of course if true you would present your best example. Think before you write!

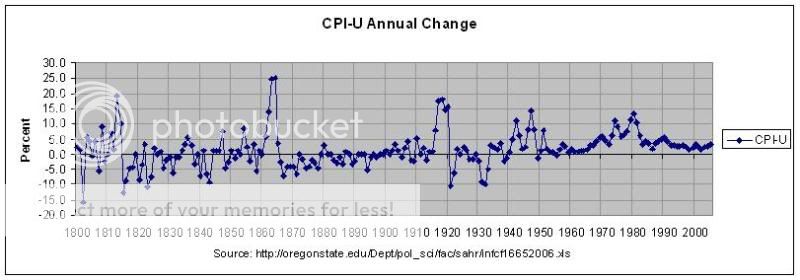

When you find your proof that there was no inflation or deflation under the gold standard, be sure to let me know.

you don't seem to understand that the definition of a gold standard is that inflation is impossible. You present a graph of US history as if there was solid gold stanbdard in place for all of it. Was there? PLease say yes or no?

In truth we had a quasi gold standard with many variations over the years.

A solid gold standard makes inflation impossible and liberals all but illegal.

Wasn't the US under a gold standard?

Didn't prices flucuate, up and down, during this time?

If you're claiming price changes are impossible, you're wrong.

Is that your claim?