply concerned about the budget deficit and the national debt, yet repeatedly demand additional large tax cuts. For example, former Minnesota Gov. Tim Pawlenty, a candidate for the Republican presidential nomination, supports a balanced budget amendment to the Constitution but also wants an $8 trillion tax cut. He rationalizes this contradiction by asserting that his tax cut will not actually lose any revenue. As Pawlenty told Slate reporter Dave Weigel on June 13:

When Ronald Reagan cut taxes in a significant way, revenues actually increased by almost 100 percent during his eight years as president. So this idea that significant, big tax cuts necessarily result in lower revenues history does not [bear] that out.

In point of fact, this assertion is completely untrue. Federal revenues were $599.3 billion in fiscal year 1981 and were $991.1 billion in fiscal year 1989. Thats an increase of just 65 percent. But of course a lot of that represented inflation. If 1981 revenues had only risen by the rate of inflation, they would have been $798 billion by 1989. Thus the real revenue increase was just 24 percent. However, the population also grew. Looking at real revenues per capita, we see that they rose from $3,470 in 1981 to $4,006 in 1989, an increase of just 15 percent. Finally, it is important to remember that Ronald Reagan raised taxes 11 times, increasing revenues by $133 billion per year as of 1988 about a third of the nominal revenue increase during Reagans presidency.

No, Gov. Pawlenty, Tax Cuts Don't Pay for Themselves | Capital Gains and Games

The bolding is mine. But somehow we need to try and destroy the myth that Reagan cut taxes and revenue increased. It's just a myth and keeps hanging on. Zombie economics.